- Trepp identified 279 US office loans with occupancy below 60% and a total loan balance of $9.02B—prime candidates for distress-driven acquisitions.

- More than half of these loans (52%) have a DSCR below 0.89x, signaling severe cash flow challenges.

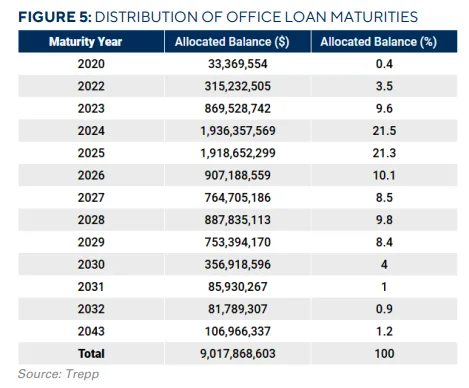

- Many assets face loan maturities between 2025–2027, with refinancing hurdles due to higher interest rates and declining valuations.

The Time May Finally Be Right

After a prolonged wait, distressed buying opportunities in the office market are emerging, driven by maturing loans, low occupancy, and the strain of higher interest rates. While some anticipated distress never materialized in 2023–2024, data from Trepp shows that 2025 is different.

With $10.1B in CMBS office originations already recorded in Q1 2025—more than all of 2024—the market is clearly bifurcated. Top-tier, Class A properties are drawing capital, while older, lower-performing assets are nearing a tipping point.

Understanding the Opportunity Set

Trepp’s latest analysis reveals 279 loans totaling $9.02B on properties with reported occupancy below 60%. Many of these properties are not only underutilized but also suffer from operational and structural obsolescence.

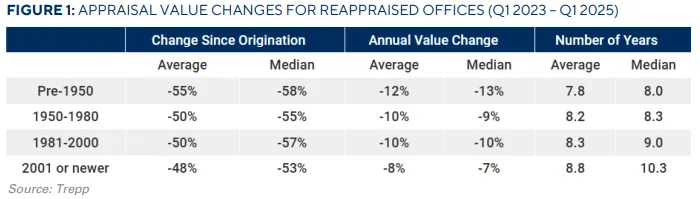

- Vintage Breakdown:

The largest share of these distressed assets falls into the pre-1940 and 1971–1990 vintages, accounting for 74.5% of the outstanding balance. These older buildings often lack modern amenities and face high barriers to repositioning without major capital investment.

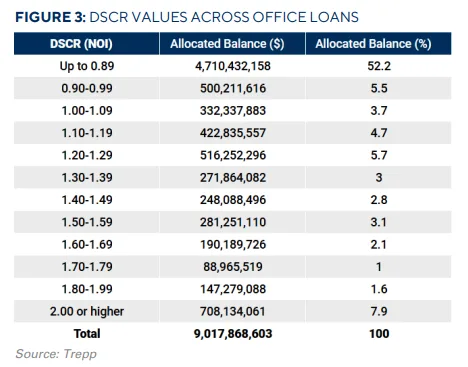

- DSCR Snapshot:

Approximately $4.71B of the distressed sample has a DSCR of 0.89x or lower. These assets are not covering their debt service and may already be in delinquency or default. Over 70% of loans in the dataset fall below the 1.25x DSCR typically required for refinancing.

The Refinancing Math Doesn’t Work

Interest rates for new CMBS office loans in 2025 are in the 6.75%–7.75% range, with some deals even hitting nearly 14%. Compare this to existing loans in the distressed pool, many of which are sitting at sub-5% rates. That rate shock—combined with depressed occupancy—creates a refinancing gap too wide to bridge for many borrowers.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Maturity Wall Ahead

The maturity wave is cresting, with a large concentration of office loan maturities between 2025 and 2027. These borrowers, already operating under distressed conditions, are unlikely to meet today’s stricter lending standards or inject enough equity to fill valuation gaps.

Unlike in the post-GFC period, rate relief isn’t on the horizon. The “extend-and-pretend” window is closing, and many lenders may begin to divest assets rather than take them on.

Where the Deals Are

The top 10 MSAs by distressed loan balance—led by New York, Los Angeles, San Francisco, and Chicago—are home to nearly $2.4B in potentially distressed assets. While Class A office has rebounded in places like Manhattan, older buildings in these same cities remain financially strained.

Raising the occupancy threshold to 75% would expand the distress pool to over $26.3B, suggesting the opportunity set is even broader than the current $9.02B sample indicates.