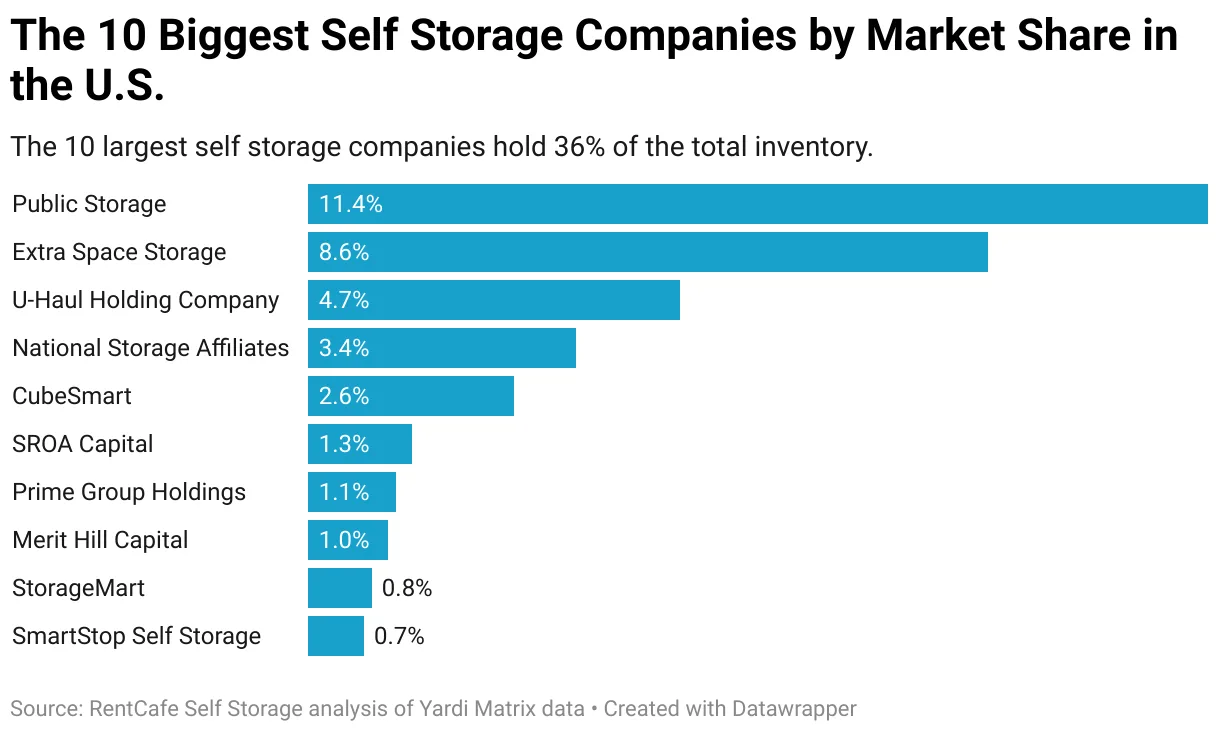

- The 100 largest self storage companies in the US control about 52% of the market — roughly 1B SF of rentable space.

- Just five companies — Public Storage, Extra Space Storage, U-Haul, National Storage Affiliates, and CubeSmart — control 35.5% of the national inventory.

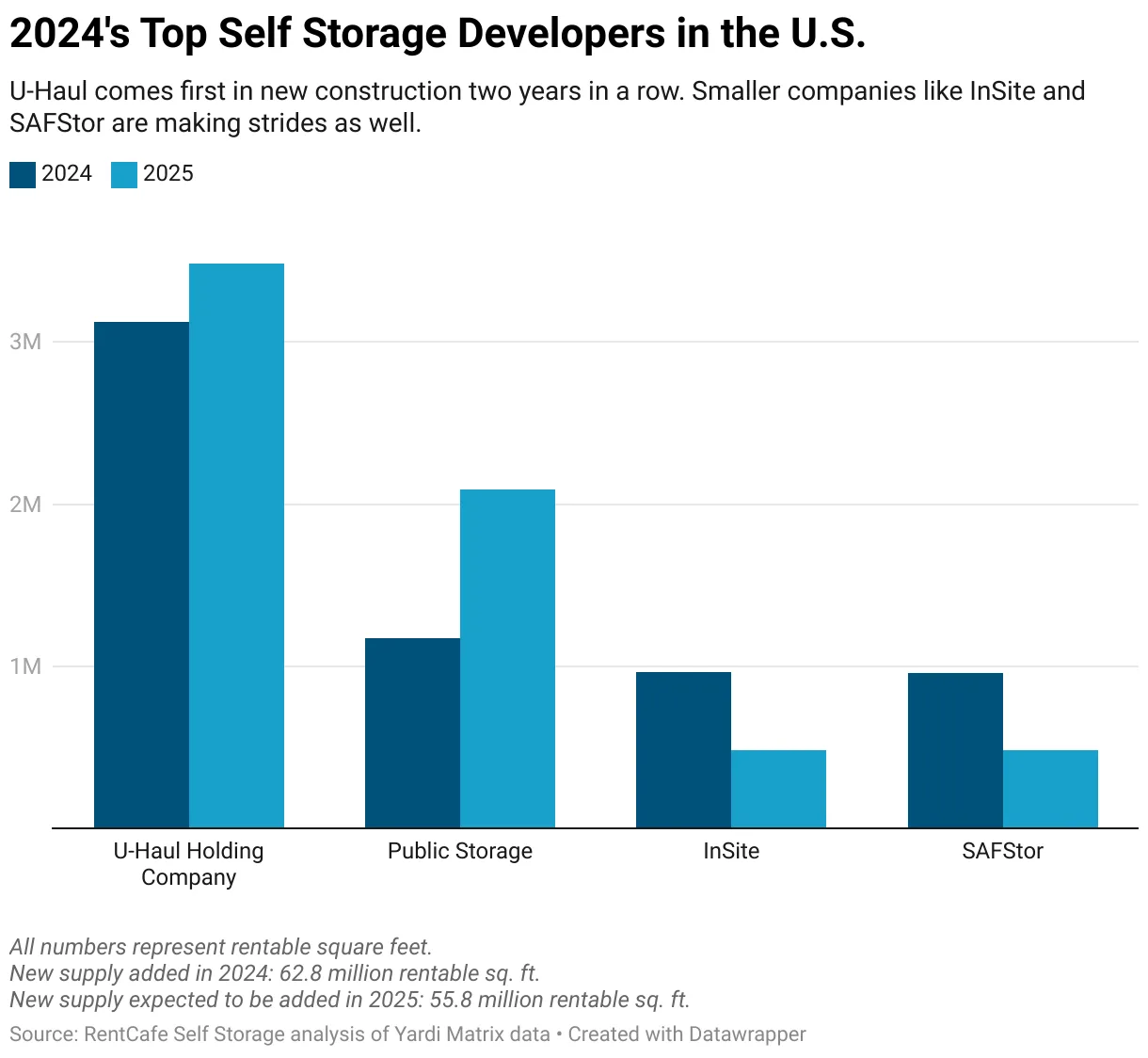

- U-Haul leads in new construction with 3.5M SF expected in 2025, followed by Public Storage and Extra Space Storage.

- New self storage supply is projected to reach 55.8M SF in 2025, down 11% from 2024, but expansion remains strong in secondary and tertiary markets.

A Consolidated Market With Room To Grow

The US self storage sector is massive, with about 2B SF of rentable space. Over half of this inventory — managed across 15K properties — is owned by the top 100 self storage companies, as reported by Rent Cafe.

Among those, five publicly traded firms — four REITs and U-Haul Holding Company — control 35.5% of the total market. These dominant players, including Public Storage, Extra Space Storage, U-Haul, National Storage Affiliates, and CubeSmart, are structured as C-corporations and trade on the New York Stock Exchange.

Despite their outsized presence, the self storage industry remains far from monopolized. A fragmented ownership model sees 64.5% of inventory held by a mix of private equity firms, LLCs, LPs, and family-run businesses — many of which are aggressively expanding.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Who Owns The Market?

Public Storage leads the sector with 226M SF across more than 3K facilities, representing 11.3% of the national inventory. It also ranks third in new construction for 2025, with 2M SF in the pipeline.

Extra Space Storage comes second, with 170M SF across 2,300+ properties. Following its 2023 merger with Life Storage, the company solidified its market position but is slowing development, projecting 567K SF of new space this year — a 33% decrease from 2024.

U-Haul Holding Company, which entered the storage market in 1993, now owns 94M SF. It’s the top contributor to new inventory in 2025, adding nearly 3.5M SF — an 11% increase year-over-year.

National Storage Affiliates and CubeSmart round out the top five, with 66M and 52M SF, respectively. Both maintain strong urban footprints and cater to high-growth markets.

The Rising Middle Tier

Companies ranked 6th through 10th — SROA Capital, Prime Group Holdings, Merit Hill Capital, StorageMart, and SmartStop Self Storage — collectively own nearly 5% of the national inventory.

These companies use varied models, including LLCs, LPs, private ownership, and real estate investment structures. Their expansion strategies often target migration-driven hotspots like Texas, Florida, and California, with emerging attention to growing states like Georgia.

StorageMart, for example, recently acquired 14 new facilities totaling 1.2M SF, pushing its inventory to over 15.5M SF. Meanwhile, SmartStop made its NYSE debut in April 2025 and achieved unsecured loan status, signaling financial stability and growth momentum.

New Supply Slows, But Activity Remains Strong

New self storage supply in 2025 is expected to reach 55.8M SF — an 11% dip from last year, but still a robust indicator of ongoing demand. The 100 largest operators will contribute 15M SF, or 0.8% of national inventory.

In addition to the top REITs, two unexpected players are making waves in development:

- Reliant Real Estate Management (#22 in size) is set to complete 522,500 SF.

- SAFStor (#80) is projected to deliver 482,500 SF — one of the highest outputs among smaller firms.

These trends highlight growth potential in secondary and tertiary markets with lower land costs and less competition.

Why It Matters

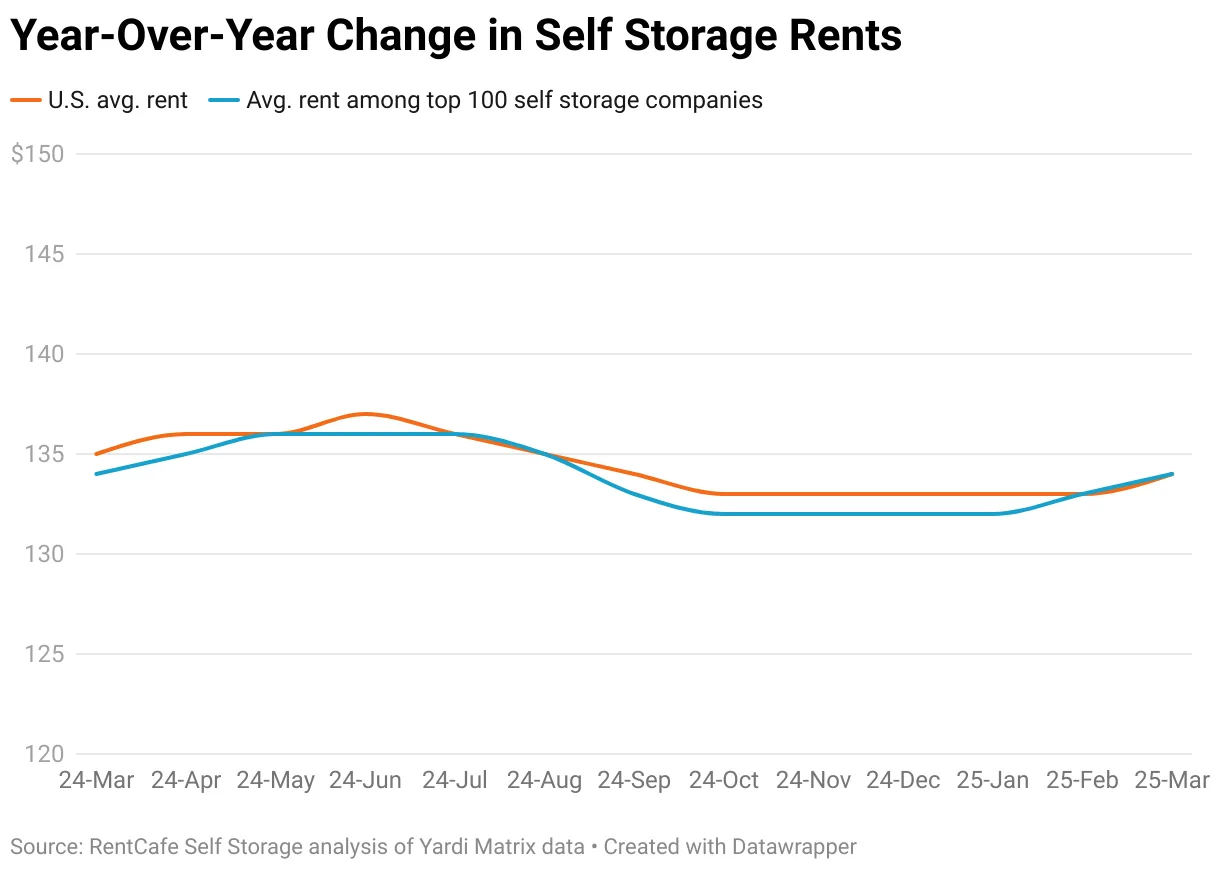

While REITs like Public Storage and Extra Space dominate the headlines, a wide range of operators continue to shape the US self storage landscape. Fragmented ownership and localized strategies have kept the market competitive and prices relatively affordable — with average rents sitting at $134 as of March 2025.

The industry’s resilience, coupled with favorable demographic trends and high margins, continues to attract investors. As the sector adapts to economic pressures and shifting migration patterns, expect smaller players to further carve out market share in what remains a dynamic and decentralized industry.