- Miami leads South Florida in apartment occupancy, reaching 95.9% in May 2025—surpassing both Fort Lauderdale and West Palm Beach, and outperforming the US average.

- Demand continues to outpace supply in Miami, with over 12,500 units absorbed in the year-ending Q1 2025, exceeding new supply by more than 1,200 units.

- Population growth is a key driver, with Miami adding nearly 325K residents since 2020—one of the highest increases in the country.

- Miami remains the only South Florida market with positive rent growth, posting a 1.2% annual increase, while Fort Lauderdale and West Palm Beach logged rent declines.

Miami Bounces Back Stronger

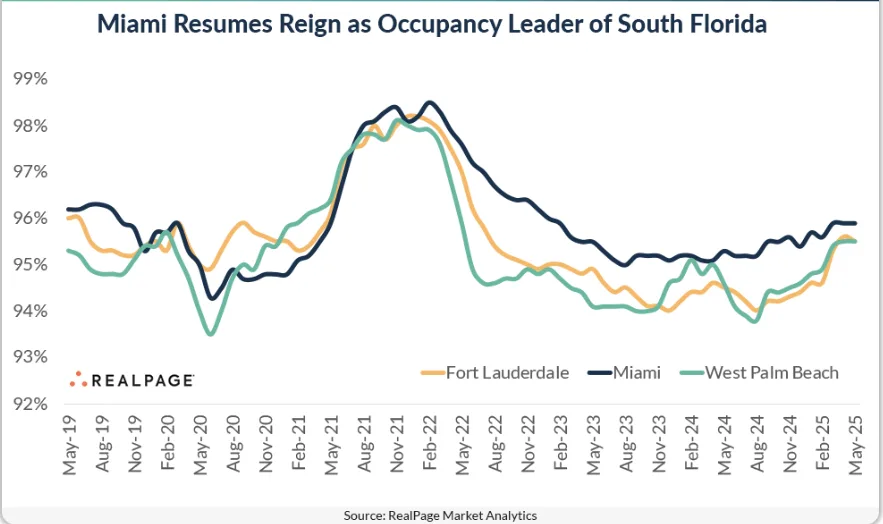

Before the COVID-19 pandemic, Miami consistently topped South Florida’s apartment occupancy charts, averaging 96.1% between 2015 and 2019, as reported by RealPage. While all three major markets—Miami, Fort Lauderdale, and West Palm Beach—experienced pandemic-era declines, Miami’s recovery initially lagged behind. That changed by mid-2021, when Miami not only caught up but also hit occupancy above 98% earlier than its neighbors.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Current Standings

Fast forward to May 2025, and Miami once again leads the region with 95.9% occupancy—slightly ahead of Fort Lauderdale and West Palm Beach, which both registered at 95.5%. It’s a notable achievement, especially as Miami remains above the national average.

Supply Vs. Demand

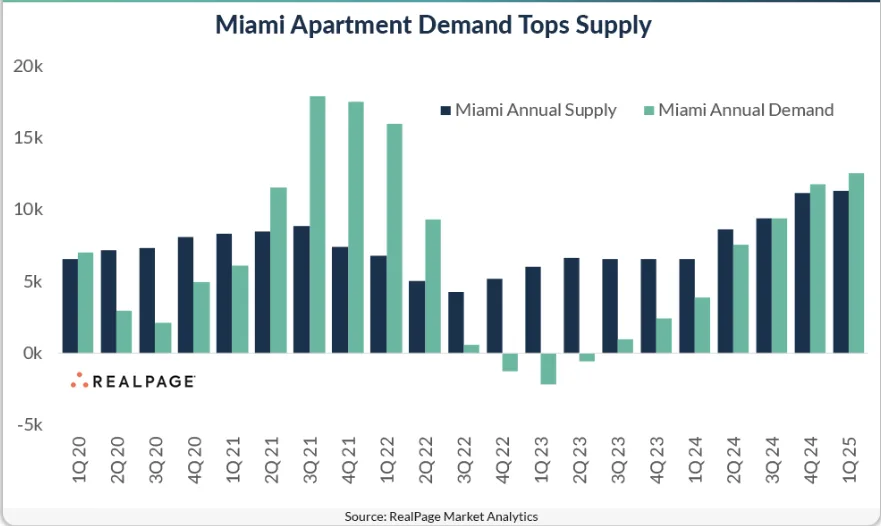

Miami’s resurgence has been driven by sustained demand that continues to outpace supply. Over 12,500 units were absorbed in the year-ending Q1 2025, exceeding new deliveries by more than 1,200 units. In comparison, Fort Lauderdale’s demand outpaced supply by just 800 units, and West Palm Beach saw a slight oversupply, with demand falling 30 units short of new deliveries.

Demographic Tailwinds

Fueling this demand is Miami’s significant population growth. The city added nearly 325K residents from 2020 to 2024, boosting its population to over 2.8M. Fort Lauderdale and West Palm Beach occupancy grew more modestly, adding 94K and 88K residents, respectively.

Rent Growth Remains In Positive Territory

Another sign of market strength: Miami is the only South Florida apartment market still experiencing rent growth. Rents rose 1.2% year-over-year in May, while Fort Lauderdale and West Palm Beach recorded declines of -1.1% and -1.7%, respectively.

High Rents, High Demand

South Florida remains one of the most expensive apartment regions in the country. As of May, average monthly rents were $2,678 in Miami—the highest in the South and among the priciest nationally. Fort Lauderdale ($2,491) and West Palm Beach ($2,497) followed closely behind, nearly cracking the top 10 nationally.

Looking Ahead

With demand continuing to outpace supply and a growing population base, Miami is well-positioned to maintain its occupancy leadership in South Florida. Continued rent growth also suggests strong investor confidence in the market’s fundamentals, setting Miami apart as the region’s most resilient apartment hub.