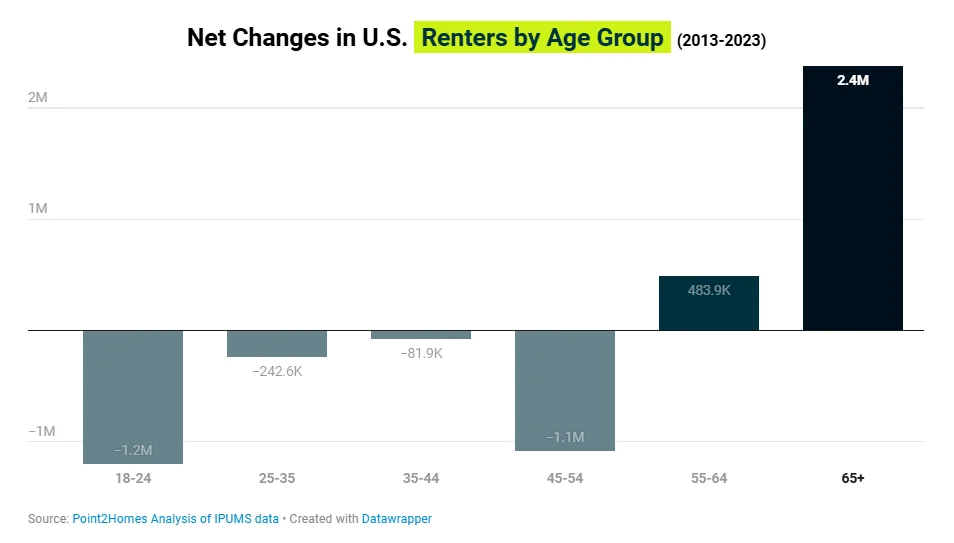

- Seniors saw the biggest net and percentage jump in rentership, rising by 2.4M over ten years, driven by downsizing, high home costs, and lifestyle flexibility.

- Southern cities like Baton Rouge (+89%) and Jacksonville (+84%) posted the highest gains in 65+ renters, reinforcing the southward shift among retirees.

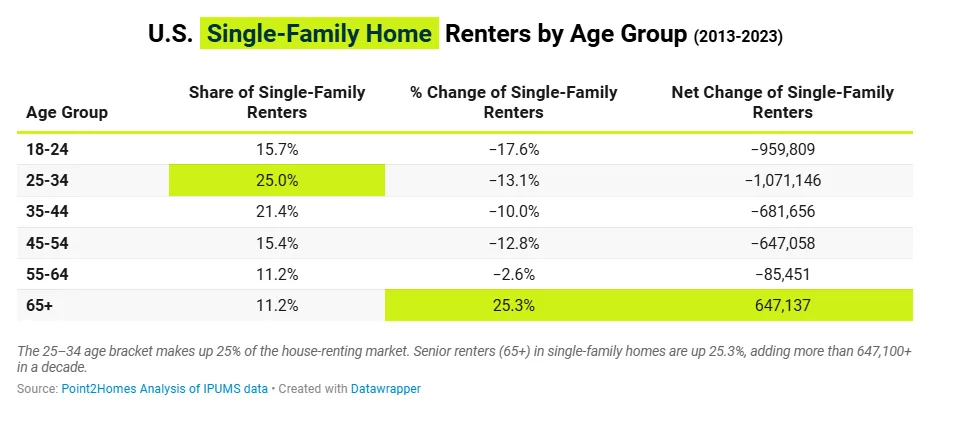

- Seniors are not just renting more — they’re renting bigger. House rentals among those 65+ are up 25%, with Omaha, Dallas, and Austin seeing 100%+ increases.

- While adults 25–34 still represent the largest share of renters, their numbers — along with other younger groups — have declined as affordability pressures and life-stage delays take hold.

Aging Into Renting: The 65+ Surge

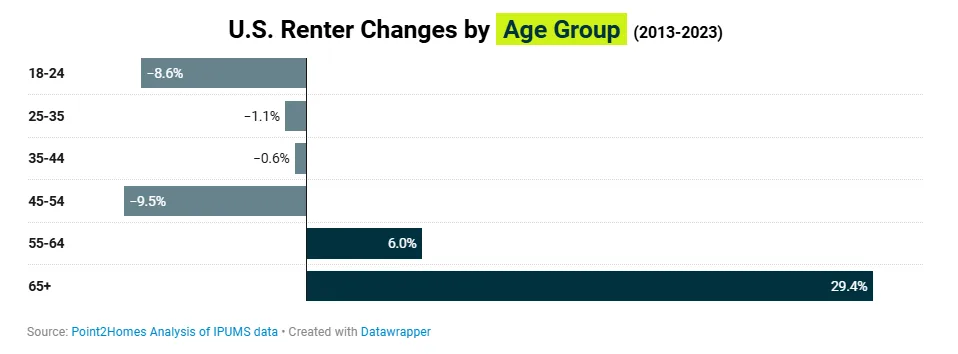

Older Americans are reshaping what it means to rent in the US, reports Points2Homes. The 65+ demographic added 2.4M renters between 2013 and 2023 — a nearly 30% increase — according to US Census data. That makes seniors the fastest-growing segment of the rental market.

This shift reflects broader demographic changes — with more Americans aging into retirement — but also speaks to evolving financial realities. High interest rates, property taxes, and maintenance costs make homeownership less attractive. Meanwhile, renting allows many retirees to downsize, stay mobile, and prioritize being near family or healthcare facilities.

Sunbelt Appeal & Urban Draw

Florida cities top the list for senior renter share: 21.3% of renters in North Port–Sarasota–Bradenton are 65+, followed by 18.5% in Cape Coral–Fort Myers. However, Baton Rouge (+89%), Jacksonville (+84%), and Austin (+82%) recorded the fastest decade-over-decade growth in 65+ renters.

While warmer climates and healthcare access are key draws, many seniors are also following family — a phenomenon dubbed “baby chasing.” Proximity to grandchildren, shared expenses, and part-time employment opportunities all contribute to the Sunbelt migration.

Still, major metros saw the biggest absolute gains. New York added nearly 276K renters aged 65+; Los Angeles added over 141K — suggesting large cities remain attractive due to their broad rental stock and support services.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Older Renters Prefer Houses, Too

One of the most significant shifts: more seniors are renting single-family homes. Over the past decade, house renting among those 65 and older jumped by more than 25%. Cities like Omaha, Dallas, and Austin each saw 100%+ growth in this category.

Why houses? They offer more space for hobbies, guest rooms for visiting family, and quieter neighborhoods — all with fewer long-term financial commitments.

Younger Generations Pull Back

Despite making up 27% of the rental market, Americans aged 25–34 saw a slight decline (-1.1%) in rentership. Other younger and midlife groups also retreated, with the steepest drops among adults 24 and under (-9%) and those aged 45–54.

The reasons vary: Younger adults are staying in school longer, living with family, or delaying financial independence. Midlife adults, by contrast, are increasingly buying homes in less expensive areas — often enabled by remote work.

Why It Matters

The rise in senior renters marks a structural shift in housing demand. With homeownership becoming less feasible — or less desirable — for aging Americans, the rental market is evolving to meet new needs.

Developers, investors, and policymakers may need to adapt rental offerings for older adults, particularly in walkable, healthcare-accessible, and family-friendly locations. Single-family rentals, age-friendly amenities, and mixed-use communities are likely to see increased demand.

What’s Next

As Baby Boomers continue to age — and as more Americans rethink the costs and commitments of ownership — the senior renters market is poised for further growth. Expect a continued tilt toward flexible housing, lifestyle-driven relocation, and a rental market that increasingly reflects the needs of America’s aging population.