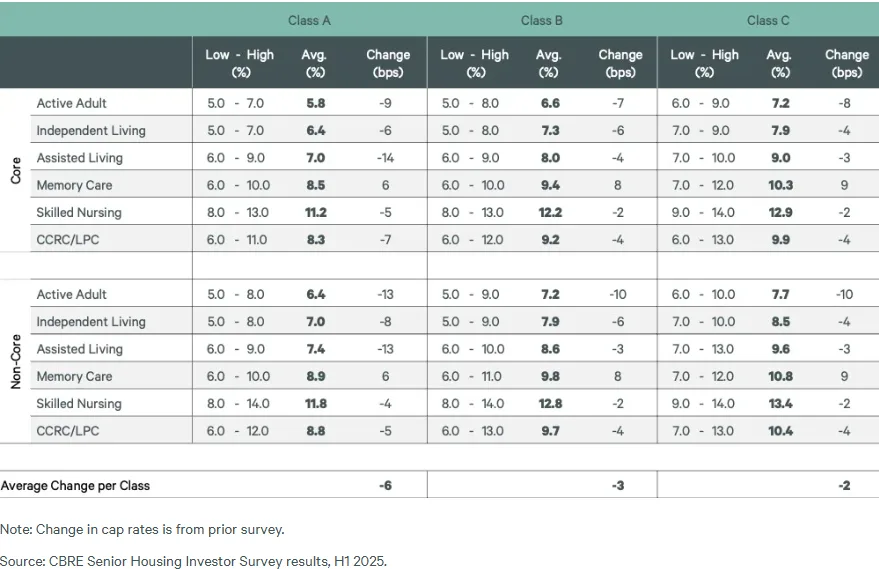

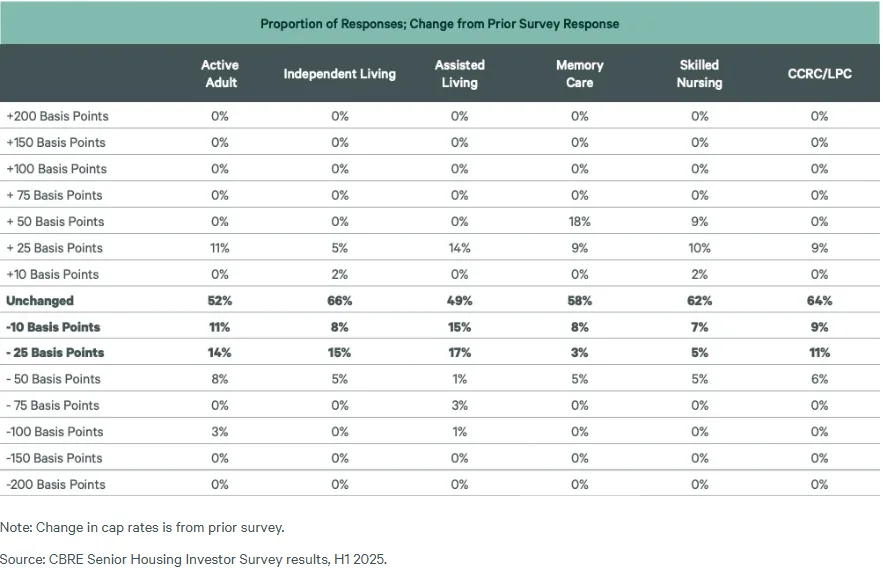

- Cap rates across most senior housing segments declined over the past six months, with further compression expected in the next 12 months.rn

- Memory care was the only segment to show an increase in cap rates, rising 8 basis points (bps) on average.

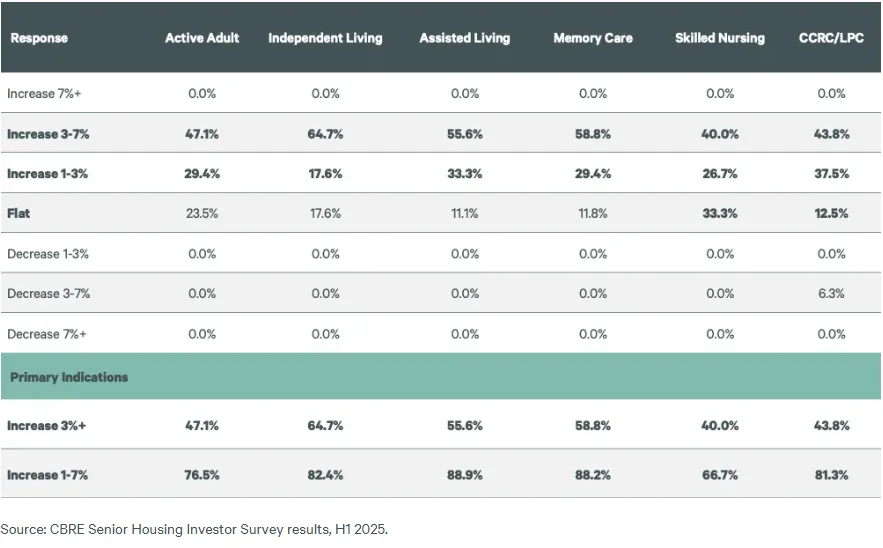

- Rent growth expectations remain strong, with over half of investors anticipating increases between 3% to 7% across senior housing types.

- Demand is outpacing supply, with more than 250K units needed through 2026, yet only 21,750 units are under construction.rn

Cap Rate Compression Trend

According to CBRE’s April 2025 senior housing and care investor survey, cap rates in the sector are likely to compress over the next year, reports GlobeSt. The average senior housing cap rate has already declined by 12 bps since the previous survey in October 2024.

By segment, active adult communities saw the largest decrease at 20 bps. Independent and assisted living followed, with 15 and 16 bps declines, respectively. Skilled nursing dropped 10 bps, continuing a trend that began in the prior survey period.

Memory Care Diverges

Memory care was the outlier, posting an average cap rate increase of 8 bps. Free-standing memory care facilities now average 9.6%, reflecting perceived operational or investment risk.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

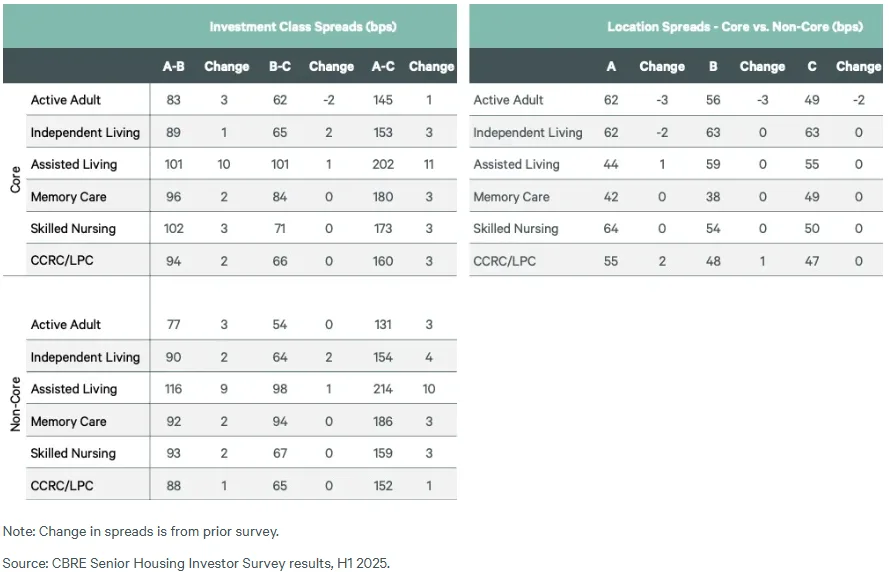

Class A And Market-Type Differences

Core market Class A assisted living facilities recorded the lowest cap rate at 7%, down 14 bps. Non-core markets also saw cap rate declines—active adult and assisted living cap rates each dropped 13 bps to 6.4% and 7.4%, respectively. The spread between core and non-core market assets remained stable at 53 bps.

Strong Rent Growth Outlook

Investor sentiment around rental growth is improving. Over 50% of respondents anticipate 3% to 7% rent increases across all senior housing segments—up from 48% in the previous survey. No respondents expect rent declines. CBRE projects rent growth to exceed 5% annually for at least the next three years.

Supply-Demand Imbalance

The senior housing market remains undersupplied. NIC MAP data cited in the report indicates that over 250K new units will be needed by 2026 to meet demand from the aging population. However, just 21,750 units were under construction as of Q1 2025. Rising construction costs are pushing developers to opt for more modest designs with fewer amenities and lower-quality finishes.

Looking Ahead

Investor confidence remains strong, bolstered by demographic tailwinds and expected rent growth. While cap rates may continue to compress, rising construction and operational costs could shape the next wave of development and investment strategy across the senior housing spectrum.