- Tariffs remain elevated, with businesses and consumers feeling the impact. Trade deals may ease some pressure by 2026.rn

- Demand for multifamily and Class A office space remains strong, even as industrial and retail face headwinds.rn

- Inflation is up while growth slows, but a rebound is likely in 2026 as interest rates fall and new policies support growth.

Trade Uncertainty Clouds the Outlook

As reported by Cushman & Wakefield, President Trump’s second term has brought a wave of policy uncertainty, especially around trade. Tariffs rose sharply in early 2025, prompting businesses to adjust supply chains and slow investment. Although the pace of escalation has eased, high tariffs are still shaping business decisions.

Surveys show consumers and CEOs are growing more cautious. Even if trade talks ease tensions, many companies now expect long-term policy shifts.

CRE Holds Steady in a Volatile Economy

Commercial real estate started 2025 in relatively good shape. Multifamily demand remains strong, helped by high mortgage rates and a cooling for-sale housing market. Urban apartment demand is picking up again, especially in major gateway cities.

The industrial sector has slowed. Space absorption dropped to one-fifth of 2021 levels, and rent growth is nearly flat. However, construction starts are down, which may help balance supply and demand by 2026.

Office space demand is slowly improving. While overall net absorption is still negative, many markets saw gains in Q1. Sublease space is shrinking, and high-quality buildings continue to attract tenants. With new office construction at its lowest level in more than a decade, well-located Class A assets may see stronger demand.

Retail faces direct pressure from tariffs. Big-box store closures and weaker consumer confidence could push vacancies higher. Still, limited new construction and strong locations support long-term value.

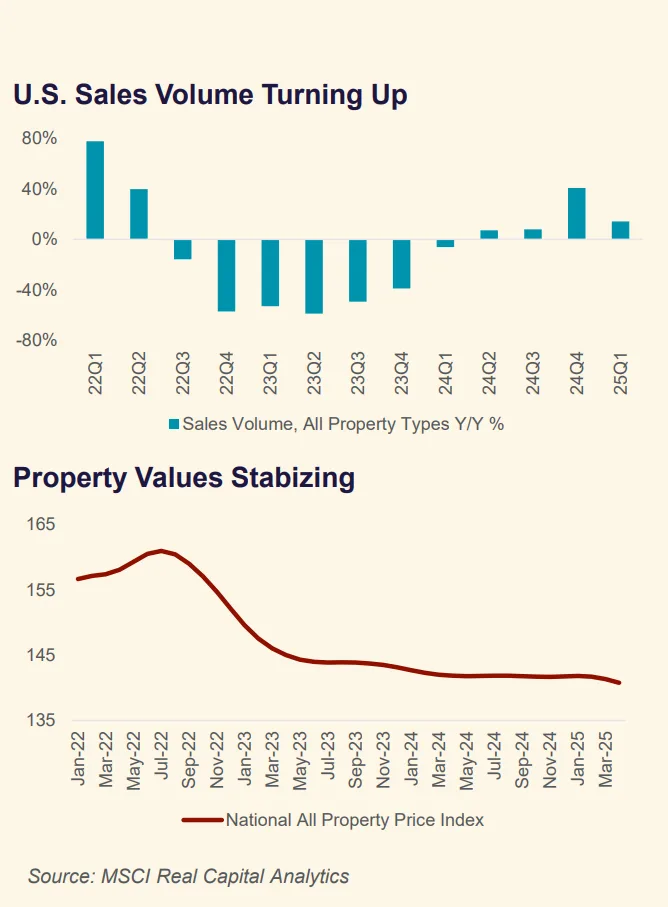

Capital Markets: Stabilizing, Not Surging

Interest rate volatility remains a challenge. While the Fed is expected to cut rates twice in 2025, uncertainty around inflation and growth has kept investors cautious.

That said, conditions for buyers are improving. Cap rates have expanded, and NOI growth is beginning to stabilize. Institutional capital is coming back into the market, and financing is more available—especially for high-quality properties.

CRE remains an attractive hedge against inflation and market swings. While base rates will likely stay higher than pre-pandemic levels, income-producing assets with solid fundamentals are still in demand.

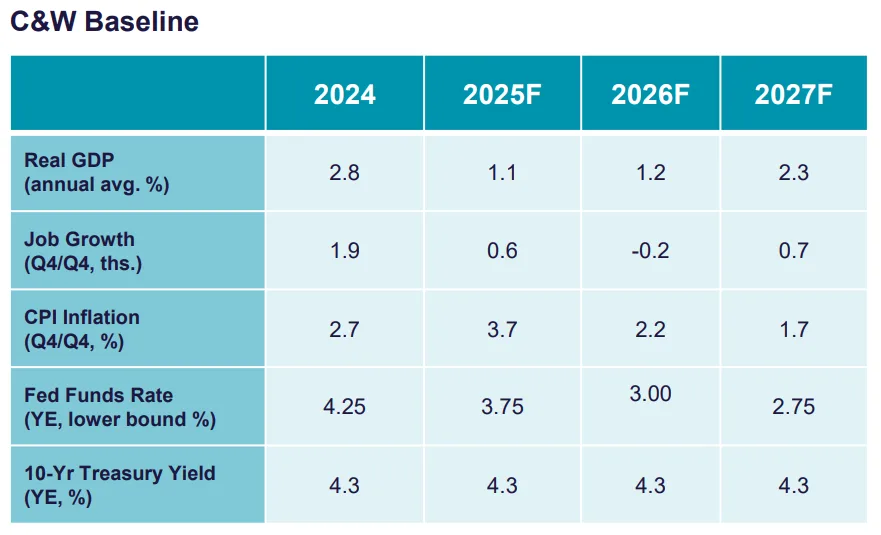

The Macro Picture: Slower Now, Stronger Later

The US economy faces short-term stagflation—slow growth and rising inflation. Job gains are fading, and layoffs are picking up. Real GDP is forecast to grow just 1.1% in 2025, with inflation rising to 3.7%.

However, a rebound in 2026 remains the base case. If the Fed cuts rates, tariffs ease, and new tax policies take effect, growth could rise above 2% in the second half of 2026.

Implications for Occupiers and Investors

Occupiers Should:

- Reassess space needs in light of rising costs and slower growth

- Use uncertainty to negotiate better lease terms

- Diversify supply chains to reduce risk

Investors Should:

- Focus on sectors with long-term demand, like multifamily and healthcare

- Look for value in market volatility

- Act when debt costs dip, but plan for higher long-term interest rates

Final Thought

The rest of 2025 may be bumpy, but CRE remains on solid footing. Demand fundamentals, especially in residential and Class A office, are holding firm. As policy shifts settle and rates fall, the sector is positioned for a stronger 2026.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes