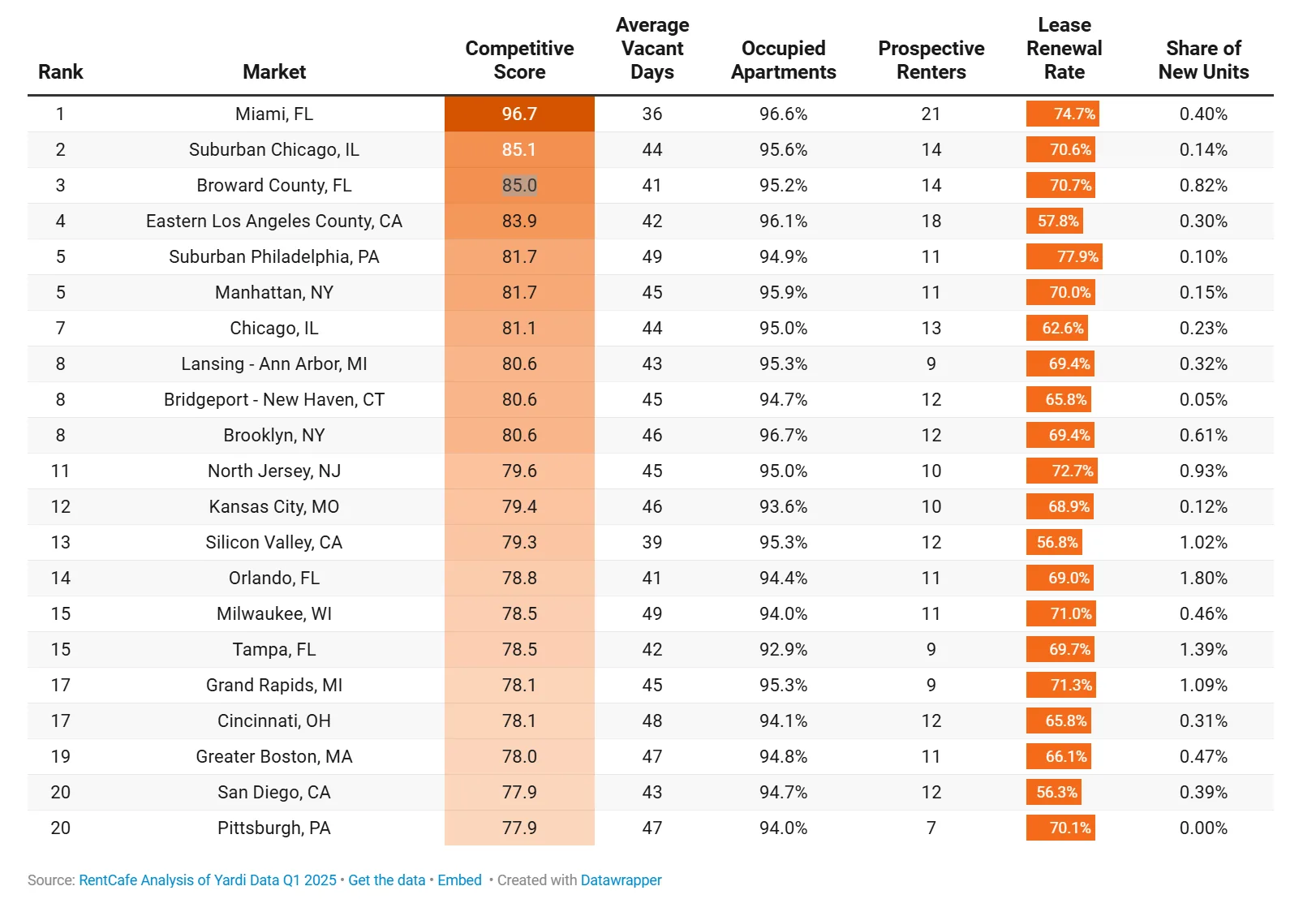

- Miami is the nation’s most competitive rental market, with an RCI score of 96.7—over 22 points above the national average. Apartments fill in just 36 days and attract 21 renters per unit.

- Florida dominates rental demand, with Broward County, Orlando, Tampa, and Port St. Lucie all ranking among the country’s most competitive markets, despite limited new construction.

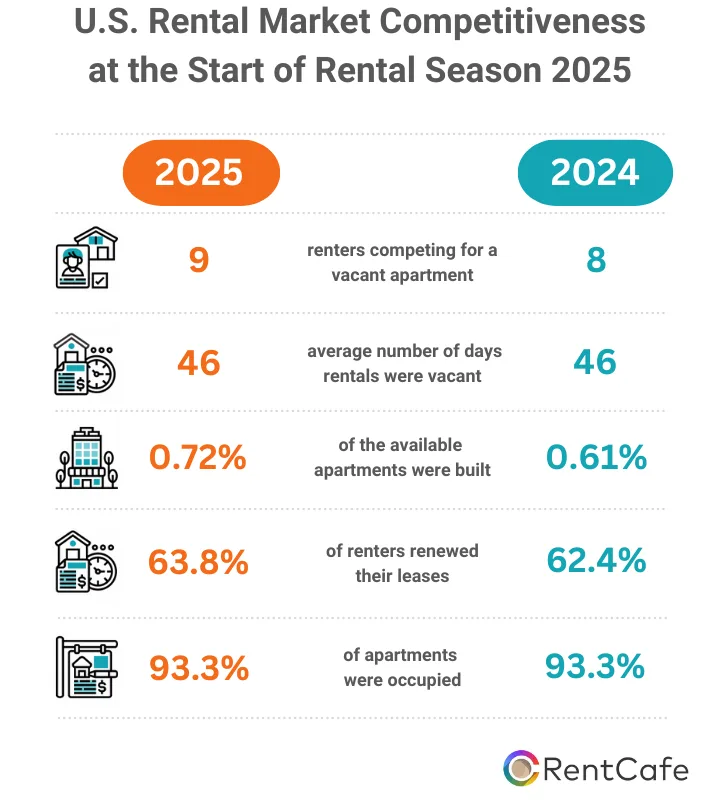

- Nationwide, renters are staying put, pushing the lease renewal rate to 63.8% and keeping occupancy high at 93.3%. As a result, nine renters now compete for every available unit on average.

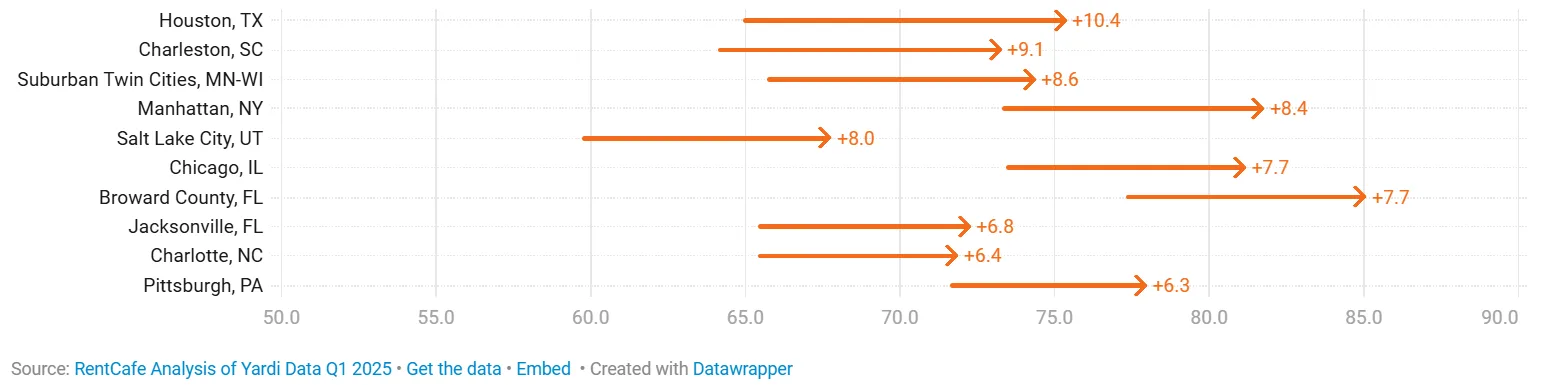

- Markets like Houston, Charleston, and Lubbock are trending upward, driven by strong job growth and falling new supply, making them some of the fastest-rising rental hubs heading into peak season.

Florida’s Rental Revival: Miami at the Epicenter

As reported by RentCafe, apartment demand in Miami has reached a fever pitch. With a Rental Competitiveness Index (RCI) score of 96.7, the city ranks first nationally, signaling the tightest rental market in the US this summer. Units in Miami are leasing in just 36 days, attracting an average of 21 renters per listing—more than double the national average.

Despite limited new supply, Miami’s lease renewal rate has climbed to 74.7%, helping to keep occupancy at 96.6%. The return of wealthy individuals, startups, and remote workers continues to fuel demand in the city, now firmly established as a high-end relocation hub.

Other Florida Cities Not Far Behind

Miami isn’t alone. Broward County (RCI 85) is now the third-most competitive market, boosted by demand in cities like Fort Lauderdale and Pembroke Pines. Nearby, Orlando (RCI 78.8) and Tampa (RCI 78.5) maintain top-15 positions nationally, despite a surge in apartment construction. High lease renewal rates in both cities (above 69%) indicate that even with new units, demand is outpacing supply.

Port St. Lucie is the third-hottest small rental market in the country (RCI 90.8), with no new units delivered recently and a renewal rate of 77.5%.

Midwest & Northeast Stay Competitive

The Midwest ranks third among regions with an RCI of 77, driven by affordability and steady job growth. Suburban Chicago (RCI 85.1) remains the second-hottest major market nationwide, while cities like Lansing–Ann Arbor and Grand Rapids post strong showings despite modest new construction.

In the Northeast, high-cost cities like Manhattan (RCI 81.7) and Brooklyn (RCI 80.6) are seeing increased renter competition amid low vacancy and rising lease renewals. Suburban Philadelphia also ranks fifth nationally, tied with Manhattan.

Top Trending Markets: Houston, Charleston, Lubbock

- Houston surged into the top 30, with an RCI increase of 10.4 points, driven by job growth and a slowdown in new construction.

- Charleston, SC also saw a 9.1-point RCI boost, as job growth and tech sector investment outpaced apartment deliveries.

- Among small metros, Lubbock, TX recorded the largest RCI gain in the nation (+14.2), vaulting it into 12th place nationally thanks to a full stop in new supply and rising lease renewals.

Why It Matters: National Pressure From Renewals & Lack of Supply

Across the country, renters are staying put. Over 75% of renters renewed leases in markets like Fayetteville, AR (RCI 92.9), the hottest small market this year. Meanwhile, new apartment deliveries remain subdued, with just a 0.72% increase in availability compared to 0.61% a year ago.

As a result, the national RCI stands at 74.6, indicating a market where apartment-seekers face tight inventory, limited move-in windows, and growing competition.

What’s Next

With demand continuing to outpace supply in most regions—and the average renter now staying in place for 29 months—the pressure on the US rental market is unlikely to ease soon. Key metros across Florida, the Midwest, and the Northeast will remain high-stakes battlegrounds for renters in 2025 and beyond.

Expect more intense competition during peak summer months unless construction meaningfully accelerates in the nation’s hottest markets.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes