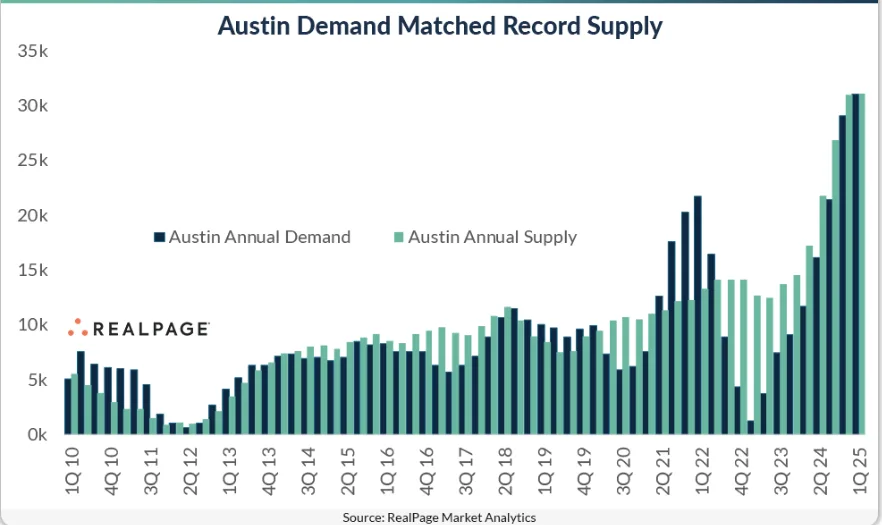

- Austin delivered a record 31K new apartment units in the year-ending Q1 2025, more than doubling its average annual completions from the past decade.

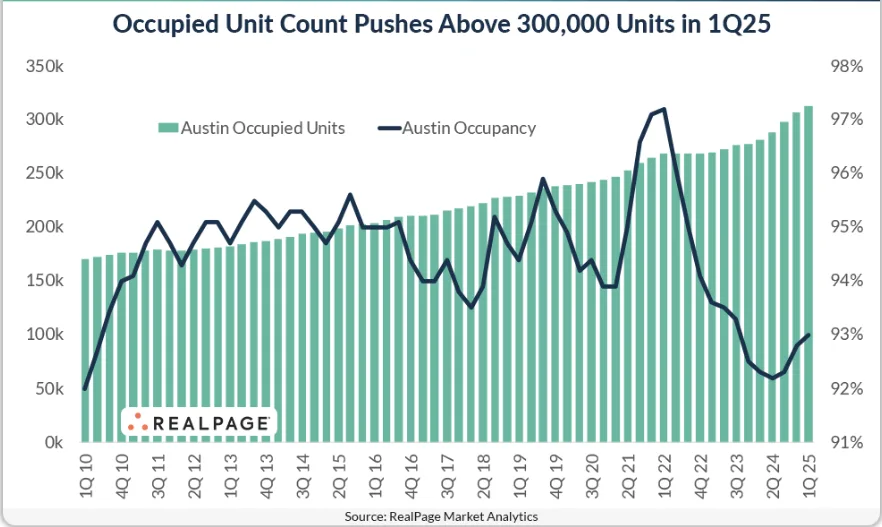

- Strong demand, fueled by population growth, in-migration, and a young renter base, kept occupancy high despite the supply surge.

- Apartment occupancy rose to 93.8% in May 2025, gaining 170 basis points year-over-year, while rents dipped 8% annually but remain above pre-pandemic levels.

Austin’s apartment market continues to defy expectations, as reported by RealPage. Even with a record number of new units delivered in recent years, fundamentals remain solid—thanks to unmatched population growth and persistent demand.

Record Supply, Still Resilient

In the year-ending Q1 2025, Austin saw over 31K new units delivered—more than twice the market’s average from the past decade, according to RealPage Market Analytics. That’s second only to Dallas and far above the 13K-unit average from 2015 to 2025.

By comparison, Austin averaged just 4,400 new units annually between 2005 and 2015. Such an increase might typically strain a market, but not in Austin.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

A Demand-Driven Market

Instead of faltering, the market kept pace. Austin’s apartment demand hit a record high of nearly 31K units over the same 12-month period, matching new deliveries one-for-one. Helping fuel that growth: a 10.9% population increase from 2020 to 2024—the strongest among major US metros per the Census Bureau.

Austin’s resilience isn’t new. Along with Raleigh, it’s the only major apartment market that avoided annual net move-outs during both the Great Recession and the COVID-19 downturn.

Occupancy Holds Steady

Apartment occupancy in Austin reached 93.8% in May 2025. That’s slightly below the 10-year average of 94.3% but up 170 basis points from the previous year—showing improvement despite high supply levels.

Over the last decade, the number of occupied units in Austin surged by nearly 117K. The market grew from 207K total units in Q1 2015 (95% occupied) to over 336K in Q1 2025, with more than 312K now occupied.

Submarket Highlights

East Austin led the charge in growth, adding 19K units to its base and 17,353 to its occupied count since 2015. Northern suburbs like Round Rock/Georgetown and Cedar Park followed closely, each adding over 13K occupied units during the same period.

Rent Trends And Outlook

While rents are still trending downward—falling 8% year-over-year in May, the steepest decline in the nation—effective asking rents remain about $150 above pre-pandemic levels, currently averaging $1,456.

What’s Next

With apartment supply volumes expected to ease, and demand showing no signs of weakening, Austin could see continued occupancy growth and eventual rent stabilization in the coming quarters.

Why It Matters

Austin’s ability to maintain stability during a massive construction cycle underscores its growing stature as one of the country’s most durable apartment markets. If demand continues to match or exceed supply, the Texas capital is well-positioned for long-term multifamily investment.