- Millionaire renters have tripled since 2019, growing 204%, as high earners opt for flexibility and luxury rental living over ownership.

- Southern metros like Houston, Dallas, and Miami are emerging as top destinations for wealthy renters, outpacing traditional coastal hubs.

- Generational trends show Millennials prefer renting while Gen X leads in homeownership, reshaping the housing market’s upper tier.

- New millionaire hotspots such as Charleston, Oxnard, and Pensacola signal a shift toward affordability, lifestyle quality, and regional growth.

Wealthy Renters Are On the Rise

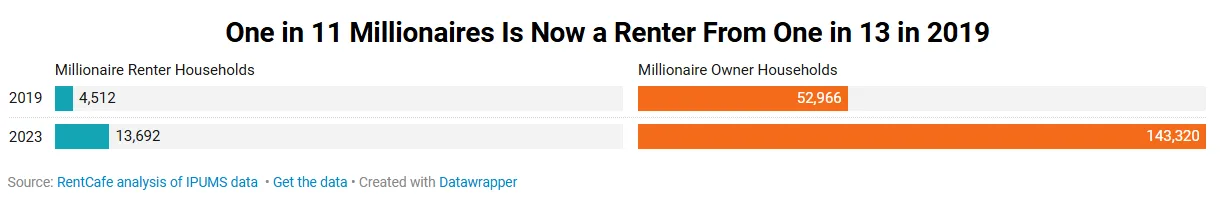

Affluent Americans are increasingly choosing to rent, with the number of renter households earning over $1M annually growing from 4,500 in 2019 to 13,700 in 2023, reports Rent Cafe. While still well below the 142,320 millionaire homeowners in the US, the rapid rise in millionaire renters underscores a shift toward flexibility, luxury amenities, and location independence over traditional ownership.

This change is driven by a mix of stock market gains, booming tech sector wages, and the rise of remote work. High earners are drawn to amenity-rich rental offerings and less burden from long-term property ownership — even as homeownership remains a core wealth-building strategy.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Southern Metros Gain Ground

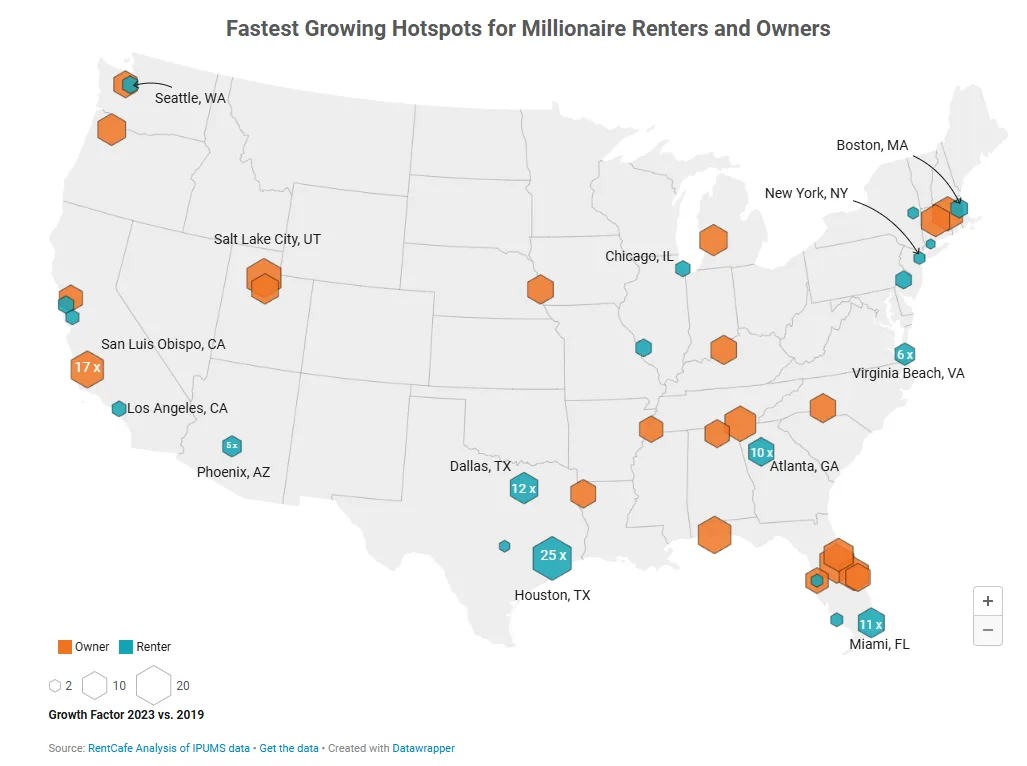

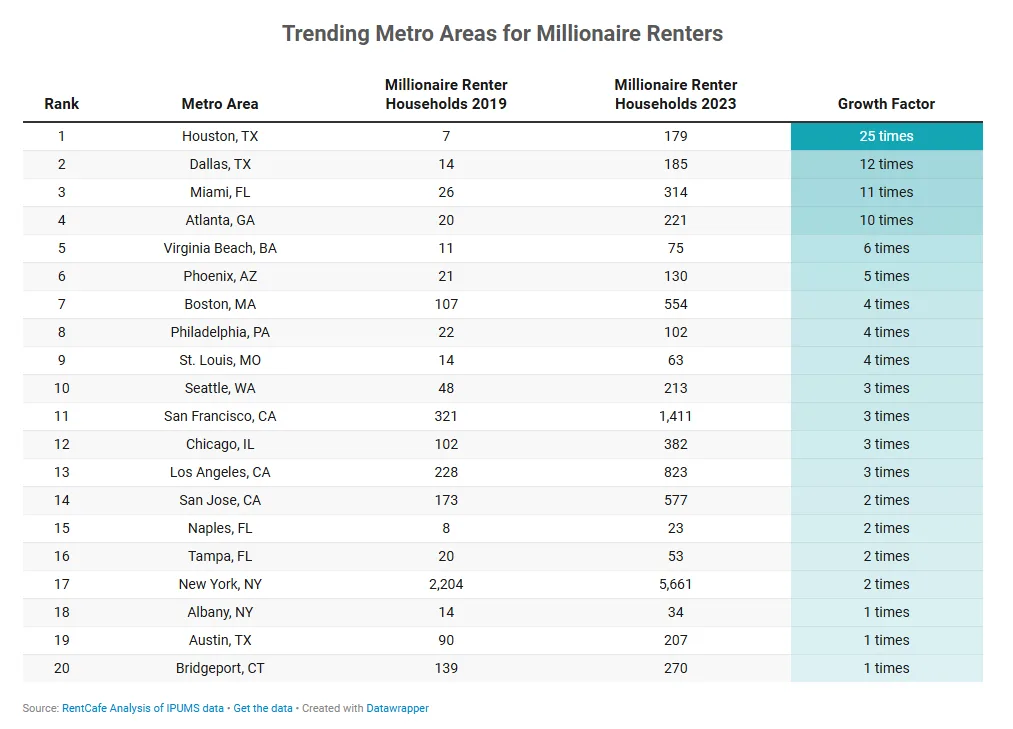

Southern cities are climbing the ranks fast. Houston saw its millionaire renter households increase from just 7 in 2019 to 179 in 2023 — a 25-fold jump. Dallas–Fort Worth followed with a 12x increase, while Miami recorded 11x growth in that same period. Atlanta and Virginia Beach also saw significant increases in affluent renter households.

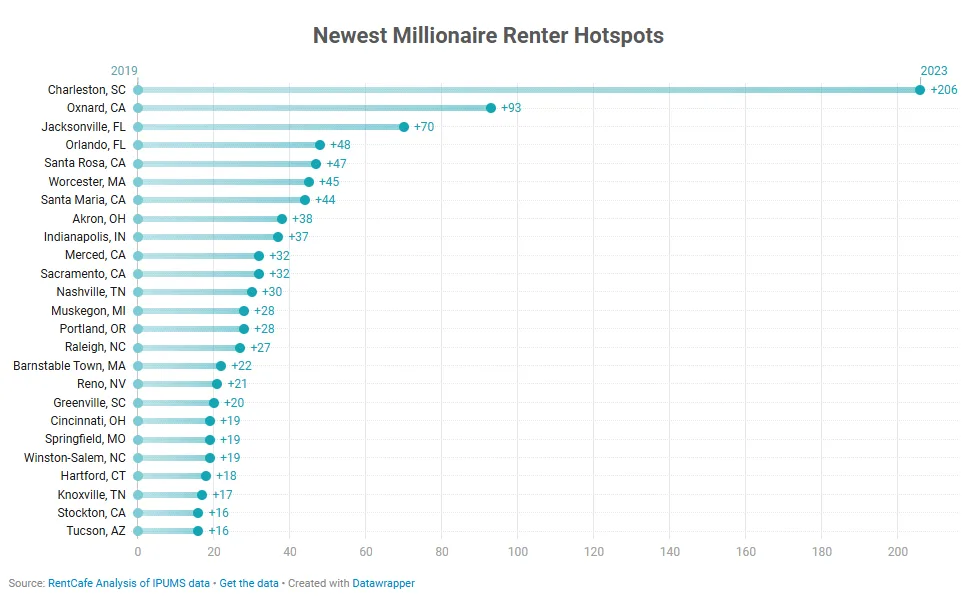

Less traditional markets are booming as well: Charleston, SC went from zero to 206 millionaire renter households, while Oxnard, CA and Jacksonville, FL entered the millionaire renter club with 93 and 70 households, respectively. These markets offer a lifestyle blend of lower cost, economic opportunity, and lifestyle appeal without the sky-high home prices of legacy luxury hubs.

Generational Divide: Renting VS. Owning

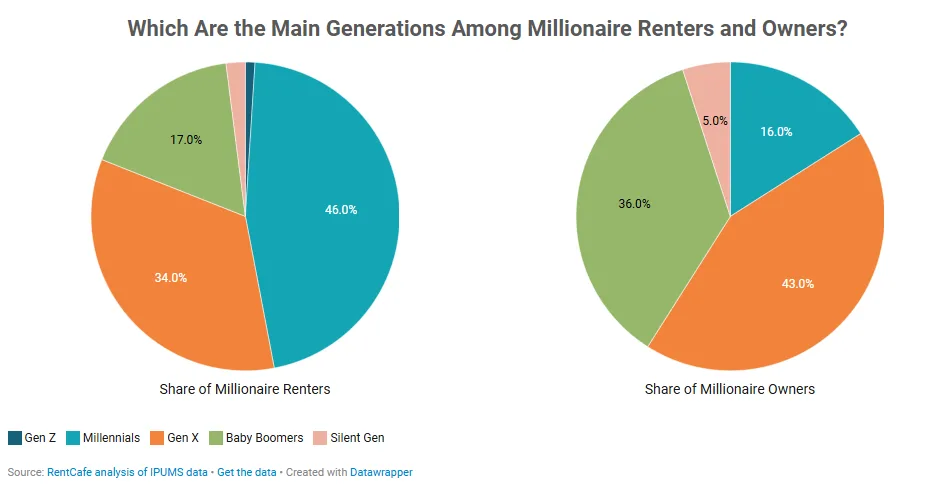

Generational preferences are reshaping the luxury real estate landscape. Millennial millionaires are far more likely to rent than their Gen X counterparts, whose preference for ownership has helped them overtake Baby Boomers as the dominant homeowner group.

From 2019 to 2023, the share of high-earning Millennial renters increased by 60%, while Gen Xers fueled the rise in millionaire homeownership. While Millennials have recently tipped into majority-homeowner status, many still choose to rent for the flexibility.

Where The Wealth Lives Now

Top Markets for Millionaire Renters (2019–2023 growth):

- New York, NY: +157% (5,661 households in 2023)

- San Francisco, CA: +339% (1,411 households)

- Los Angeles, CA: Tripled to 823 households

- San Jose, CA: Tripled to 577 households

- Boston, MA: +5x growth in high-income renters

Top Emerging Renter Hubs (Previously 0 Millionaires in 2019):

- Charleston, SC: 206 households

- Oxnard, CA: 93 households

- Jacksonville, FL: 70 households

- Orlando, FL / Santa Rosa, CA: 48 and 47 households, respectively

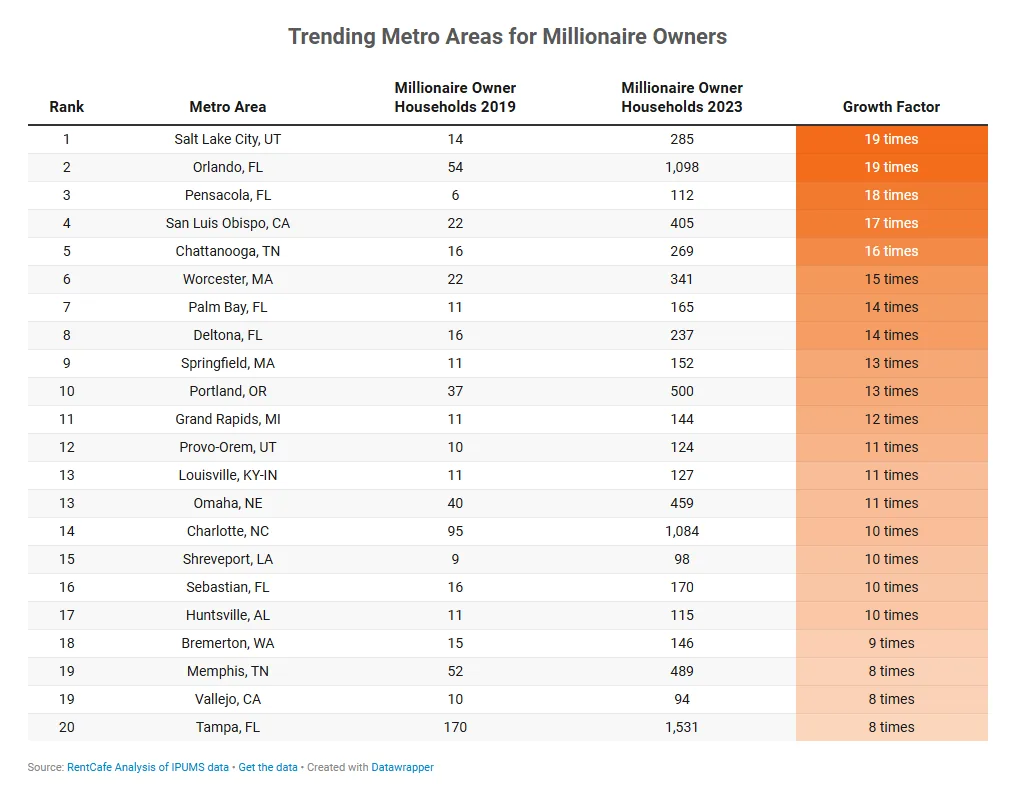

Millionaire Homeowners Still Favor New And Traditional Markets

While renters diversify their location choices, high-income homeowners are gravitating toward both classic and surprising metro areas. Salt Lake City saw a 1,935% increase in millionaire homeowners, jumping from just 14 to 285 households. Orlando grew from 54 to 1,098, while Pensacola, FL; San Luis Obispo, CA; and Chattanooga, TN all posted 16-18x increases.

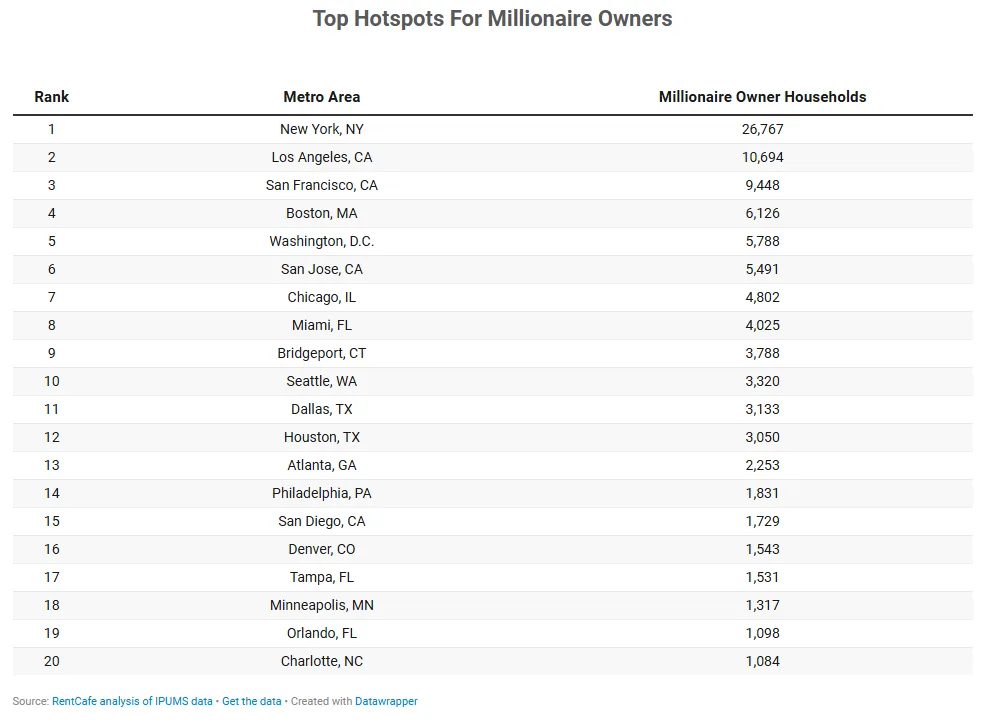

Classic luxury hubs remain strongholds:

- New York, NY: Still #1 in millionaire homeowners, nearly doubling since 2019

- Los Angeles, CA: From 4,414 to 10,694 households

- San Francisco, CA: +145% increase

- Boston, MA: +196% to over 6,000 households

- Washington, DC: 5,788 millionaire households in 2023

Why It Matters

The shifting patterns among wealthy renters and owners reflect evolving priorities: flexibility, convenience, and lifestyle quality. As more high earners opt to rent — especially in rising Southern markets — developers and investors are responding with a surge in luxury rental offerings.

Whether driven by tech wealth, generational shifts, or market volatility, one thing is clear: the millionaire renter is here to stay.