- Industrial rent growth is slowing, with Q1 2025 posting the steepest decline in bulk rents since COVID-19.

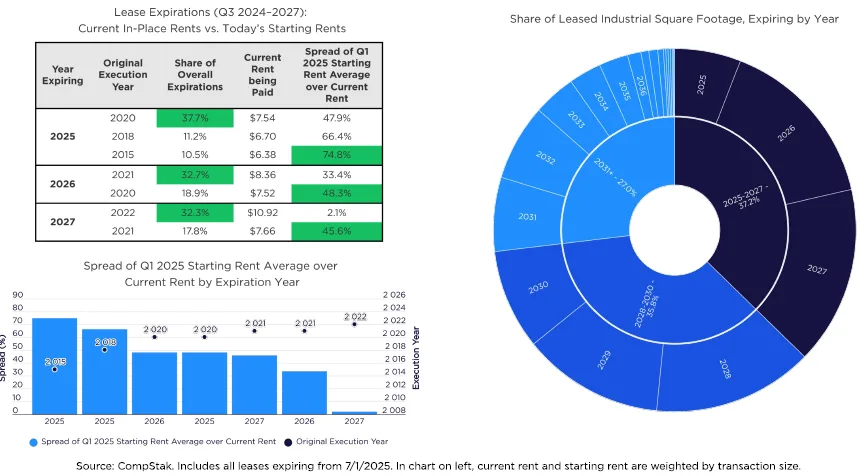

- Over 37% of US industrial leases will expire by 2027, many signed at rates far below today’s market, setting up large rent increases—or tenant churn.

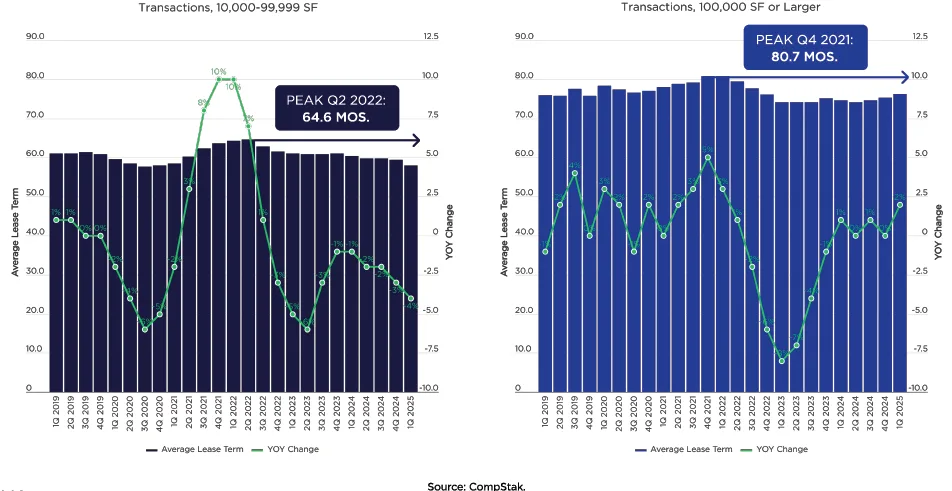

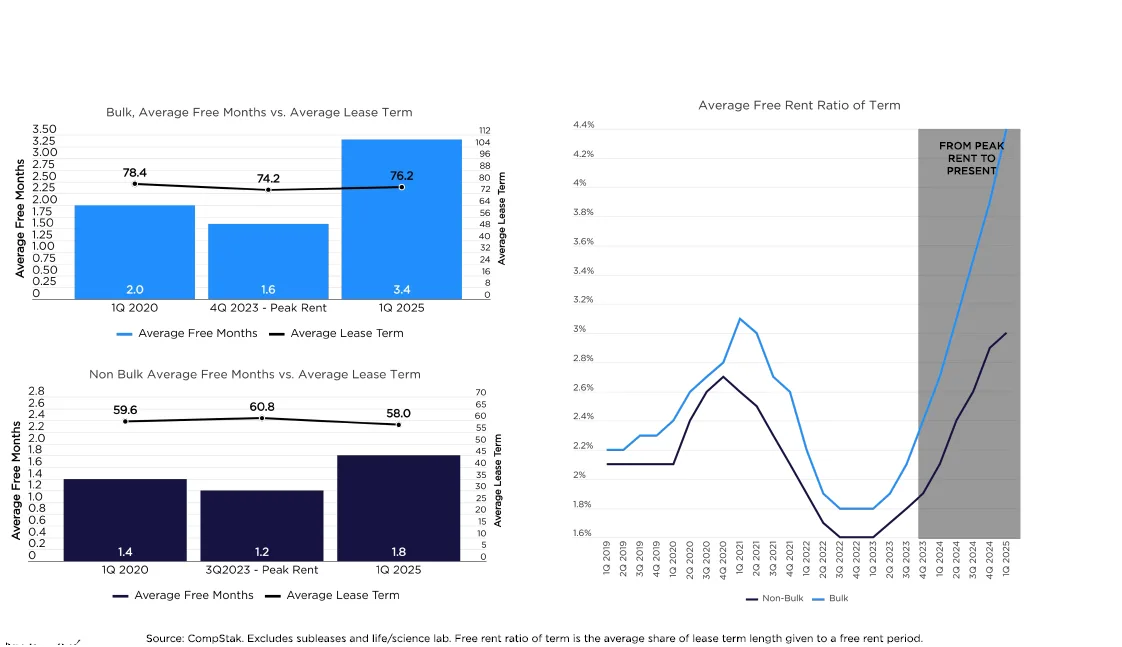

- Free rent and shorter lease terms are shifting negotiating power toward tenants, especially in bulk deals and short-term leases.

Industrial real estate in the US is entering a transitional phase, with tariffs, softening demand, and an aging lease base pressuring both landlords and tenants. According to 2025 Biannual Industrial Report, rents, vacancy rates, and concessions all point to a market in correction, reports CompStak.

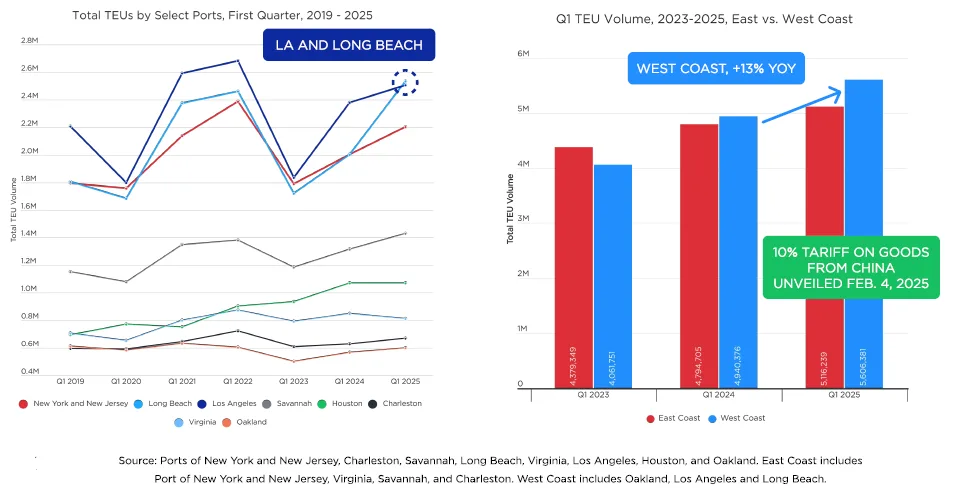

Tariffs And Trade Whiplash

A preemptive import surge ahead of a 10% tariff on Chinese goods announced in February 2025 pushed West Coast port volumes up 13% year over year in Q1. However, monthly volume at Long Beach and Los Angeles ports dropped over 14% in March, suggesting a sharp reversal is imminent as tariffs take full effect.

Rent Trends

National industrial rents fell again in Q1 2025. Bulk starting rents dropped 4.3% from their Q4 2023 peak, while effective rents fell 6.1%. Non-bulk rents declined more modestly, but all categories have now logged three consecutive quarters of year-over-year declines.

Lease Repricing Looms

Over one-third of all US industrial leases are set to expire by the end of 2027. Many of these were signed well before 2023’s rent peak, with rates up to 75% below today’s starting rents. Leases signed in 2015, 2018, and 2020 are particularly underpriced.

Tenant Leverage Rising

Free rent reached new highs in Q1 2025—averaging 4.4% of lease term for bulk leases and 3.0% for non-bulk. Meanwhile, escalation rates declined most for short-term, sub-100K SF leases, down significantly from their peaks.

E-commerce And Inventory Trends

E-commerce held near pandemic-era highs at 16.2% of total retail sales, and retail spending rose modestly in Q1—likely in anticipation of tariff-driven price hikes. However, warehousing capacity fell to neutral for the first time in over a year, indicating strain from front-loaded imports.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

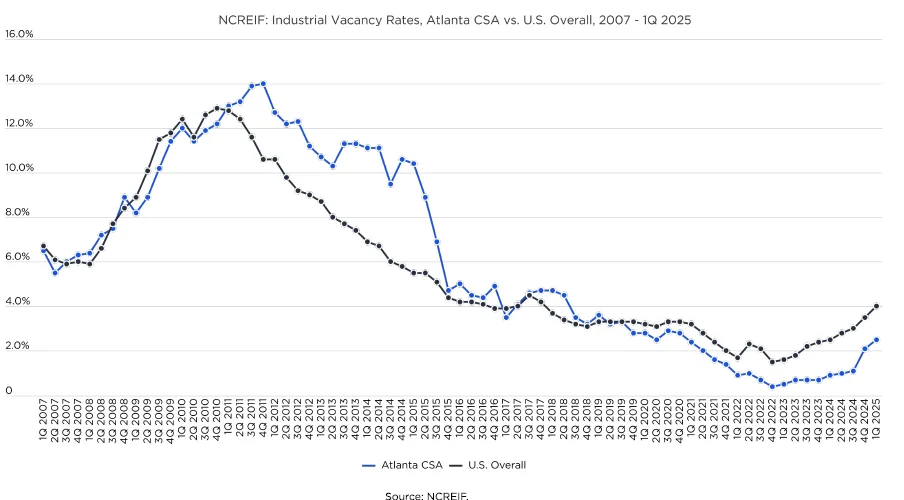

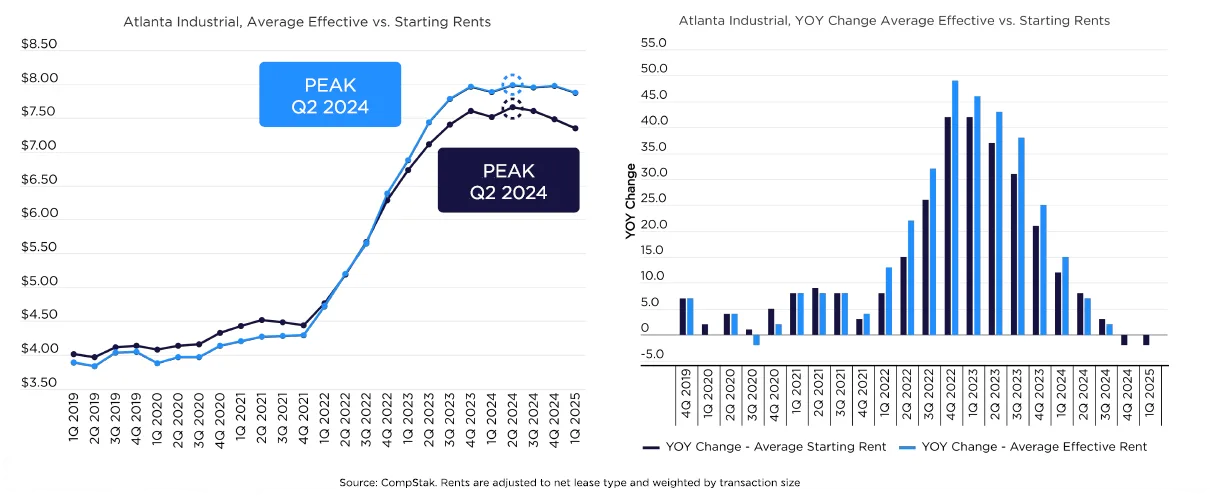

Market To Watch—Atlanta

Atlanta’s industrial market mirrored national trends with a three-quarter decline in starting rents and a 57% surge in free rent. Still, effective rents declined only slightly due to longer lease terms and resilient escalation rates. Renewals in Atlanta posted a 60.4% average rent increase.

Why It Matters

The industrial real estate sector is at a crossroads. Landlords are seeing pricing power erode, especially on renewals. As more leases roll over in the next few years, landlords will face the challenge of repricing at higher rents while also needing to offer more concessions to attract or retain tenants.

What’s Next

With more tariff volatility expected and tenant-favorable trends intensifying, industrial landlords will likely need to reprice and restructure deals strategically. Vacancy and concession levels suggest that the current softening is far from over.