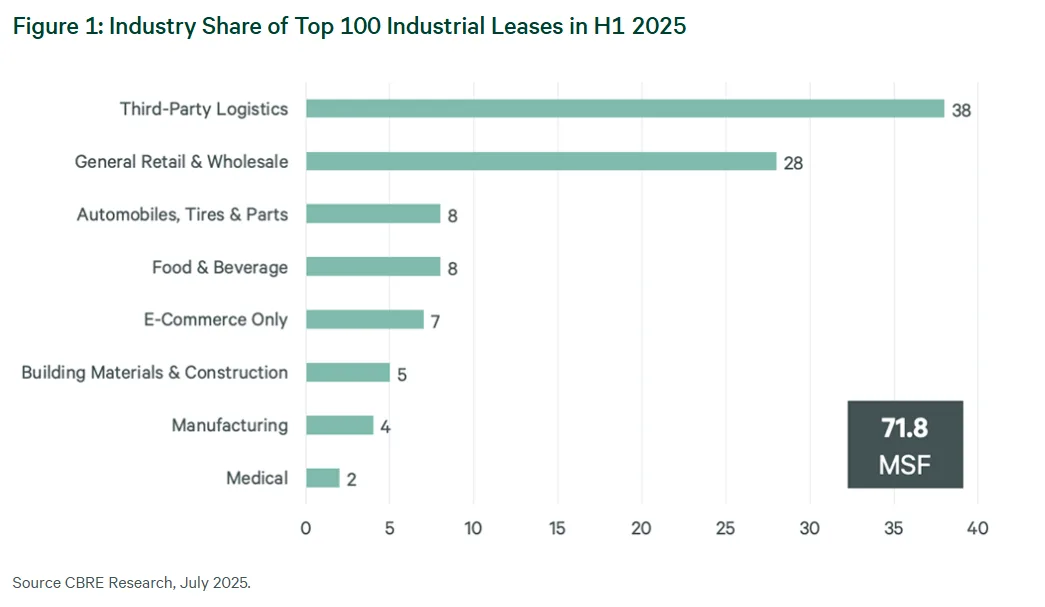

- 3PL leases led the market with 38 deals totaling 28.9M SF, reflecting a rise in outsourced logistics.

- Only 13 mega leases (1M+ SF) were signed in H1 2025, down sharply from 31 in H1 2024.

- E-commerce lease volume dropped 64%, signaling continued sector contraction.

- Top markets included Inland Empire, PA I-78/I-81, and Dallas-Fort Worth.

A Shift In Strategy

H1 2025 marked a notable cooling in the industrial leasing market. Just 13 mega leases (1M+ SF) were signed, compared to 31 in the same period last year, reports CBRE. Overall volume among the top 100 leases dropped by nearly 12% year-over-year. Average lease sizes also shrank as tenants pulled back from large-scale expansions. The shift comes amid rising rents and higher operating costs.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

3PLs Take The Lead

Third-party logistics firms became the dominant player in the top 100 industrial leases, accounting for 38 deals and nearly 29M SF of space. Their rise reflects the growing trend among retailers and manufacturers to outsource warehousing and logistics, helping these tenants gain flexibility and manage costs more effectively.

Retail and wholesale tenants, previously the largest occupier group, slid into second place with 28 leases totaling 21.4M SF.

E-Commerce Pullback

E-commerce-only occupiers dramatically scaled back leasing activity in the first half of 2025. Just seven deals totaling 4.7M SF were signed, down from 31 deals and 13.2M SF in H1 2024. The drop mirrors ongoing consolidation and cost-cutting in the sector, which is still correcting after a pandemic-era surge.

Top Industrial Hubs

Despite the overall slowdown, key logistics markets maintained their dominance.

- Inland Empire led the pack with 14 leases totaling 9.8M SF.

- PA I-78/I-81 Corridor followed with nine leases totaling 6.3M SF.

- Dallas-Fort Worth secured seven leases for a combined 5.8M SF.

These regions continue to benefit from strategic locations, highway access, and modern logistics infrastructure.

What’s Next

Leasing activity is likely to remain subdued through the rest of 2025, with few large occupiers actively searching for space. Higher interest rates, limited large requirements, and cautious corporate outlooks are dampening new deal volume.

However, a potential rebound may be on the horizon. As interest rates stabilize and new construction slows, competition for large, modern logistics facilities could intensify in 2026—especially in key distribution hubs.