- Global REITs enter 2026 trading at deep discounts, with valuations at or near cyclical lows relative to global equities.

- A decline in new construction across most major property types is restoring pricing power, while resilient demand supports growth in rents and earnings.

- Sectors poised for outperformance include industrial (U.S., Europe, Japan), senior housing (North America), data centers (U.S., Singapore, Hong Kong), and residential (Germany, Australia).

A Rebound Year for Public Real Estate?

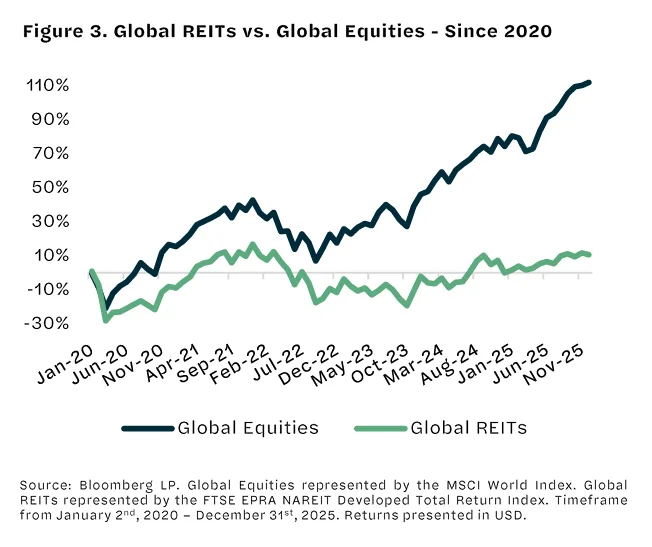

After years of macroeconomic turbulence, global REITs may finally be positioned for a sustained comeback, according to Hazelview Investments’ 2026 Outlook. Since the onset of the pandemic, the asset class has faced unprecedented challenges—from a global health crisis to one of the fastest monetary tightening cycles in decades.

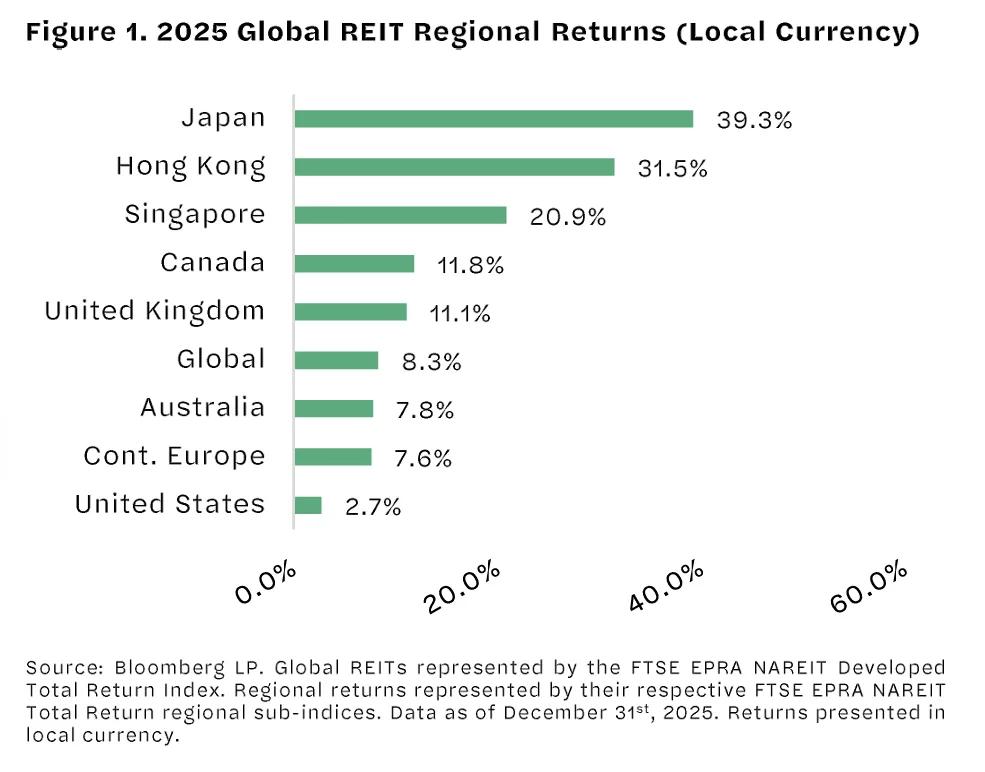

In 2025, REITs delivered an 8.3% return in local currency terms—outpacing global bonds, but trailing equities, which benefited from AI-driven enthusiasm. But the narrative heading into 2026 has shifted: interest rates are falling, supply pipelines are thinning, and investor positioning is at multi-year lows. These ingredients are setting the stage for a broader REIT re-rating.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Valuations Enter the “Buy Zone”

From a valuation standpoint, REITs are now trading at some of the most attractive levels seen in two decades. According to the report, global REITs are priced at a 17% discount to intrinsic value, with U.S. REITs leading the divergence. Forward P/FFO ratios have compressed significantly since 2021, and REITs now trade at their lowest price-to-cash-flow multiples relative to equities in nearly 20 years.

Trailing 10-year returns for global REITs have fallen to 4.2%—a level that, historically, has marked an inflection point. Previous dips to these levels have been followed by periods of above-average forward returns. As public valuations continue to lag private market asset values, share buybacks and privatizations are increasing, reinforcing investor confidence that the current dislocation is unsustainable.

Supply Shrinks, Demand Holds Steady

Beyond valuation, fundamentals are strengthening. Construction starts across residential, industrial, retail, and senior housing are declining sharply, due to higher costs, tighter financing, and regulatory constraints. This is expected to enhance pricing power for landlords in 2026 and beyond.

Occupancy levels remain resilient across most sectors. Even in office—one of the most challenged segments—higher-quality, centrally located assets are seeing better leasing activity. In sectors like senior housing, net absorption is rising above pre-pandemic norms. Demand is also stable in industrial and residential markets, with tight inventories supporting rental growth.

Sector Highlights: Where the Opportunities Lie

Industrial (U.S., Europe, Japan):

Oversupply concerns are easing. In the U.S., new construction has dropped to its lowest level in a decade. Europe remains structurally undersupplied due to construction barriers, while Japan’s modern logistics segment is benefiting from rising e-commerce penetration and labor shortages, especially in infill markets.

Senior Housing (North America):

The U.S. and Canadian senior housing markets are entering a long-anticipated demographic boom. The 80+ age cohort is set to grow at 4.8–5% annually through 2030. Meanwhile, construction starts are at multi-decade lows, driving a favorable supply-demand imbalance that supports strong NOI growth and robust total returns.

Data Centers (U.S., Singapore, Hong Kong):

Despite underperformance in 2025, the secular demand story remains intact. Power and land constraints are limiting new supply, while AI infrastructure demand is accelerating. In Singapore and Hong Kong, limited land and tight vacancy are leading to double-digit rental growth and multi-year development lags.

Residential (Germany, Australia):

Germany’s housing shortage continues to intensify, with completions far below demand. In Australia, land lease communities for seniors are gaining traction. With just 1–1.5% penetration and strong demographic growth, the sector offers stable, inflation-linked income with long development runways.

Why It Matters

REITs have been largely left behind during the recent equity rally. The combination of depressed valuations, falling supply, and stable demand creates a favorable setup for outperformance. For long-term investors, the current environment mirrors prior cycles where real estate rebounded sharply from periods of dislocation.

The opportunity for active management is also expanding. With wide dispersion across sectors, regions, and companies, stock selection will be a key driver of returns in 2026.

What’s Next

As we move further into 2026, all signs point to a turning point for global REITs. Investors seeking durable income, inflation protection, and discounted asset exposure may find the current window particularly attractive. For now, the message is clear: public real estate is too cheap to ignore.