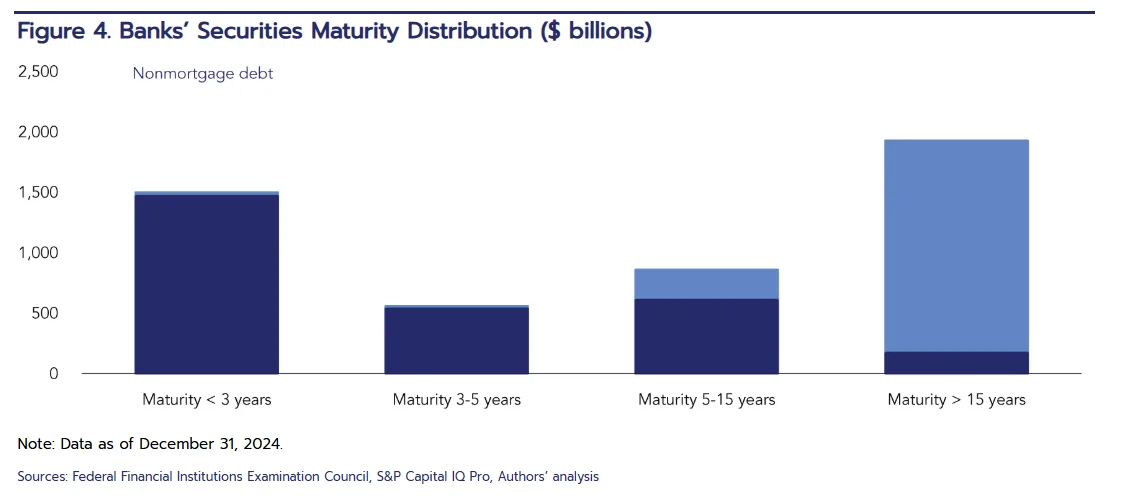

- Unrealized securities losses across FDIC-insured banks stood at $481B as of December 2024, or nearly 20% of bank equity.

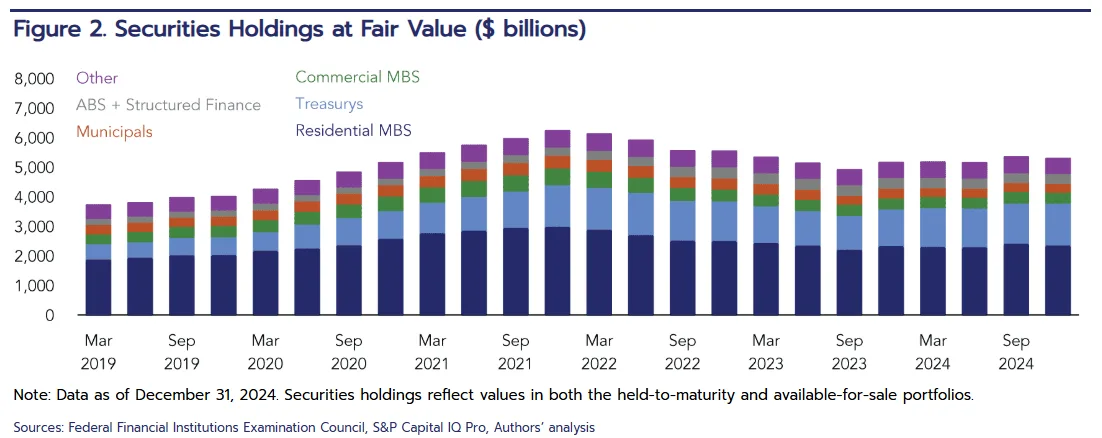

- Rising long-term interest rates—despite recent rate cuts by the Fed—have kept losses elevated, with RMBS being the largest contributor.

- While losses are not immediately realized, they could amplify risks in the event of depositor stress or other systemic shocks.

A Lingering Risk

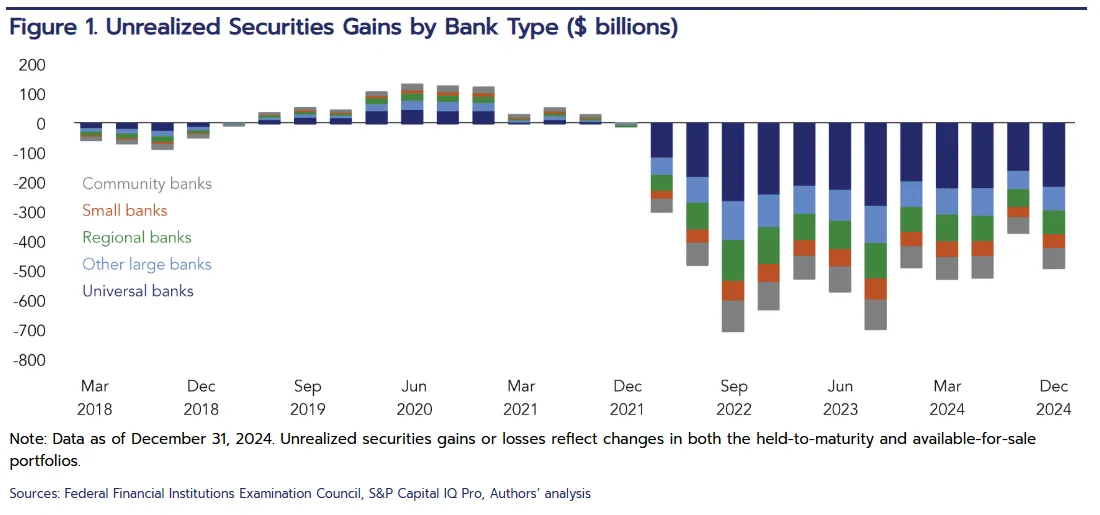

Rapid interest rate increases in 2022–2023 significantly eroded the market value of banks’ securities portfolios, reports Financial Research. Fixed-income holdings like Treasuries and residential mortgage-backed securities (RMBS) were hit hardest. These paper losses drew widespread attention following the collapse of Silicon Valley Bank, where unrealized losses combined with high levels of uninsured deposits created a toxic mix that led to a bank run.

Regional banks, in particular, faced elevated risks due to poor interest rate hedging strategies. Larger institutions, though carrying more unrealized losses in absolute terms, proved more resilient due to diversified funding bases and stronger liquidity positions.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Fed Cuts Ease, But Long-Term Rates Climb

To boost credit markets, the Federal Reserve began cutting the federal funds rate in September 2024, with three reductions since. While this helped moderate some losses mid-year, longer-term interest rates—including 30-year mortgage and 10-year Treasury yields—have since risen. That counterintuitive move has kept aggregate unrealized securities losses high, although still below their Q3 2022 peak.

As of year-end 2024, unrealized losses stood at $481B—8.6% of the fair value of securities portfolios and nearly 20% of total equity held at banks’ subsidiaries.

RMBS: The Primary Driver Of Losses

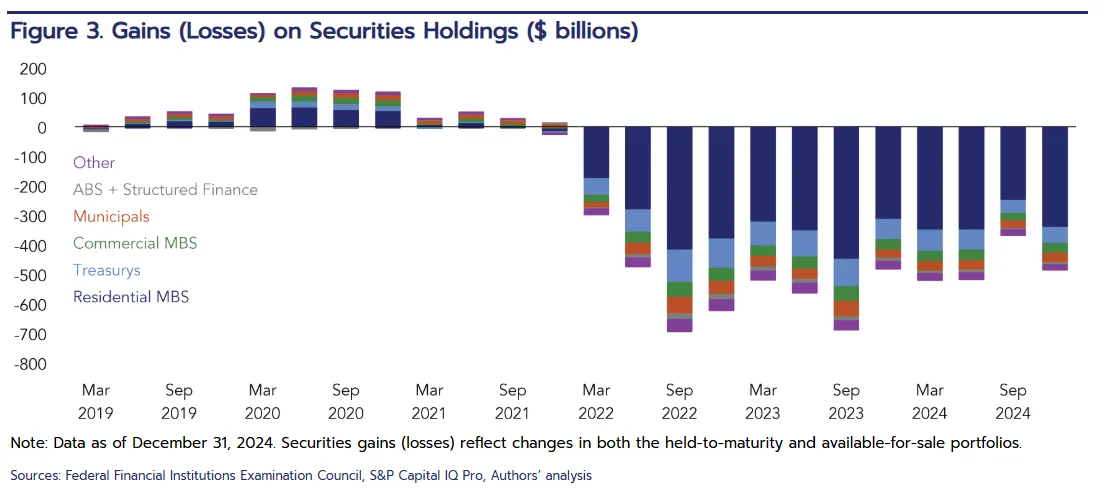

The bulk of unrealized losses are concentrated in RMBS, which tend to have maturities exceeding 15 years and exhibit negative convexity—making them less responsive to falling interest rates. In contrast, Treasuries have seen smaller proportional losses due to their shorter average durations and greater liquidity.

Commercial mortgage-backed securities (CMBS) and municipal debt also showed disproportionately high losses relative to their smaller portfolio weightings.

Why It Matters

Unrealized losses aren’t an immediate solvency threat but can worsen stress, especially if depositor confidence begins to erode. The hedging value of bank liabilities disappears when deposits are withdrawn, removing a natural counterbalance to interest rate risk.

Looking ahead, the outlook for unrealized gains or further losses will hinge on how long-term rates evolve, the composition of banks’ portfolios, and the effectiveness of interest rate hedging strategies. Market dynamics—such as shifts in demand for long-duration securities—will also play a role.

What’s Next

Unrealized securities losses will likely persist on bank balance sheets until long-term interest rates stabilize or decline significantly. If other pressures—like commercial real estate loan defaults—mount, these hidden losses could become a flashpoint once again.