- The number of rent-burdened Americans reached a record 22.6 million in 2023, with 12.1 million spending over half their income on rent.

- Despite over 600,000 new apartments built in 2024, the supply is concentrated at the high end, limiting relief for low-income renters.

- Cuts to federal housing aid and rising energy bills are making conditions worse, especially in the South and West.

A growing gap

Despite a boom in construction, a growing share of renters are spending more than they can afford on housing, as reported by the WSJ. According to Harvard’s Joint Center for Housing Studies (JCHS), 65% of working-age renters can’t cover basic expenses after rent. In total, 22.6 million renters are considered cost-burdened, with 12.1 million paying more than half their income toward housing.

The middle-class squeeze

While low-income renters remain the hardest hit, the JCHS found that affordability issues are growing fastest among middle-income households. For those earning between $45,000 and $75,000 annually, the share considered rent-burdened has doubled since 2001 to 45%.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Supply up, affordability down

The U.S. added 608,000 new market-rate units in 2024—one of the strongest years for multifamily development in decades. Still, the pace hasn’t matched the 848,000 new renter households added that same year. Most new supply targets higher-income renters, with the median rent for new units reaching $1,900—well above affordable levels for most Americans.

Waning federal support

Proposed cuts to housing assistance programs, including a 40% reduction in Section 8 vouchers, threaten to further strain renters. Analysts from Harvard noted these programs are critical, particularly when private development does not serve the lowest-income segments of the population.

Rising costs beyond rent

Higher electricity and natural gas prices are driving up overall housing costs. The Energy Information Agency projects an 80% increase in natural gas costs in 2025 compared to the previous year. Additional charges, such as application and utility fees, are also expanding, adding to the burden on tenants.

Outlook worsening

Affordable housing production peaked in 2024 with 94,261 units, but completions are expected to fall by half by 2027, according to data from Yardi Matrix. At the same time, rents remain elevated in key markets like New York City and Los Angeles. In Manhattan, the median rent hit $4,500 in February 2025—a new record.

Why it matters

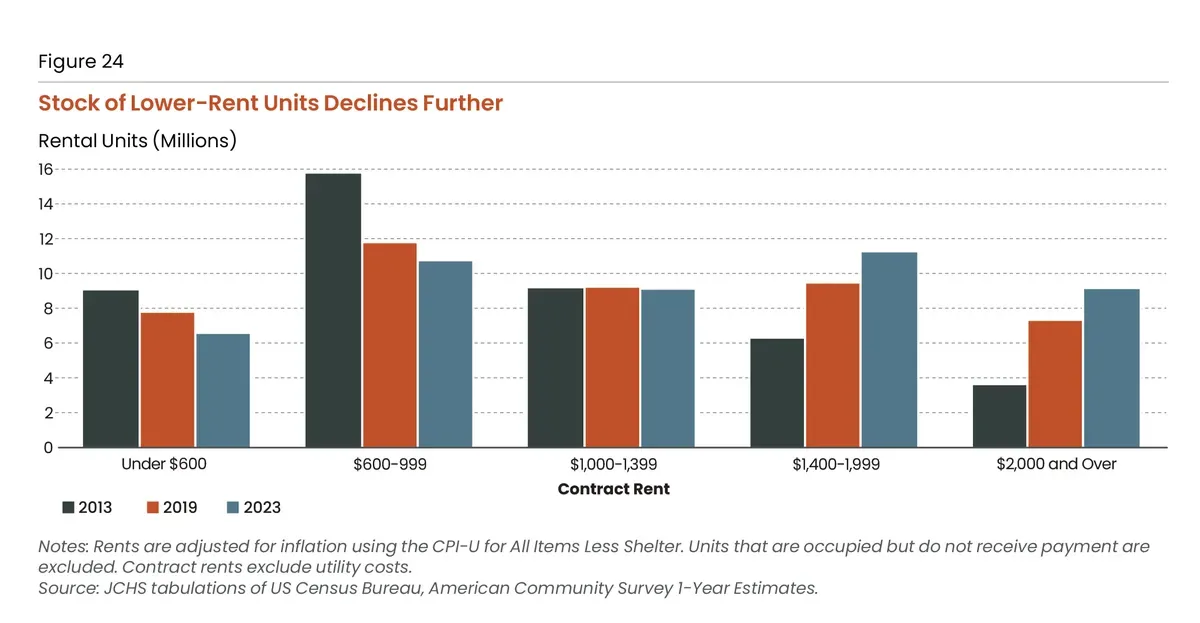

While construction has ramped up, the majority of it is aimed at high-income renters. Units renting for under $1,000 per month have declined by 30% since 2013, while the number of units renting for more than $2,000 has more than doubled. This structural shift in the rental market is making it harder for lower- and middle-income renters to find affordable options.

What’s next

Experts anticipate that without increased public investment, affordability will worsen—especially if proposed cuts to federal aid are implemented. Advocacy groups are calling for expansion of programs like the Low Income Housing Tax Credit and LIHEAP, as well as state-level interventions to stem the rise in utility costs and service fees.