- Home prices are up 60% since 2019; mortgage payments now require over $126K in annual income, pricing out millions.

- The US homeownership rate dropped to 65.1%—the first decline in eight years—especially among buyers under 35.

- Despite a wave of new units, half of all renters are cost burdened, and rents remain high in many markets.

A Market Under Strain

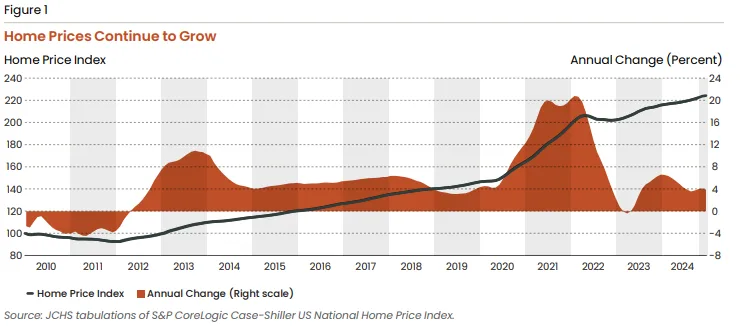

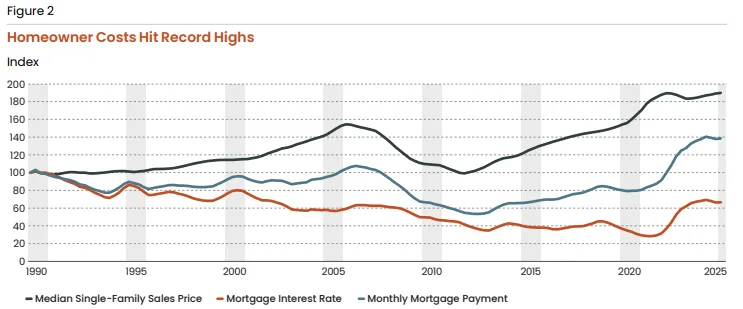

In 2024, home prices hit new highs, climbing to a median of $412,500—five times the median household income, per JCHS.

While construction of new homes slightly increased, affordability continued to erode due to persistent supply shortages, high interest rates, and rising insurance and tax costs. Mortgage payments on a median-priced home now require over $2,500 a month, effectively locking out all but the most affluent buyers.

Homeownership Hits a Wall

The homeownership rate fell for the first time in eight years, dipping to 65.1%. The biggest drop was among households under 35, where ownership declined 1.4 percentage points in 2024. Tight credit, down payment hurdles, and record-high costs have made it nearly impossible for many first-time buyers to enter the market. Notably, only 6M of the nation’s 46M renters earn enough to afford the median-priced home.

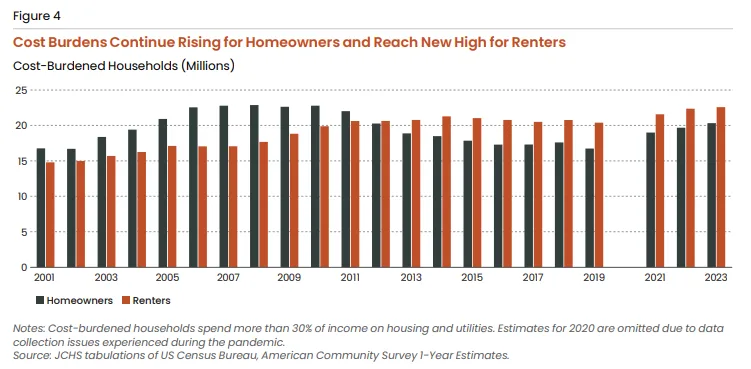

Renters Face Record Cost Burdens

Although multifamily completions reached a 40-year high in 2024, rents remain unaffordable for millions. Half of US renters now spend more than 30% of their income on housing, with over 12M severely cost burdened. The hardest hit are low- to middle-income renters, but even those earning $45,000–$74,999 have seen burden rates double since 2001.

A Shrinking Safety Net

Federal housing assistance is falling short as the need surges. Only one in four income-eligible renters receives any subsidy, and a record 8.5M very low-income households now face “worst case” housing needs. Meanwhile, homelessness reached an all-time high in 2024, with more than 771,000 unhoused—up 33% since 2020. Many local programs risk collapse due to delayed federal grants and looming funding cuts.

Slower Growth, Older Households

Demographic trends are also reshaping housing demand. Household growth slowed sharply in early 2025, as immigration tapered and fewer young adults formed new households. The report warns that household growth could fall to historically low levels over the next two decades. In contrast, the number of households headed by adults aged 80+ is set to double, adding pressure for accessible and affordable housing.

Why It Matters

Affordability remains the dominant issue in US housing. Despite recent construction gains, years of underbuilding have left a supply gap estimated between 1.5 and 3.7M units. Without meaningful federal support and zoning reforms, affordability challenges will likely worsen—pushing homeownership further out of reach and deepening rent burdens nationwide.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes