The newest update to the 421a tax abatement is all but signed into law and it is out for review. The contours of the abatement have been made clear, and developers, government officials, and multifamily investors must understand how the updates work.

For some detailed summaries of the changes, have a look at the below resources:

- Rosenberg & Estis P.C.’s summary

- Note: the firm is also hosting a webinar today detailing the new policy

- Adler & Stachenfeld LLP’s summary

- Metropolitan Realty Exemptions’ summary

I provide these attorney and expeditor summaries instead of official NYC government language because NYC has yet to release guidelines, which is not technically law yet. I am focused on understanding the broad outlines of the law. Below are some essential items I want to draw your attention to.

The critical differences between 421a and 485x:

- Affordable apartments are permanently rent stabilized and tied to AMI bands under 485x.

- Apartments not subject to the affordability requirement are forever free market with 485x.

- Additionally, 485x fair market units will not be subject to Good Cause Eviction for 30 years after completion.

- Minimum wage requirements for 485x projects 100+ and 150+ apartments are steeper than under today’s 421a requirements.

Consequences of the new abatement

- The highly profitable option C of the 421a abatement that allowed all units to have high rents (130% AMI on 30% of units, which today is $3,787 for a one-bedroom) is gone.

- Compliance measures for 485x are tight, and owners who intentionally or accidentally violate the agreements will face escalating penalties.

Some questions you may have:

- Is 485x better than 421a?

It’s different, not better, or worse. Affordable rents will continue forever. On the other hand, most rents in 485x buildings will be fair market forever (and exempt from Good Cause Eviction for 30 years).

- How do I make money on 485x?

Build projects that are 11-99 units. Avoid the wage requirement and maintain 80% fair market unit rents, with 20% at medium affordability.

Sell these properties into the open market. With new building systems and predominantly fair market unit mixes these properties will appear attractive to the upwardly mobile professional class moving to New York for career opportunities. Fair market rents in new buildings will allow pro forma rents on these properties to climb higher than on the older building stock, allowing for premium pricing.

- How will this abatement impact the pricing of land?

This deal benefits properties built between 11 and 99 units most. Land pricing for properties in this niche will increase, especially in Manhattan neighborhoods.

- Which option for 485x is the best and offers the most bang for the buck?

Option B for properties 11-99 units. Buildings in this range will also be the most compelling to lenders because they will have almost no taxes, require little maintenance, and have high rent growth (~3-5% a year, or ~8-10% on tenant turnover years).

- How does Good Cause come into play for the 485x?

All new development properties, beginning with those built in 2009, are exempt for 30 days following the receipt of Certificates of Occupancy.

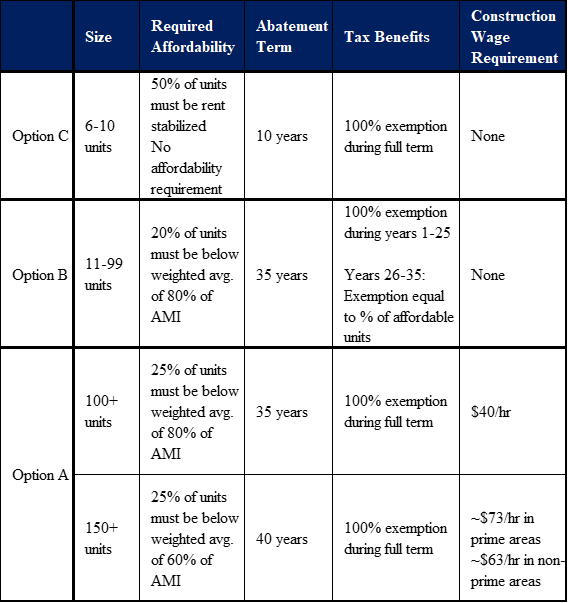

Below is a helpful diagram that summarizes the key changes in the new abatement

If you enjoyed this and want more updates on New York’s multifamily market, subscribe to Romain’s newsletter here.