- DC ranked second nationally in office sales as of April, with $1.4B in volume, up 8.5% year-over-year.

- Vacancy rates hit 19.2%, prompting more conversions and repositionings as owners adjust to a shifting office demand landscape.

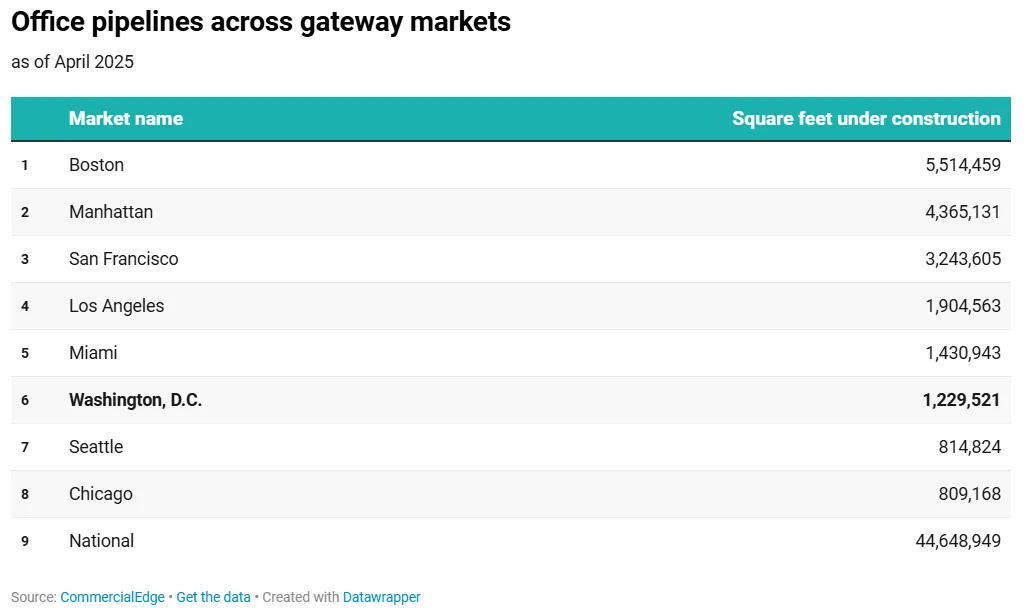

- The construction pipeline remains limited, with just 1.2M SF underway—one of the smallest among gateway markets.

- Coworking remains resilient, with over 6.6M SF in DC, making it the third-largest flex office market among major US cities.

Investment Demand Remains Solid

Washington, DC retained its No. 2 spot in the US for office investment activity, with $1.4B in transactions across 41 properties totaling 7.2M SF through April. Only Manhattan outpaced the capital, recording $2.6B in sales, as reported by Commercial Search.

The average sale price in DC was $252 PSF—well above the national average of $191 and ranking fifth among major markets. The top deal so far this year was Exelon’s $175M acquisition of Edison Place, followed by Rockwood Capital’s $153M purchase of the Victor Building, both sold by Brookfield Properties.

Rising Vacancies Spur Conversions

While investor interest remains high, fundamentals tell a more complicated story. DC’s office vacancy rate rose 230 basis points over the past year, reaching 19.2%—just under the national average of 19.7%. This uptick is pushing landlords to consider adaptive reuse.

Programs like the Housing-in-Downtown (HID) and Office-to-Anything initiatives offer tax incentives for office-to-residential or mixed-use conversions. One flagship project is Accolade, a 243-unit luxury conversion of the former Department of Justice building by Foulger-Pratt, slated for completion this fall.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Minimal New Construction But Completions Up

Washington, DC’s construction pipeline remains limited, with only 1.2M SF of office space under construction—just 0.3% of total inventory and on par with Manhattan and Chicago. However, completions jumped 17.6% year-over-year, led by Virginia Tech’s Academic Building One (298,864 SF).

The largest project underway is 600 Fifth St. NW, a 400K SF office development by Rockefeller Group and Stonebridge, expected to deliver by year’s end. No new office construction starts were recorded in the first four months of 2025.

Coworking Sector Holds Ground

DC continues to be a stronghold for coworking, with 6.6M SF of flex office space across 286 locations—third among gateway markets, behind Manhattan and ahead of Boston and San Francisco.

Coworking makes up 1.7% of total office space in DC, below the 2% national average. Leading providers include Navigate, WeWork, and Regus, each with more than half a million SF under management.

Why It Matters

Washington, DC’s office market reflects a broader trend seen in gateway cities—resilient investment volume despite soft fundamentals. As vacancy pressures mount and construction slows, office-to-residential conversions and adaptive reuse are likely to play a larger role in shaping the capital’s commercial real estate future.