- Shares of NYC real estate firms dropped following Zohran Mamdani’s lead in the Democratic primary. His rent-freeze proposal raised fears of stricter regulations.

- Office and multifamily REITs like AvalonBay, Equity Residential, and Vornado saw steep declines. The platform’s potential to reduce returns spooked investors.

- Final results await a July 1 runoff. Still, the market reaction shows growing anxiety about political risks in New York real estate.

Investor Reaction to a Progressive Shift

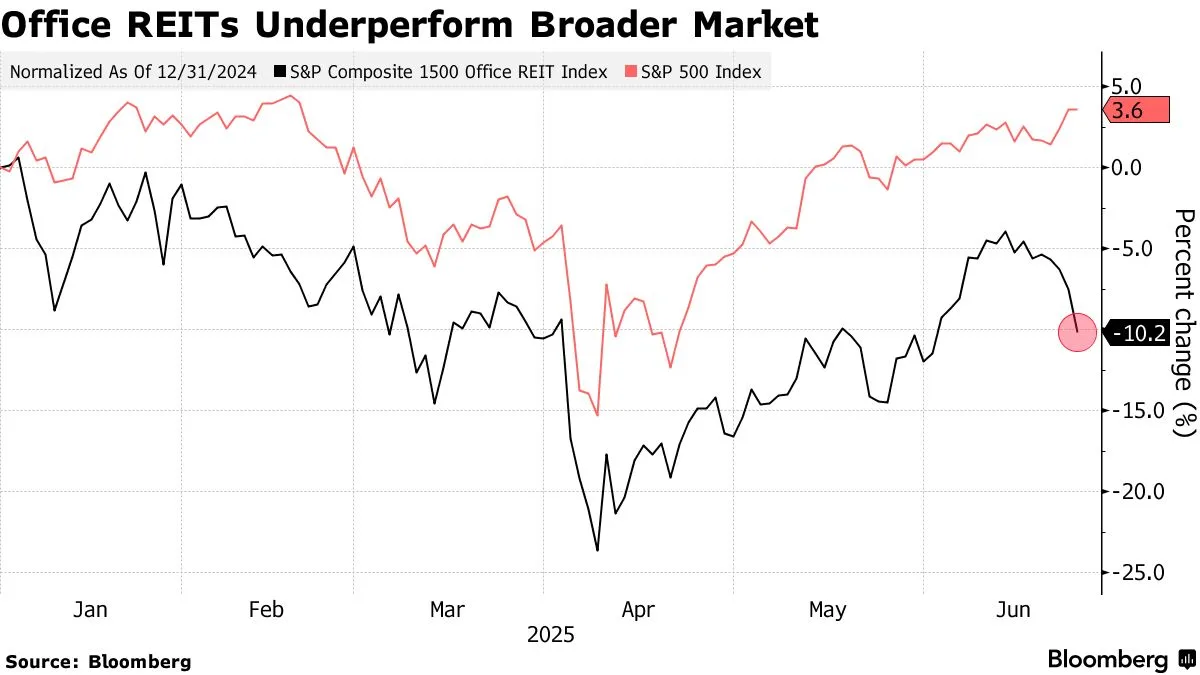

According to Bloomberg, shares of NYC real estate investment trusts slid Wednesday after Mamdani appeared poised to win the Democratic mayoral nomination. His platform includes a rent freeze, tax increases, and free public transit. While popular among voters, the plan sparked investor concern. The real estate sector became the day’s worst performer on the S&P 500.

REITs Feel the Pressure

Multifamily-focused REITs, including AvalonBay Communities, Equity Residential, and UDR Inc., fell sharply. These companies rely on stable rental income, and Mamdani’s policies could threaten profitability. Vornado Realty Trust, one of the city’s largest office landlords, dropped over 6%. Despite the loss, some analysts view the dip as a buying opportunity.

Concerns Beyond Housing

According to Mizuho’s Vikram Malhotra, the broader issue is not just rent control. He warned the agenda could discourage corporate investment and hiring. Former Governor Andrew Cuomo echoed that fear, saying Mamdani’s ideas might drive wealthy residents out of the city.

Moreover, the pain is not limited to landlords. Flagstar Financial, a key lender to NYC apartment owners, also fell nearly 4%. Rising fears of rent defaults could weigh on banks with real estate exposure.

Landlords Already Strained

Peter Hungerford, founder of PH Realty, said the rent freeze could push many landlords over the edge. “Many already operate with razor-thin margins,” he explained. “If this goes through, a lot of owners may walk away.” That could trigger more loan defaults and distressed sales.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

What Comes Next

The primary results won’t be final until a July 1 ranked-choice runoff. Mamdani must also win the general election in November. Still, Wednesday’s market reaction shows how seriously investors are taking his candidacy.

Alexander Goldfarb of Piper Sandler pointed out that candidates often moderate their platforms. “Positions change based on union feedback and voter support,” he said. Labor groups, especially those tied to office jobs, could push Mamdani to adjust.

Why It Matters

This moment signals more than just a political shift. It’s a warning to real estate investors. Progressive housing policies are gaining ground in major cities. As a result, landlords, lenders, and developers are reassessing their strategies in high-regulation markets like New York.