- Commercial real estate investment is expected to grow 10% in 2025, led by a rebound in the office sector.

- Prime assets—especially in office, retail, and data centers—continue to outperform amid a flight to quality.

- Slower economic growth and new tariffs are delaying rent recovery and construction in several sectors.

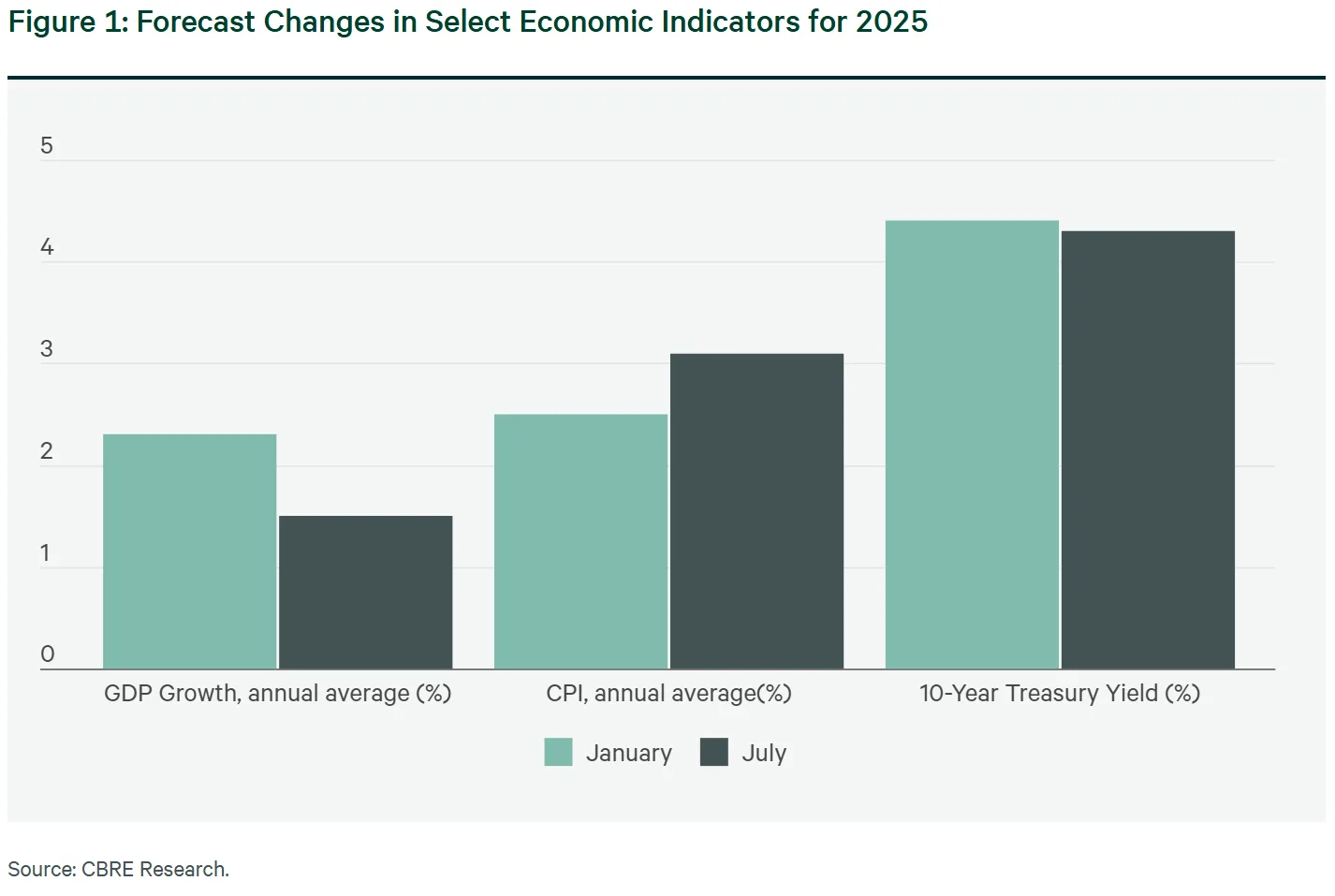

Economic Outlook: Growth Slows, Inflation Rises

As part of its 2025 CRE outlook, CBRE lowered its GDP forecast to 1.5%, down from the earlier 2%–2.5% range. Recent tariffs have driven inflation up to a projected 3.1%, while job growth is expected to slow to 0.5%, with unemployment rising to 4.4% by year-end.

Still, strong real estate tax benefits from a new tax law support confidence in long-term property fundamentals.

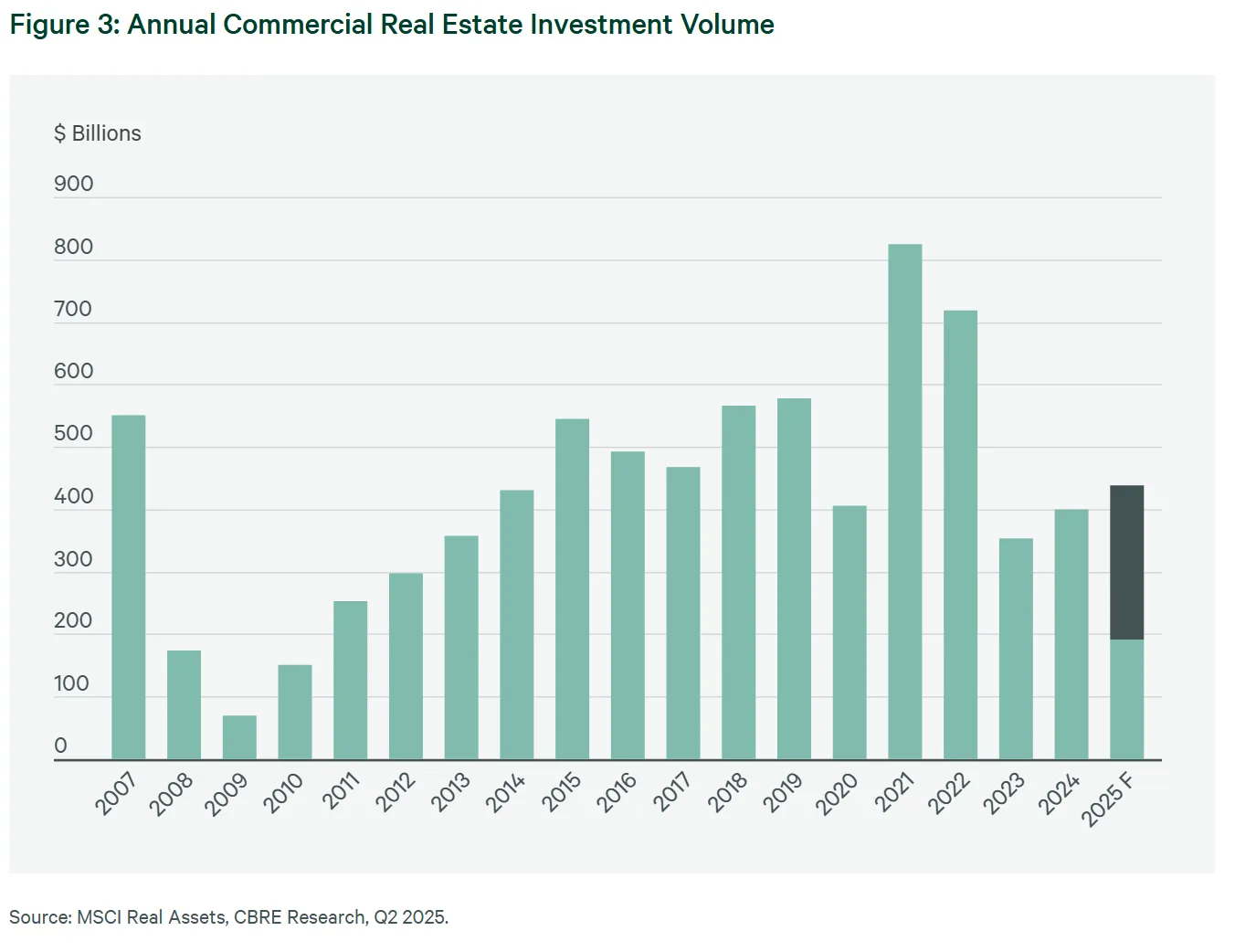

Capital Markets: Steady Growth, Rising Caution

Investment activity is on pace to grow 10% this year, though still below pre-pandemic levels. Office deals are leading the recovery, projected to grow 19%. Cap rates have stayed stable, but CBRE expects slight compression in 2026.

Investors remain active, aiming to lock in long-term income before interest rates rise further.

Office: Prime Space Gains Ground

Prime office leasing is outpacing non-prime as tenants chase quality in key metros like Manhattan, Dallas, and San Francisco. Prime vacancy sits at 14.5%, nearly five percentage points lower than non-prime.

CBRE expects limited new office construction in 2025—just 13M sq. ft., the lowest in over a decade.

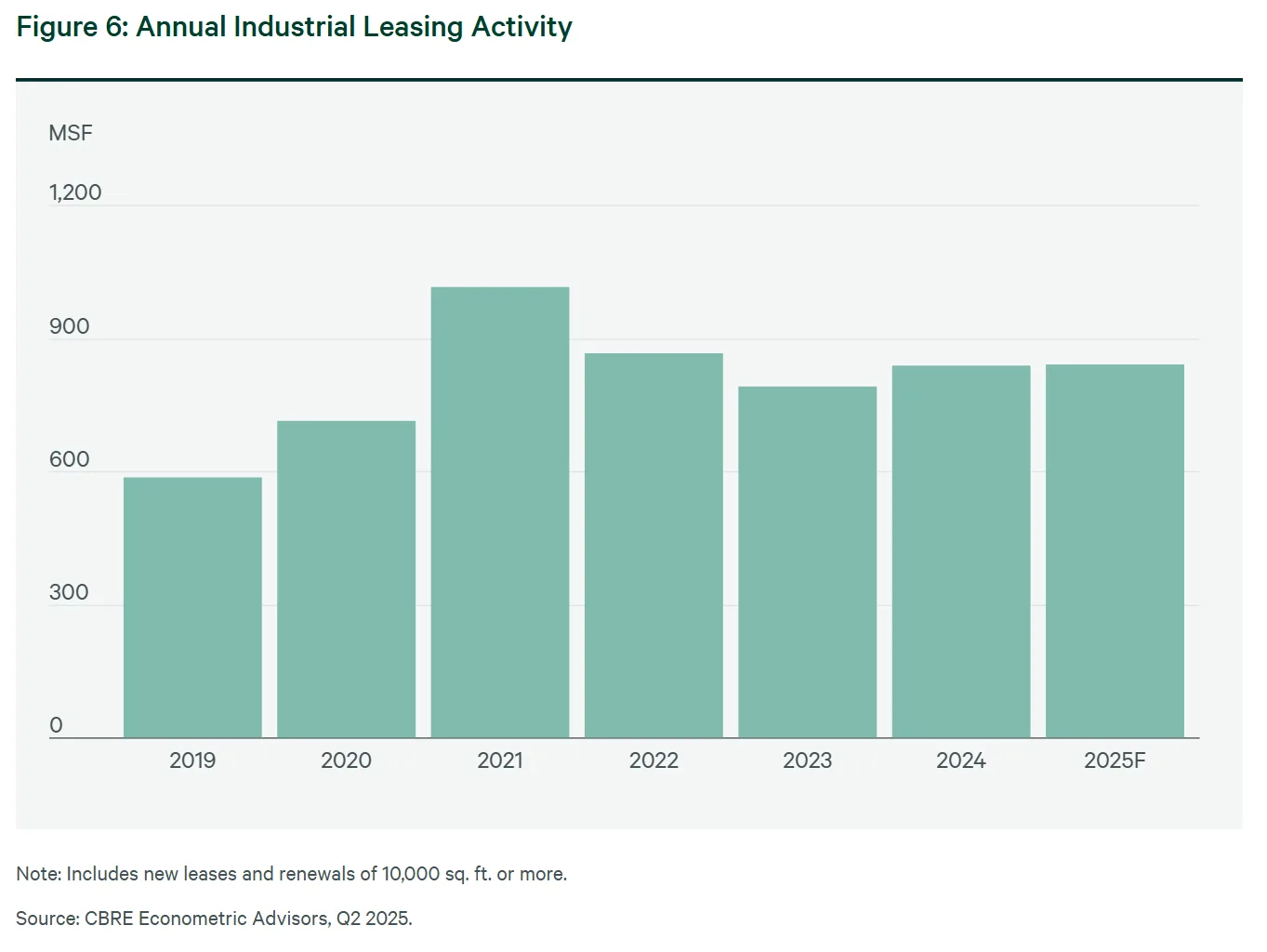

Industrial: Flight to Quality Hits Older Warehouses

Occupiers are moving out of older industrial space, pushing vacancy toward 7%. While total leasing matches 2024 levels, construction delays and rising material costs are slowing new supply.

Third-party logistics (3PL) providers are driving demand, especially for midsize spaces in central US markets.

Retail: Strong Demand Meets Limited Supply

Retail availability rose slightly to 4.9%, mainly due to bankruptcies and mall closures. But demand is growing in high-traffic power centers and grocery-anchored properties.

Core markets with dense populations and strong foot traffic are seeing bidding wars for anchor space.

Multifamily: Rent Growth Returns Slowly

Rent growth began to rebound in H1 2025, but high-supply markets in the Sun Belt are slowing the recovery. CBRE now expects national rent growth to average 2.8% over the next five years, down from 3.1%.

Vacancy dropped to 4% midyear but may rise as new units come online.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Data Centers: Demand Surges, Power Delays Continue

The data center sector remains hot, with 75% of new construction already leased. Power grid delays are holding back completions, especially in Dallas and Silicon Valley.

Some developers are turning to on-site or temporary power to keep projects on track.

Why It Matters

The CRE outlook highlights market resilience, even as the economy slows. Investors and tenants are focusing on high-quality assets, while weaker properties face more pressure. With limited new supply and rising costs, now may be a key window for strategic moves in the market.

What’s Next

Expect continued strength in core sectors like office, industrial, and data centers, even as policy shifts and inflation create new risks. Investors who stay focused on quality and timing may find solid returns through the rest of 2025.