- Student housing preleasing hit 79.9% in May, up from last year despite flat rents.

- Rent growth slowed to 2.1%, the lowest since 2021, as operators prioritized occupancy.

- Future enrollment growth is uncertain due to demographic and policy shifts.

- Large markets like Purdue and Georgia Tech lag due to new supply, while others lead with over 90% preleasing.

Strong Preleasing Amid Slower Rent Growth

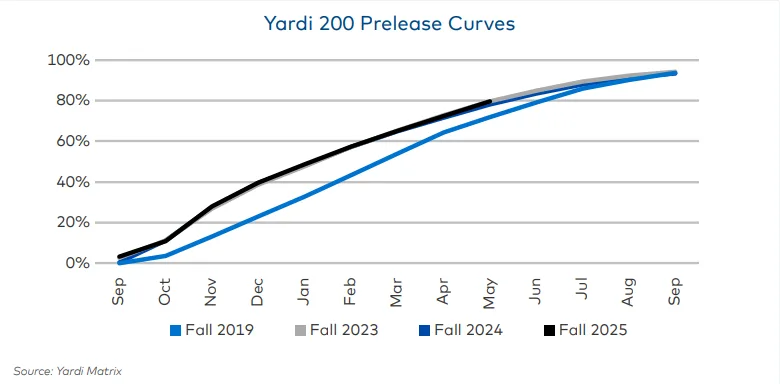

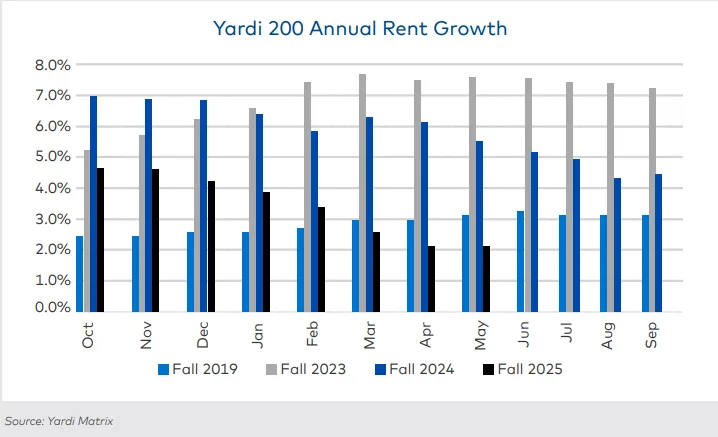

Preleasing activity in the student housing sector remains resilient. At 79.9% in May 2025, leasing at Yardi 200 universities surpassed last year’s pace by 1.5 percentage points, reports Yardi Matrix. Yet despite the demand, operators are curbing rent increases to ensure occupancy, leading to the slowest annual rent growth in nearly four years.

The average rent per bed held steady at $918 in May, just $1 below the record high. However, rent growth has been trending downward across most markets. The fall 2025 leasing season shows a 3.4% average rent growth, significantly down from 5.8% in fall 2024 and 7.0% in fall 2023.

Enrollment And International Student Risks

Average enrollment growth rose to 1.8% in Fall 2024, but structural challenges loom. The declining number of high school graduates, threats to higher education funding, and stricter international student visa processes could weaken future enrollment—particularly concerning for large public universities like Illinois, Arizona State, and Purdue that enroll thousands of international students.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Investment And Market Dynamics

Sales of student housing properties in 2025 are on pace with last year, though the average price per bed fell to $88,467 from $105,252 due to a lack of portfolio deals. Still, sustained demand and prior years’ performance support ongoing investor interest.

Preleasing Leaders And Laggards

Thirty universities have surpassed 90% preleased, with Mizzou (98.6%), Illinois State (98.3%), and Alabama (96.8%) leading the charge. Meanwhile, several large schools trail expectations due to supply pressure. For example, Purdue (86.6%), Florida State (77.9%), and Georgia Tech (65.6%) are each more than 5% behind last year’s preleasing pace.

Rent Growth Diverges By Market

Rent performance varies dramatically. Smaller markets like Louisiana Tech (+17.2%) and Kansas State (+10.7%) posted double-digit growth, while rent at Tennessee–Knoxville dropped 8.2%, and Ohio State fell 7.7%, following previous spikes. In total, 59 markets saw negative annual rent growth as of May.

Why It Matters

Despite solid preleasing activity, slowing rent growth suggests that affordability concerns and competitive pressures are beginning to temper pricing power in the student housing sector. Meanwhile, enrollment headwinds and supply challenges could reshape market dynamics in the coming years.