- Over 61% of industrial space delivered in Q1 2025 — or roughly 45M SF — came online vacant, with speculative construction making up 71% of total deliveries.

- National industrial vacancy rose to 7%, as leasing volume declined 6.4% year-over-year and demand for large footprints weakened.

- Cushman & Wakefield projects vacancy rates will continue to climb, peaking at 7.8% in 2026, as supply continues to outpace absorption.

Spec Space Dominates New Supply

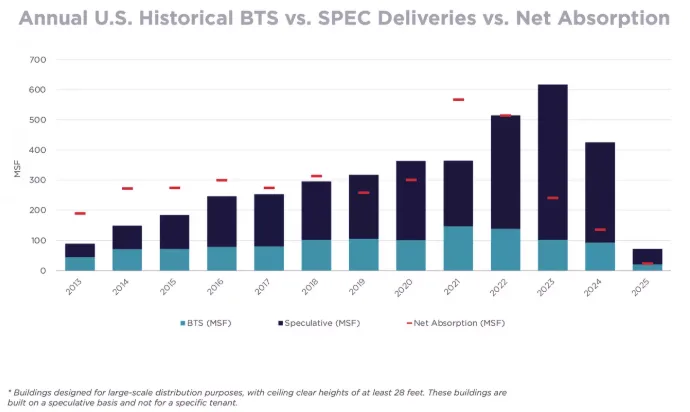

The US industrial sector is feeling the effects of overbuilding during the pandemic boom, as speculative construction continues to outpace demand, reports Bisnow. Of the 73M SF of industrial space delivered in Q1 2025, 45M SF — or over 61% — came to market without tenants in place, according to Cushman & Wakefield.

Spec development made up 71% of new deliveries, pushing the national vacancy rate up by 30 basis points to 7%. Two-thirds of the 83 markets tracked by the firm reported rising vacancy.

Demand Normalizing After Pandemic Surge

Industrial occupancies are stabilizing at historical norms following a pandemic-era frenzy in logistics and manufacturing activity. While warehouse and logistics tenants added 21M SF of space in Q1, the manufacturing sector posted negative absorption of 30M SF.

Leasing activity totaled 140M SF during the quarter — a 6.4% drop compared to the same period last year — as occupiers tread carefully amid market uncertainty and shifting trade policies.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Large Footprints Face The Biggest Vacancy Challenge

The appetite for large industrial spaces continues to wane. Vacancy at facilities over 250K SF rose above 10%, while deals over 1M SF fell to just 5% of total leasing volume, down from 9% in 2024. Mid-sized leases between 100K and 300K SF made up 40% of transaction volume, consistent with last year.

The tightest segment remains small-bay warehouses under 100K SF, which are 96% occupied and often command a $2 to $3 per SF rent premium due to scarcity.

Market Rents Flat Despite Regional Declines

Nearly 40% of markets tracked saw asking rents fall in Q1, though strength in others held the national average steady at $10.11 per SF. Small-footprint properties remain a bright spot, commanding higher premiums amid strong competition.

Oversupply Pressures Likely Through 2026

New supply continues to outpace demand, with Q1 absorption roughly matching build-to-suit deliveries but trailing speculative completions. Cushman & Wakefield forecasts this supply-demand imbalance to persist into 2026, when vacancy rates are expected to peak at 7.8%.

Pipeline slowdowns are beginning to take shape. About 25% of markets have seen their construction pipelines cut in half over the past year, and only five markets currently have more than 10M SF under construction — down from 12 a year ago.

Despite the moderation in starts, the industrial sector is still digesting a multi-year wave of new deliveries.