- CRE sentiment is cautiously optimistic, with activity expected to stay steady or rise in H2 2025.

- Top-tier assets outperform in office and multifamily, deepening the market’s bifurcation.

- Construction stays active in industrial, multifamily, and data centers despite tariff concerns.

- AI and automation drive demand, especially in data centers and site selection strategies.

A Nationwide Reset

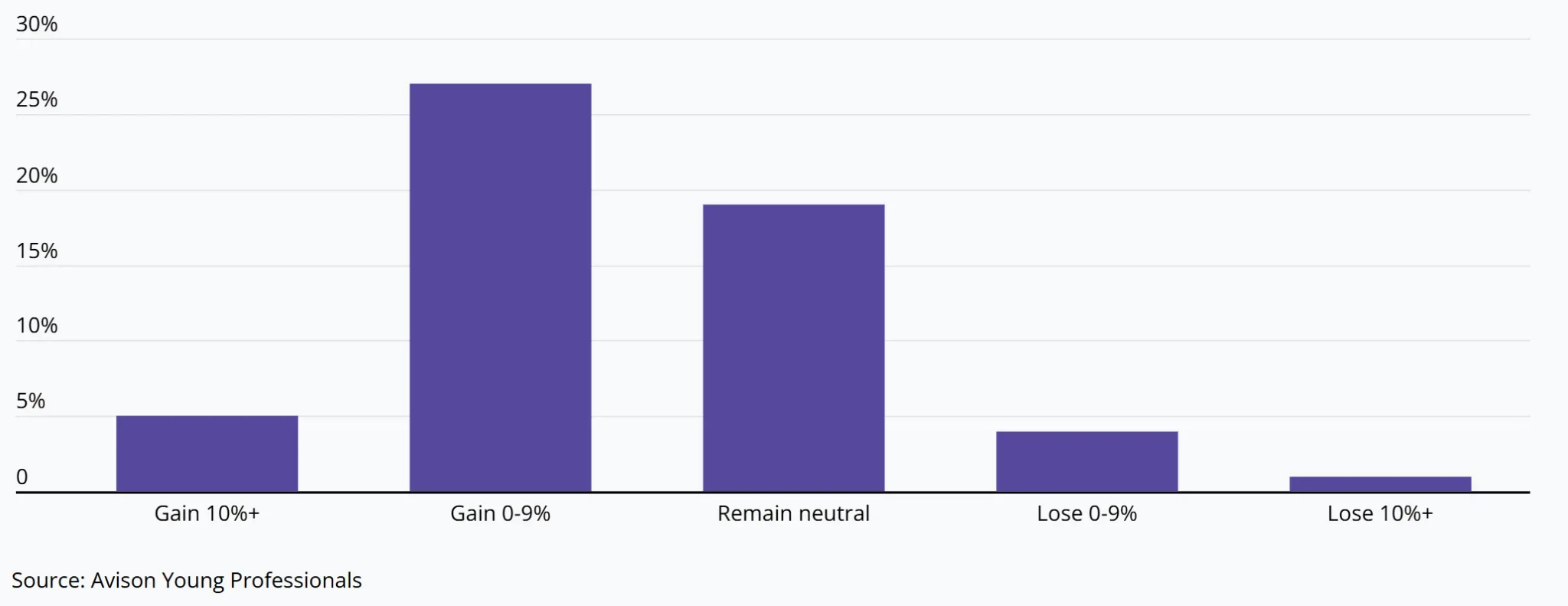

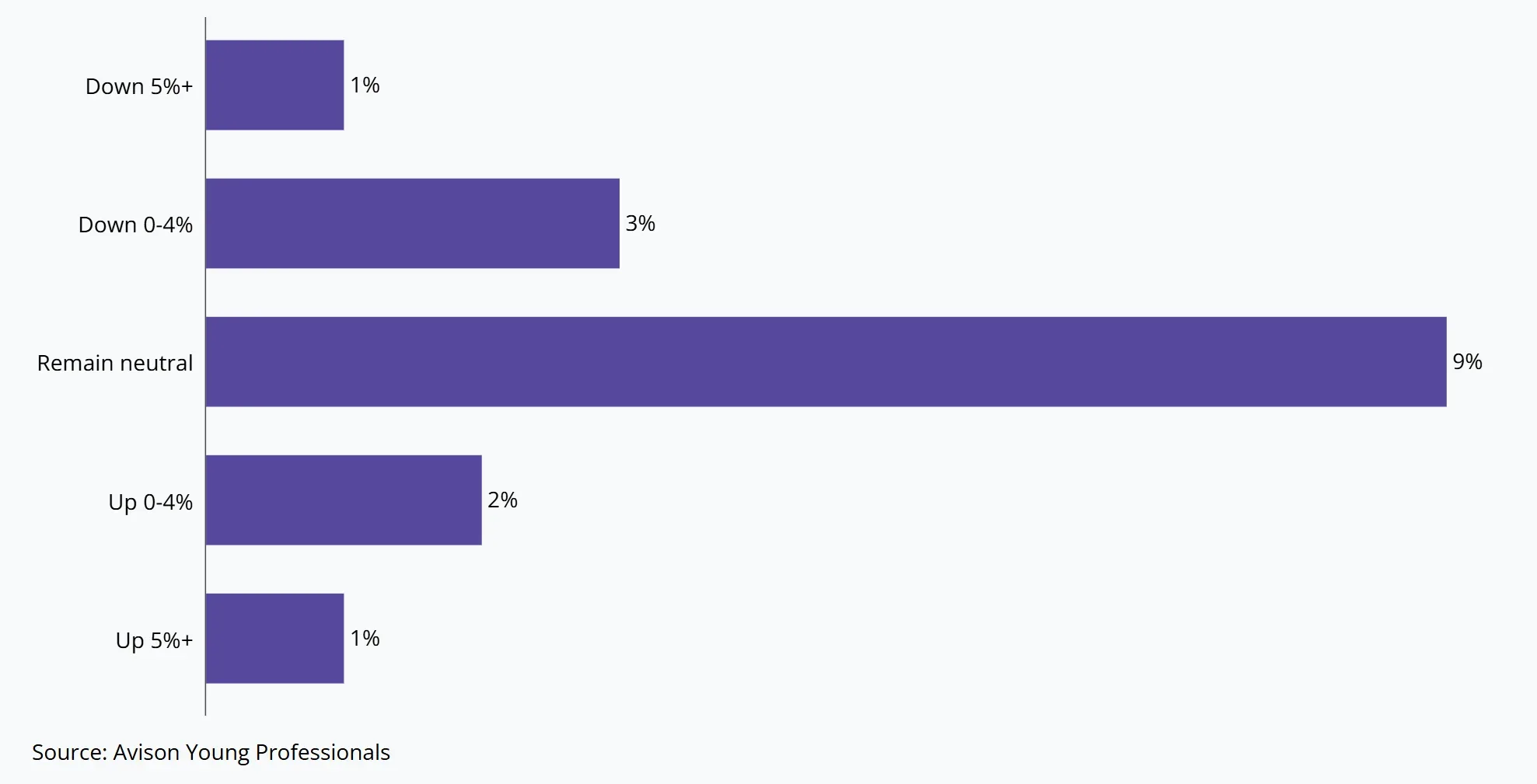

Commercial real estate in the US is stabilizing after a period of change. Real estate professionals across the country report a more confident outlook than at the end of 2024. While the mood isn’t overly optimistic, it reflects a steady confidence. Most expect activity to hold or improve as investors and users adapt to shifting conditions.

Avison Young’s internal survey shows growing interest in leasing tours, deal activity, and investment. Most fundamentals remain steady, even with ongoing uncertainty around tariffs, supply chains, and economic policy.

Office

The office market is split. Trophy and class A buildings in urban cores like Manhattan, Miami, and D.C. are still in high demand. Class B and C buildings are falling behind as they struggle to offer the modern features tenants want.

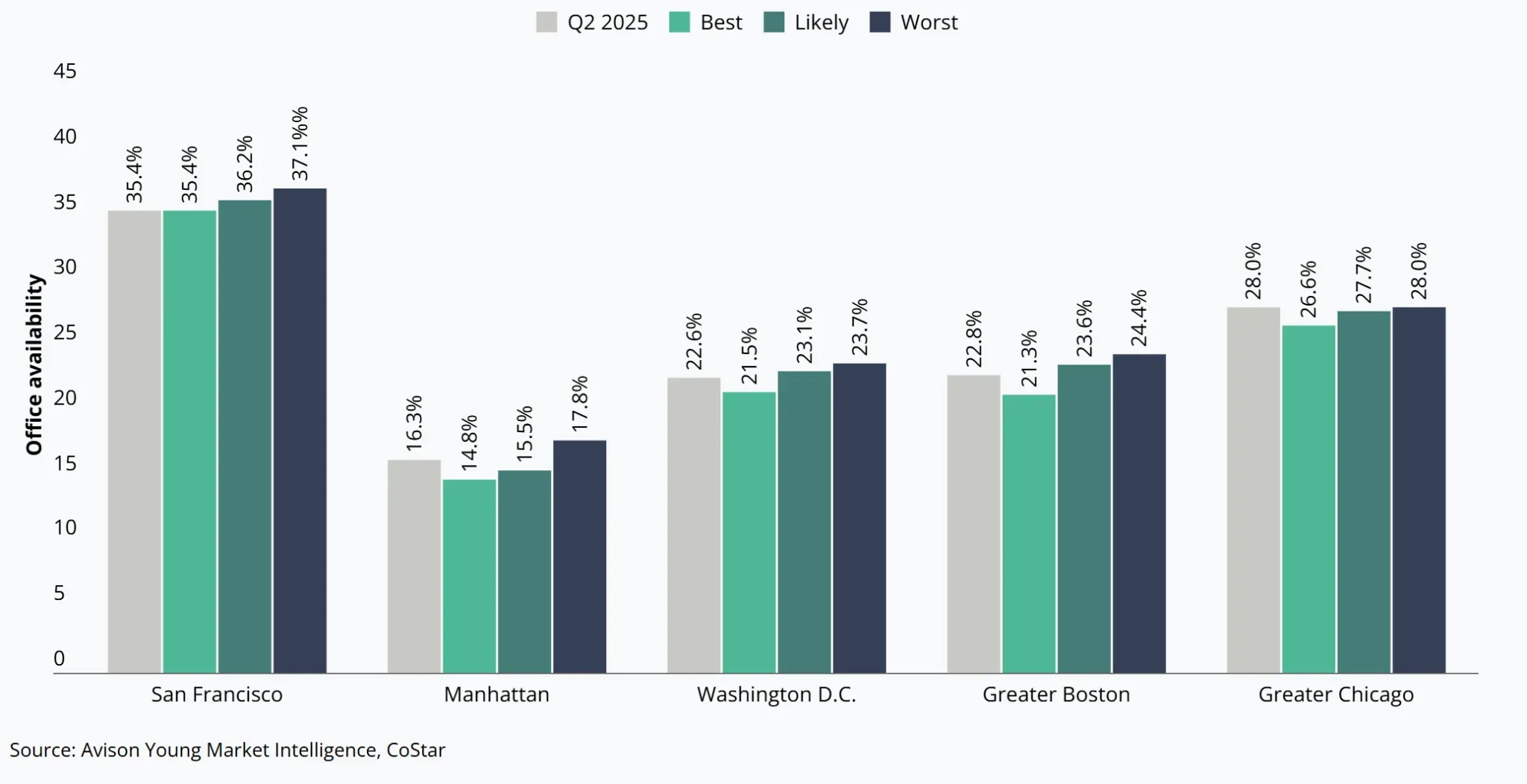

More companies now enforce return-to-office (RTO) rules. This shift is helping stabilize occupancy, especially in well-located buildings with transit access and strong amenities. Experts expect slight gains in Manhattan, while cities like San Francisco, Boston, Chicago, and D.C. could see small increases in vacancy.

Industrial

Industrial real estate continues to benefit from rising US manufacturing, especially in areas like semiconductors, defense, and pharmaceuticals. Demand depends on location. The Northeast may see a small decline, while the West Coast is likely to grow slightly.

However, tariff concerns are slowing some development. Companies are holding back on expansion plans as they wait for clarity on trade and pricing.

Retail

Retail remains one of the tightest sectors in commercial real estate. Vacancy is low, and tenant demand is strong—especially among discount brands and health-related businesses. Many older retail spaces are being reused for entertainment or medical services.

But the sector still faces challenges. Tariffs, rising costs, and ecommerce growth are cutting into profits. Store closures and bankruptcies are hitting areas like department and hobby stores hardest.

Data Centers

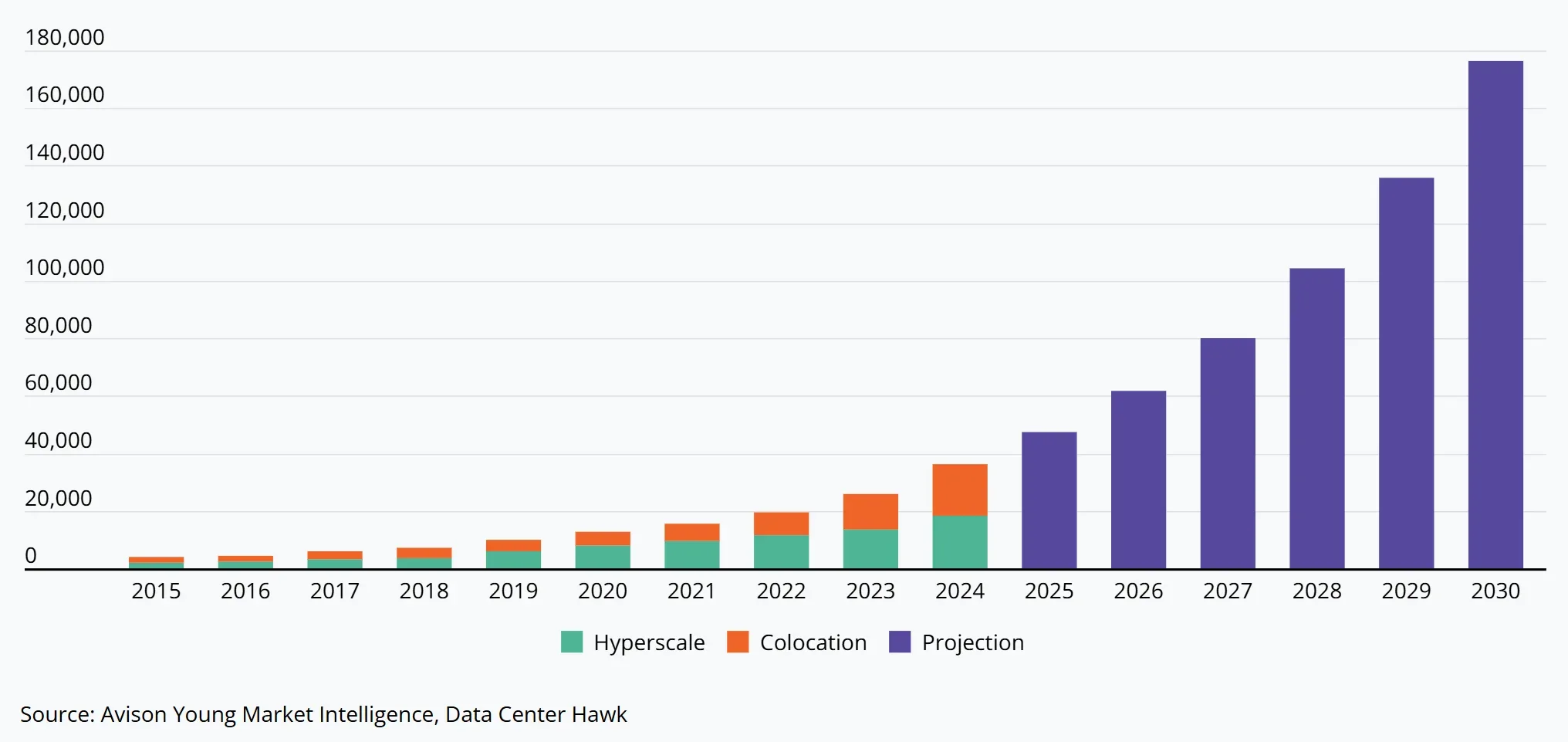

Data centers are seeing rapid growth. Demand is being fueled by AI, cloud services, streaming, and autonomous tech. Large firms like Amazon and Google are boosting their investment to keep up.

Still, developers face major hurdles. Limited power supply and higher tariffs on materials could slow new projects. Even so, the US data center market is on track to quadruple by 2030, reaching 180 gigawatts.

Healthcare

Healthcare real estate is expanding fast. Providers are using AI tools to choose sites more strategically. At the same time, low supply of outpatient centers is pushing up values.

Despite this growth, the sector faces some headwinds. Fewer patient visits, slower reimbursements, and uncertain regulations are limiting how much providers can invest in new space.

Multifamily

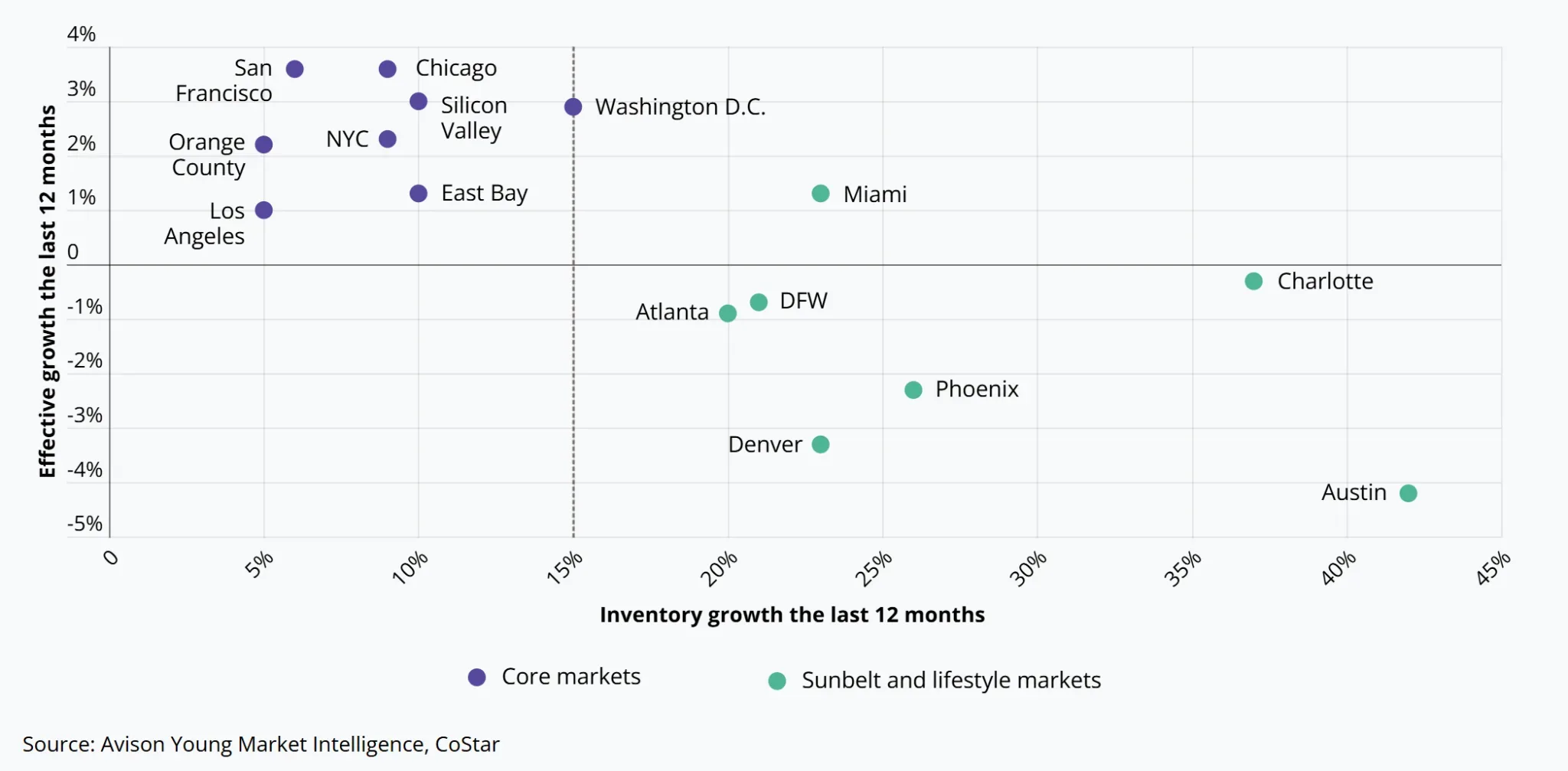

The multifamily market is shifting. A wave of new, high-quality housing is set to open in 2025. After that, construction may slow due to rising costs. Cities like Miami remain strong, but rent in some Sun Belt areas may flatten or fall.

Many renters are still priced out of homeownership. At the same time, more people are moving back near work due to RTO policies. But long-term demand may change as millennials start families and look for single-family homes.

AI & Tech

AI continues to change commercial real estate. It’s driving more demand for high-end office space and data infrastructure. Venture capital remains strong, especially in cities like San Francisco and Austin.

But smaller startups face rising costs and fewer resources. Tariffs and global supply issues are also slowing tech growth. Still, tech hubs with talent and capital are seeing new leases and expansion activity.

What’s Next

Adaptability and resilience define the outlook for late 2025. Even with ongoing challenges, most professionals believe quality assets in strong locations will continue to perform. Demographics, policy shifts, and technology are reshaping the market. Across all sectors, the industry is responding—not waiting—for what’s next.

Expect developers and investors to focus more on user experience, repositioning strategies, and smart capital use to lead the next phase of US commercial real estate.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes