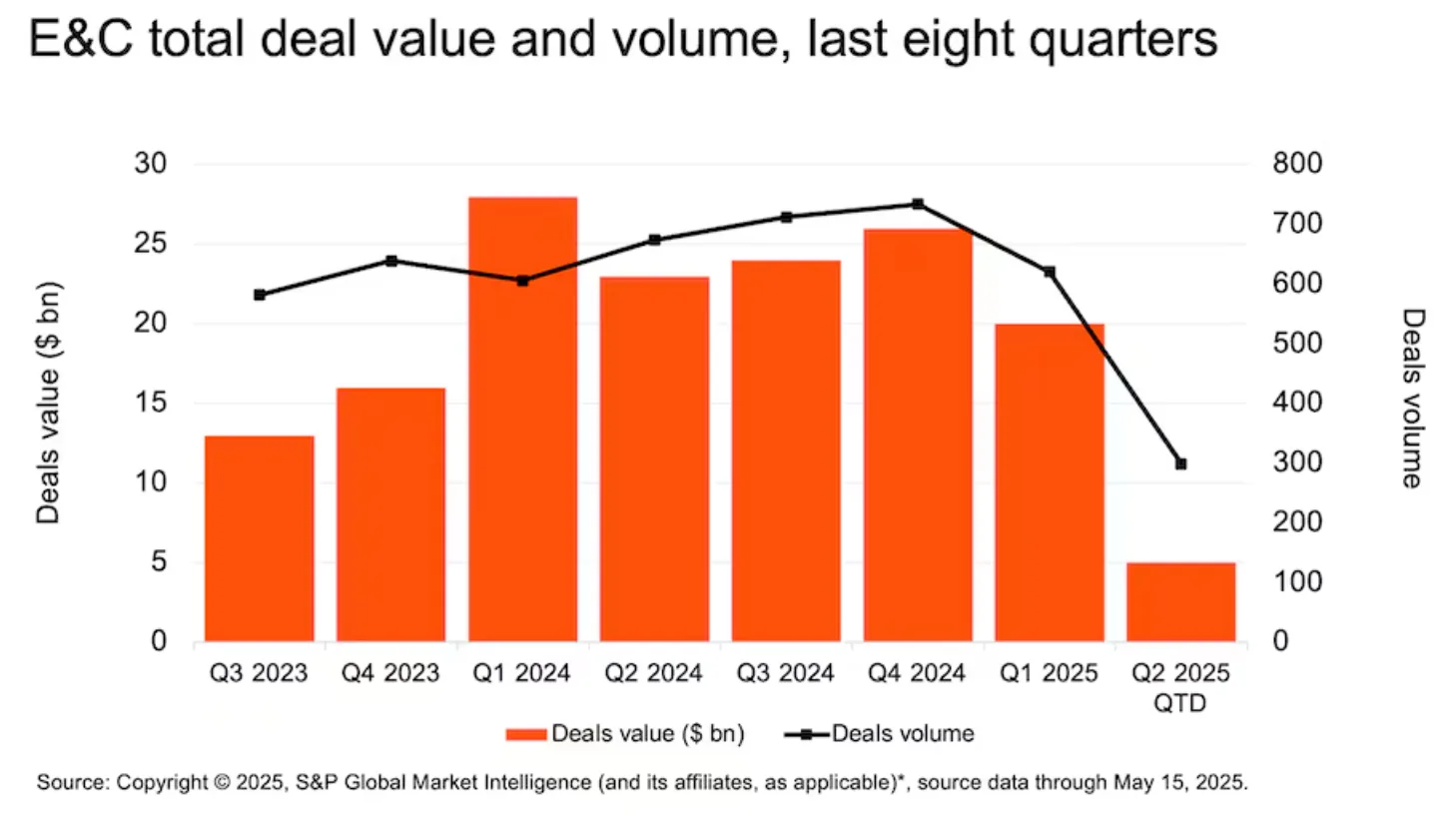

- E&C deal activity remains steady in 2025, supported by strong housing demand and government-backed infrastructure investment.

- Tariffs and labor shortages are raising costs, prompting buyers to focus on modular and prefabricated solutions.

- Southern states lead residential growth, while sectors like healthcare and education remain stable drivers of construction demand.

A Resilient Sector Amid Uncertainty

According to the Commercial Observer, engineering and construction deal activity is holding strong in 2025. This comes despite challenges like labor shortages, tariffs, and high interest rates. Housing demand and infrastructure investment are keeping the sector active, reports the PwC.

Housing Demand Drives Deals

Residential development—especially in the South—continues to lead. Demand for new homes still outpaces supply. Builders and investors are targeting both single-family and multifamily projects. As a result, deals are rising in key trades like HVAC, plumbing, and roofing.

Public Spending Brings Stability

Federal investment is also playing a major role. Government funding for healthcare, education, and public safety is fueling new construction. These areas are less vulnerable to economic swings and continue to attract investor interest.

Tariffs and Labor Costs Squeeze Margins

New tariffs are raising the cost of building materials. About 30% of the US supply comes from imports. Canada, China, and Mexico make up nearly half of that. With trade policy still shifting, pricing pressure is likely to grow.

Labor remains another major challenge. There is a shortage of skilled workers, and subcontractor costs are rising. This is pushing buyers to look for companies with modular and prefabricated capabilities. These models can help lower costs and reduce delays.

Focus on Scalable and Efficient Businesses

Looking ahead, deal activity is expected to stay steady but more selective. Buyers are targeting businesses that can grow efficiently. Many are pursuing add-on deals or roll-ups in fragmented markets. Firms that offer labor savings, stable revenues, or essential services are in high demand.

“Acquirers are prioritizing operational resilience, scalable delivery models, and exposure to stable end markets,” said Danny Bitar, US Engineering and Construction Deals Leader at PwC.

Why It Matters

With the industrial pipeline shrinking and costs rising, strategic investments matter more than ever. Tariff pressure is beginning to stabilize, but it remains a concern. Buyers are adjusting to the new environment by focusing on value, flexibility, and resilience.

What’s Next

Expect more interest in modular and prefabricated construction. Firms tied to housing and essential infrastructure will likely remain popular targets. As trade talks and policy changes continue, dealmakers will need to stay nimble and focused on long-term growth.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes