- Over $23 billion in CMBS loans are past maturity with no resolution, reflecting a systemic slowdown beyond the typical “extend-and-pretend” strategy.

- Office and multifamily sectors face the highest maturity drag risk, with resolution delays increasingly tied to low debt yields rather than traditional performance metrics like DSCR.

- Trepp’s analysis links growing loan drag to structural shifts, including remote work, elevated interest rates, and execution barriers amid economic uncertainty.

A Systemic Slowdown: What’s Driving the Drag?

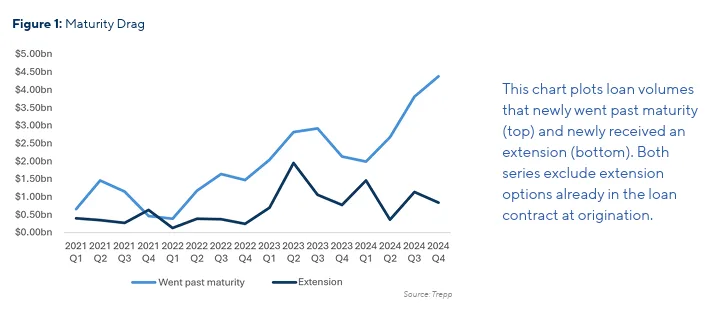

Commercial real estate is facing a new kind of credit cycle disruption. According to Trepp’s July 2025 report, over $23 billion in CMBS loans have gone past maturity without being paid off, liquidated, or formally extended. These unresolved maturities—termed “maturity drag”—are growing fast and reshaping how lenders, servicers, and borrowers approach distressed debt.

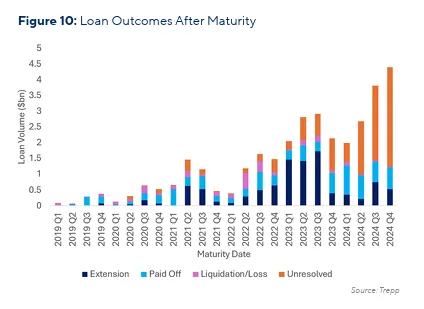

The traditional view of maturity extensions—simply delaying losses—no longer fully captures today’s situation. Many loans in question are still current on interest payments and backed by viable assets. Instead, Trepp’s data suggests that structural issues in the market, such as stalled price discovery and execution barriers, are driving indecision even for performing loans.

Where and Why It’s Happening

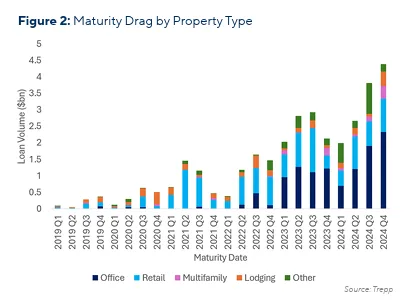

The slowdown isn’t uniform across property types. Initially driven by pandemic-era distress in retail, maturity drag is now dominated by the office sector. Loans secured by office buildings face steep valuation ambiguity due to remote work trends, lower demand, and uncertain futures for urban workspaces. Multifamily loans are also showing elevated risk, especially in markets like New York and California.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Trepp’s regression analysis pinpoints several contributing factors:

- Debt yield has become a stronger predictor of loan delays than DSCR, suggesting that market participants are placing more weight on long-term asset viability than short-term income coverage.

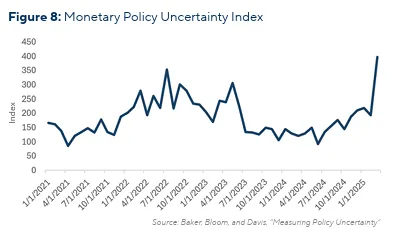

- Macroeconomic variables such as the 10-year Treasury yield and monetary policy uncertainty are statistically tied to maturity drag, particularly in the office and multifamily segments.

- Loan fundamentals like prior modifications, higher interest rates, and large loan size also raise the risk of resolution delays.

These shifts indicate that delays are no longer confined to troubled loans—they’re spreading across a broader swath of the market as risk perceptions evolve.

The Three Bottlenecks Behind the Drag

Trepp identifies three main causes of today’s maturity drag:

1. Slow Price Discovery

A lack of comparable transactions—especially in the office sector—has made it difficult to reprice assets in a post-pandemic world. As stakeholders debate new valuation baselines, many loans remain stuck in limbo. Borrowers and lenders may differ in their assumptions, with one party clinging to past valuations and the other bracing for further declines.

2. Macroeconomic Uncertainty

Lingering questions about interest rates, inflation, tariffs, and broader economic conditions are making it harder to plan ahead. Lenders are wary of locking in losses too early, while borrowers delay in hopes of refinancing under better terms. Trepp’s analysis finds a strong correlation between heightened monetary policy uncertainty and stalled loan resolutions.

3. Execution Paralysis

Even when valuations and forecasts align, the mechanics of resolving a loan remain complex. High interest rates have rendered many prior deal structures obsolete, and coordination across multiple stakeholders—servicers, borrowers, and investors—can stall decisions. The fear of setting unfavorable precedents or taking reputational hits adds further friction.

What It Means for the Market

The consequences of this unresolved loan buildup are significant. If capital markets fail to adapt, the industry could face a wave of forced defaults and write-downs, potentially triggering broader credit stress. On the other hand, if refinancing tools, recapitalization structures, and flexible loan modifications become more accessible, many of these loans could exit maturity drag without major disruption.

Data from Trepp shows that in 2024, most loans that passed maturity remained unresolved, a notable departure from prior years when extensions or payoffs followed more promptly. The risk now is that unresolved loans may tip into liquidation if no solution materializes.

Opportunity Amid Indecision

While unresolved loans present challenges for servicers and lenders, they also offer potential buying opportunities for investors with a high risk appetite. As valuation gaps widen and resolution slows, distressed debt buyers may find entry points that were previously unavailable—particularly in the office space.

For stakeholders navigating these conditions, Trepp recommends scenario-based valuation models, stress testing under multiple economic paths, and standardized resolution protocols to accelerate decision-making and reduce uncertainty.

Bottom Line

Maturity drag has emerged as a defining issue in commercial real estate. With over $23 billion in CMBS loans lingering unresolved, stakeholders are being forced to adapt to a new normal marked by pricing ambiguity, economic volatility, and execution hurdles. For those prepared to navigate this complexity, the current landscape may offer as many opportunities as it does risks. more than distress—it reflects a market in recalibration. As debt markets adapt to post-pandemic realities, maturity drag may become the defining challenge (and opportunity) in commercial real estate finance.