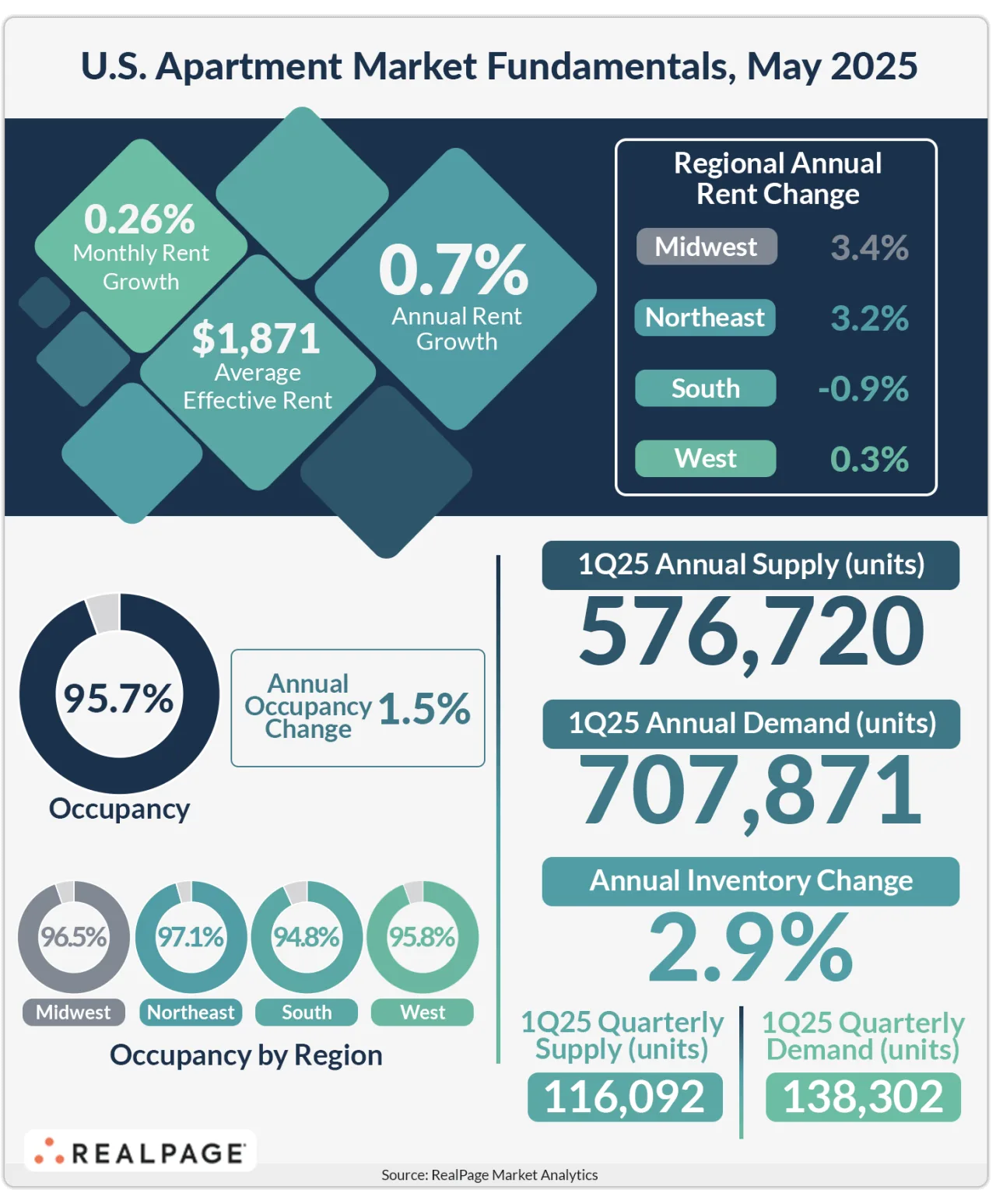

- US apartment occupancy remained unchanged at 95.7% in May, holding gains made earlier in 2025.

- National monthly rent growth slowed to 0.26%, roughly half the rate seen a year ago.

- Rent cuts deepened in many South region markets, while gateway cities like San Francisco and New York posted notable monthly gains.

- Annual rent growth remains strongest in the Midwest and Northeast, while the South posted a -0.9% decline.

Occupancy Holds at 95.7%

US apartment occupancy held steady in May, unchanged at 95.7%, unchanged at 95.7%, while rent growth showed signs of slowing. That level is up 90 basis points since the start of 2025, per RealPage Market Analytics. All 50 major markets saw occupancy rise year-over-year. Still, 40% of them reported slight declines from April.

By region, the South slipped 10 basis points in May. The West was flat, while the Midwest and Northeast rose 10 and 20 basis points, respectively.

Rent Growth Slows in May

Monthly rent growth cooled to 0.26% in May. That’s down from 0.51% in the same month last year. Annual rent growth also slowed, dipping from 1% in April to 0.7%.

The Midwest led the country with 3.4% annual rent growth. The Northeast followed at 3.2%. The West trailed at 0.3%. The South posted a 0.9% annual rent decline.

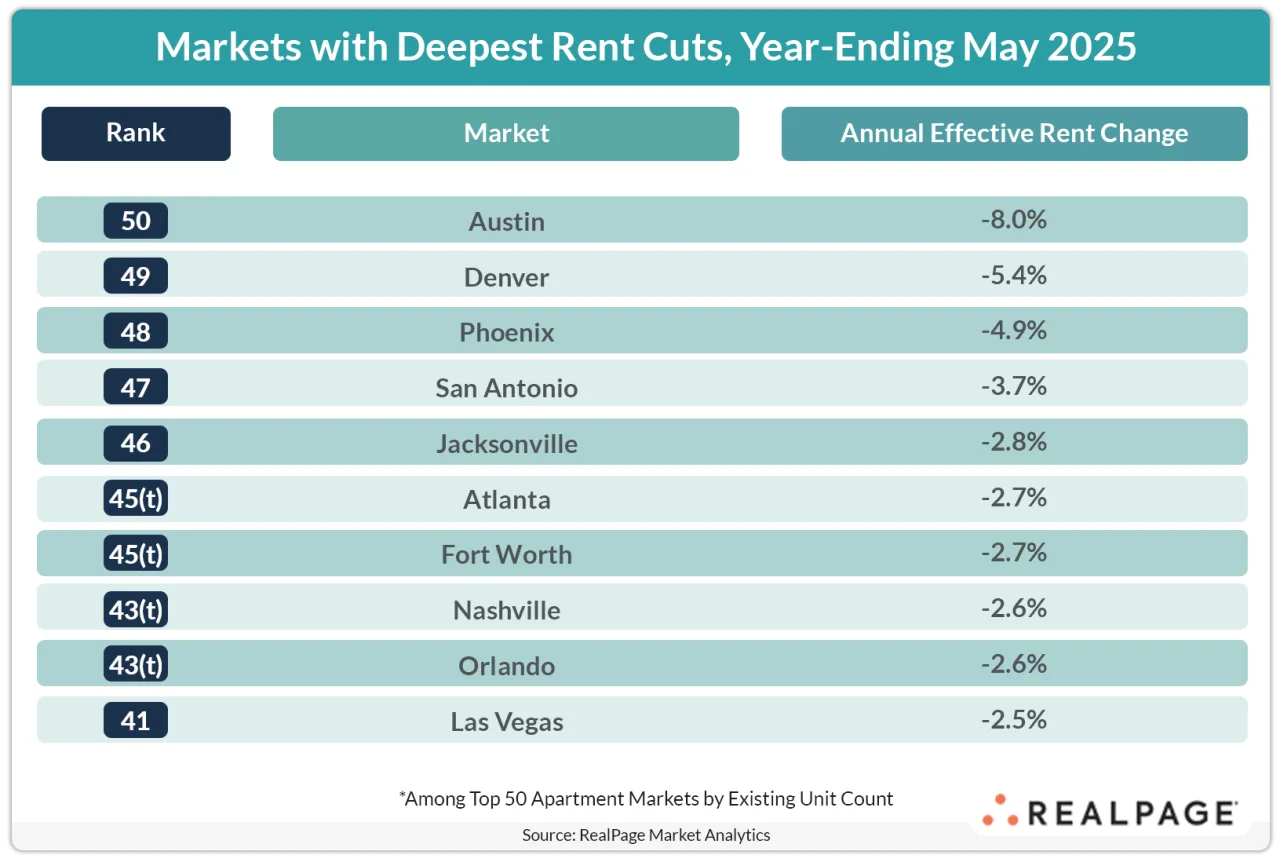

South Region Struggles

Sun Belt markets continued to weaken. Austin led the downturn, with rents down 0.9% in May. That brought annual losses there to 8%, the steepest among all major metros.

Other cities—Phoenix, Tampa, Houston, Memphis, and Sacramento—also posted monthly rent cuts of 0.4% to 0.6%.

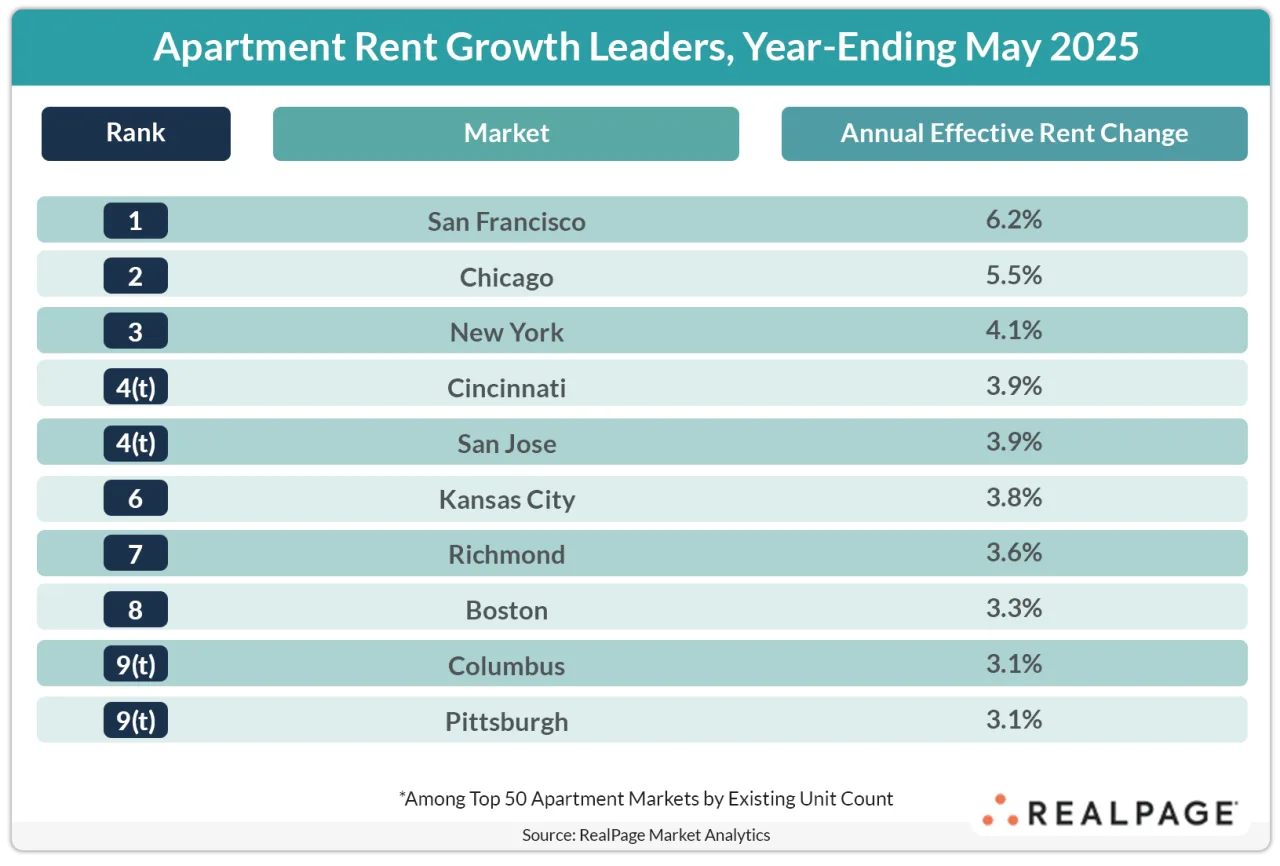

Gateway Cities Show Strength

Several major markets posted strong rent gains in May. San Francisco saw the largest increase, overtaking Chicago as the national rent growth leader. This was the first time in over a year that a Midwest city did not top the list.

San Jose, New York, and Boston each posted 1% or higher rent growth for the month.

Why It Matters

The national market remains stable, but regional differences are growing. Coastal and Midwest cities are holding strong. Southern markets, facing high supply, continue to see rent losses.

What’s Next

With peak leasing season underway, all eyes are on rent trends. Gains in gateway cities may signal broader recovery. But oversupplied regions will likely stay under pressure through summer.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes