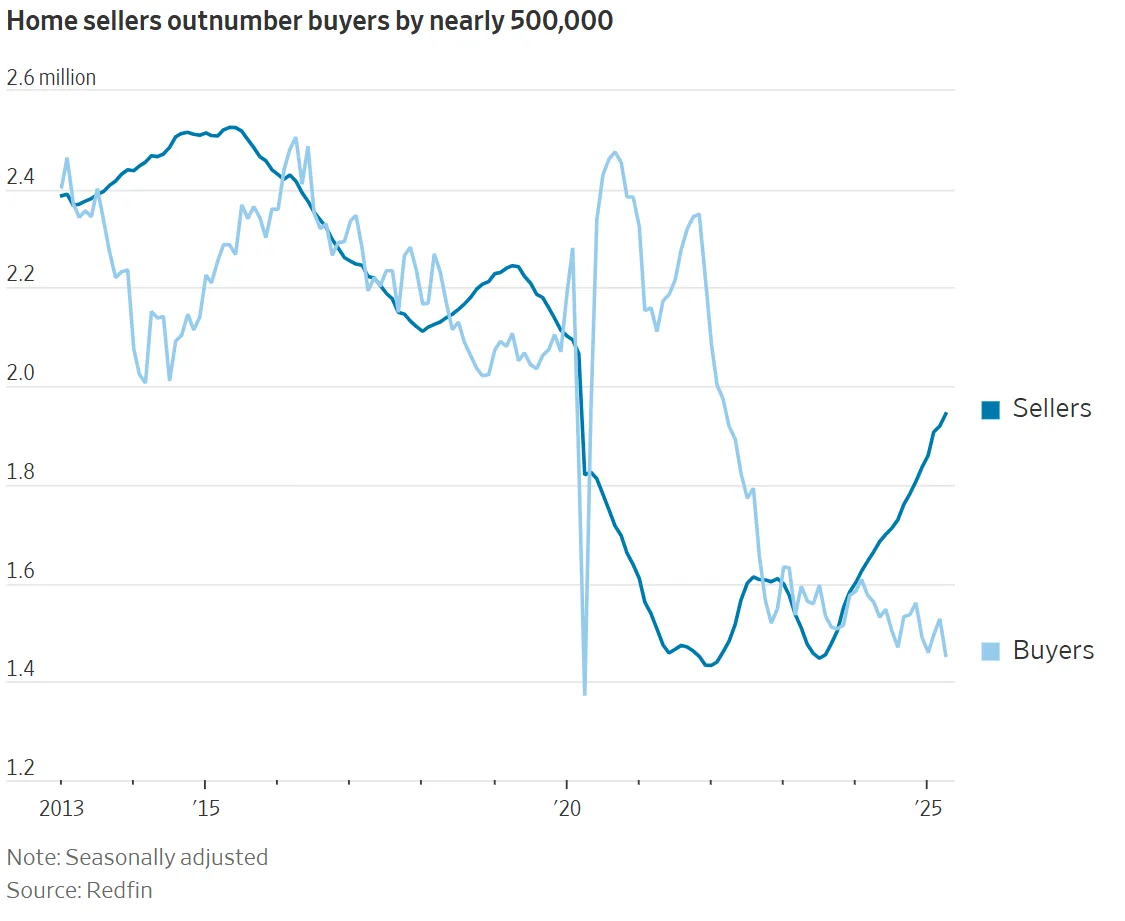

- In April, there were nearly half a million more home sellers than buyers—the widest gap since at least 2013, per Redfin.

- Despite a rise in listings, high mortgage rates and elevated home prices are keeping many buyers sidelined.

- The market is cooling fastest in Sunbelt metros like Miami, while some Northeast and Midwest cities remain seller-friendly.

Buyers Pull Back as Listings Climb

The US housing market is shifting, per The WSJ. According to a new Redfin analysis, April marked the largest recorded housing imbalance between sellers and buyers—around 500,000 more sellers were active than buyers. While inventory has finally begun to rise, demand hasn’t followed. The mismatch reflects growing affordability concerns amid mortgage rates above 6.5% and a decade of price appreciation.

Prices Feel the Pressure

National home prices were still up 1.4% year-over-year in May, but that’s a slowdown from April’s 2% gain. In 24 of the country’s 100 largest metro areas—mostly in the Sunbelt—prices fell annually. Miami, in particular, had three times as many sellers as buyers, and markets across the Southeast and Southwest are seeing the greatest softening.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Why Sellers Are Listing

A combination of life events and market uncertainty is pushing more homeowners to list. Some need to relocate or upgrade, while others want to exit before potential price drops. Investors are also offloading properties as carrying costs rise.

Buyers Are Cautious

Buyers are still hesitant to engage. Many are priced out or waiting for better deals. In contrast to the post-pandemic boom, buyers today are negotiating harder, with price cuts and concessions becoming more common. “The current sentiment is, the market’s probably going to go down further,” said one seller in North Carolina who has yet to receive an offer after lowering his price.

Where the Market Still Favors Sellers

Not all areas are cooling equally. In Newark, NJ, and parts of the Midwest, demand remains strong, and multiple offers are still common. But these are increasingly the exception rather than the rule.

Looking Ahead

Redfin expects modest price declines nationally later this year, especially in overheated markets. While active listings are still 14% below pre-pandemic levels, they are at their highest point since 2019, per Realtor.com. As more sellers adjust expectations and mortgage applications pick up, the second half of 2025 could bring more balance.

Why It Matters

The current housing imbalance, driven by a supply-demand mismatch, is a stark reversal from the ultra-competitive pandemic-era housing market. With affordability strained and economic uncertainty lingering, buyers now have leverage—at least in many parts of the country.

What’s Next

If mortgage rates stay high and prices edge down, more buyers could return later in 2025. But with nearly half a million more sellers than buyers, this may be the beginning of a slow reset in US housing market dynamics.