- As of June 2025, approximately 64,200 build-to-rent (BTR) units are under construction nationwide, with projected completions by late 2027.

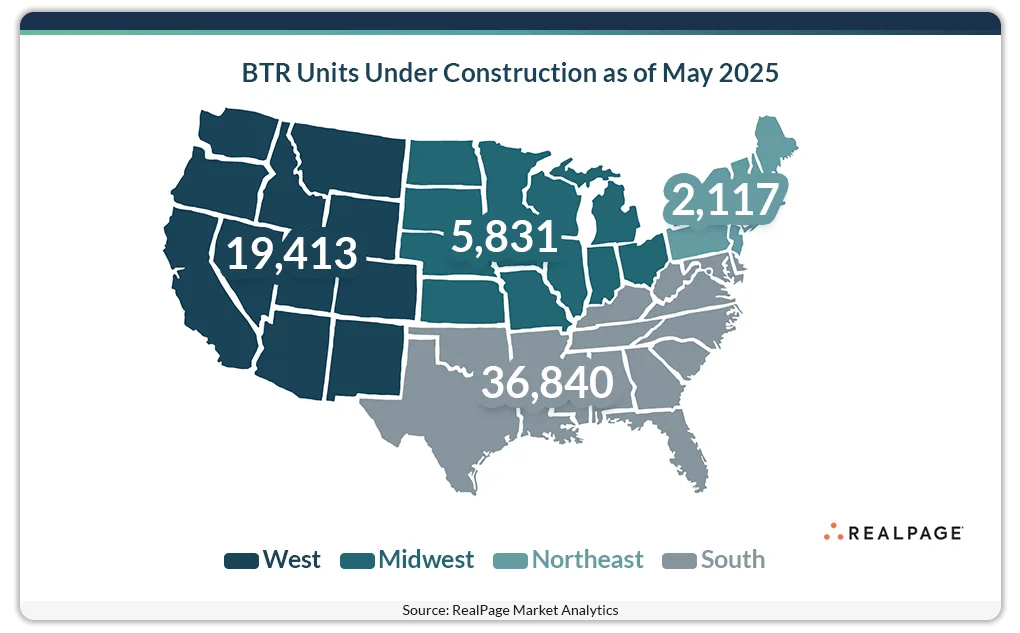

- The South, led by Sun Belt states, accounts for 57% of all BTR units under construction, or nearly 36,840 units.

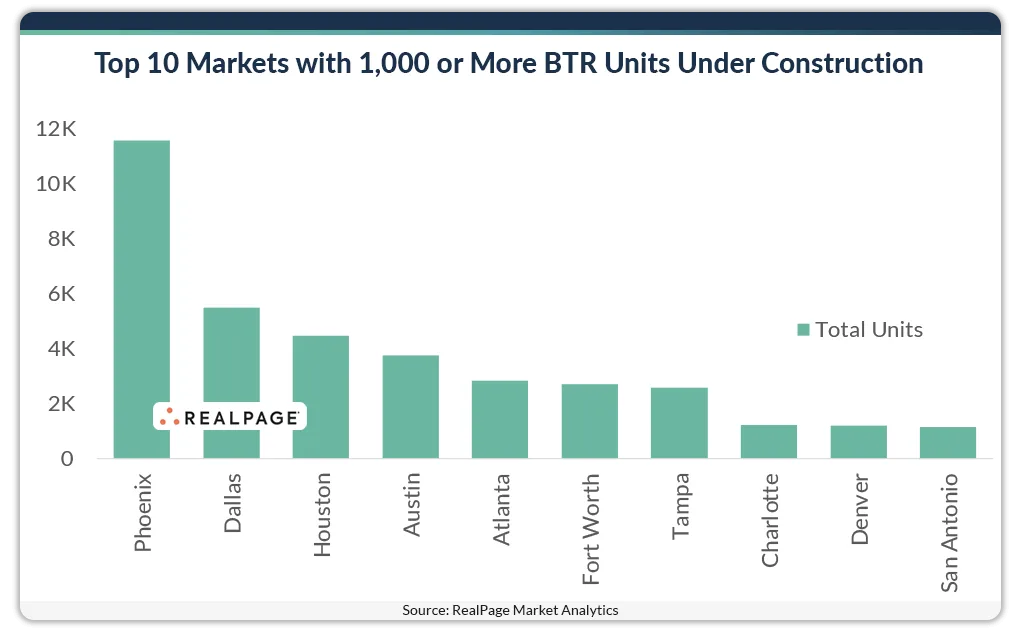

- Phoenix tops all US markets with over 11,500 units underway, representing 18% of the national pipeline.

- Dallas and Houston follow with 5,500 and 4,470 units respectively, while smaller markets like Myrtle Beach and Raleigh/Durham also show strong activity.

Sun Belt Still Dominating

Build-to-rent (BTR) development remains concentrated in the South, particularly across the Sun Belt. According to RealPage Market Analytics, more than half of all BTR units under construction are in the South, with delivery timelines stretching through mid-2027.

While other regions trail behind — the West claims 30%, or 19,413 units; the Midwest 5,831 units; and the Northeast just over 2,100 units — the South continues to attract outsized investment due to population growth, land availability, and renter demand.

Phoenix at the Top

Long considered the birthplace of the Build-to-Rent model, Phoenix has solidified its position as the national leader, with more than 11,500 units in various stages of construction. That figure places it well ahead of its peers, accounting for nearly one in five BTR units currently being built in the US

Dallas comes in a distant second with 5,500 units underway, followed by Houston at 4,470. Rounding out the top ten are Austin, Atlanta, Fort Worth, Tampa, Charlotte, Denver, and San Antonio, all markets with growing renter populations and rising demand for single-family rentals.

Emerging and Secondary Markets

Beyond the top ten, several smaller and mid-sized metros are showing notable BTR growth. Myrtle Beach, with 983 units underway, leads among small markets. Meanwhile, Nashville (971 units) and Raleigh/Durham (936 units) are contributing to the Southeast’s broader development surge.

Across the country, 21 additional markets have 500 or more units in the pipeline, underscoring the continued spread of the BTR model beyond major metros.

Why It Matters

The Build-to-Rent segment has become a key growth engine in the single-family rental space, offering developers an alternative to traditional multifamily projects. Despite a nationwide slowdown in new project starts, the current pipeline remains strong, with RealPage tracking over 7,500 planned units, ensuring continued momentum for the sector into the late 2020s.

What’s Next

Expect BTR to remain a favored development strategy in high-growth regions, particularly where land is accessible and rental demand remains elevated. As developers adjust to capital market constraints, Sun Belt metros like Phoenix and Dallas are expected to remain BTR hotspots. Meanwhile, secondary markets may offer new opportunities for expansion as the model continues to gain traction nationwide.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes