- A Q1 GDP dip, driven by pre-tariff import surges and declining government spending, has not derailed consumer or investment strength. CBRE expects 2025 GDP growth to average 1.3%, barring major policy setbacks.

- Job growth remains healthy, but unemployment has slightly increased. The Fed is expected to cut rates three times this year, potentially softening financing conditions for CRE.

- Industrial and office sectors show resilience, while retail and speculative development face pressure due to macro volatility and construction costs.

- Construction is slowing across sectors due to rising costs and financing challenges. Yet, capital markets remain active, with an 8% investment volume increase forecasted for 2025.

Economic Conditions at a Glance

As reported by CBRE, the US economy began 2025 with a minor contraction in GDP, a reflection of shifting economic conditions, including a surge in imports ahead of new tariffs and a drop in government expenditures. CBRE forecasts 1.3% GDP growth for the year and expects inflation could rise if tariffs increase significantly.

Labor market conditions remain relatively strong, with 520,000 jobs added through April, and unemployment edging up slightly to 4.2%. The Fed is expected to cut interest rates three times by 25 basis points each in 2025 to support economic growth.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Industrial & Logistics

Leasing activity remained strong in Q1, particularly among 3PL providers. Trade policy will play a key role moving forward. Tariff-induced cost pressures could temper activity, particularly for very large and small tenants. CBRE projects a 5–10% decrease in leasing volume this year. Markets along the I-35 corridor, such as Dallas and Kansas City, stand to benefit from trade diversification.

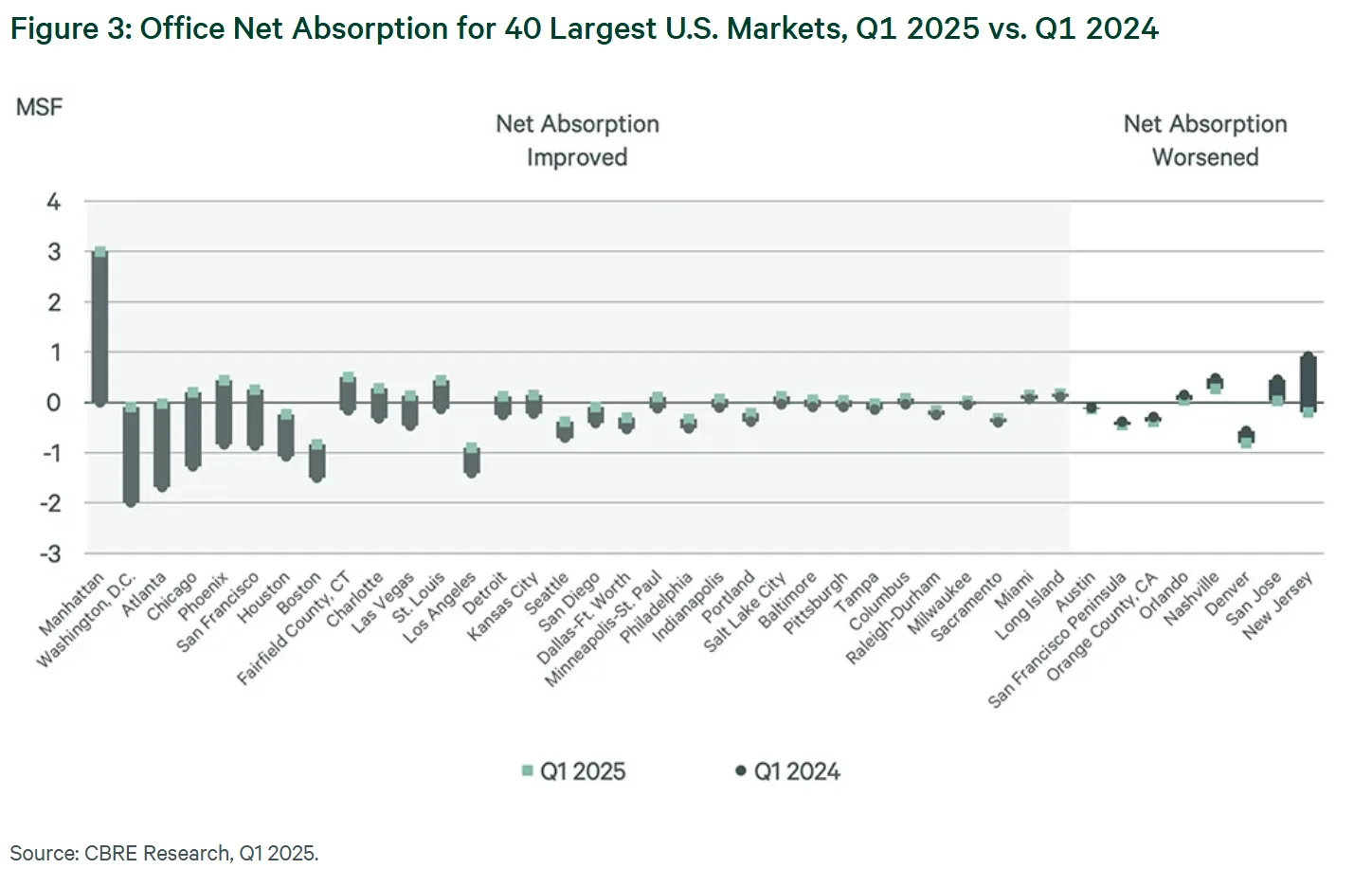

Office

The office market saw a notable 18% quarter-over-quarter increase in leasing, led by New York and expanding across 32 of the 40 largest markets. Occupiers are becoming more conservative due to uncertain economic conditions, favoring renewals over expansions. Still, CBRE anticipates a 4% leasing volume increase in 2025.

Retail

Retail availability rose slightly to 4.8% as absorption turned negative for the first time since Q3 2020. Evolving economic conditions, supply chain issues, and tighter consumer budgets are creating headwinds, particularly for discount and big-box retailers. However, low availability and limited new supply could support strategic leasing.

Construction Pipeline

Rising construction and financing costs have cut speculative development. Industrial completions fell to their lowest levels since 2017, while office space under construction is down 82% from 2020. Retail deliveries hit a decade low at 4.5M SF.

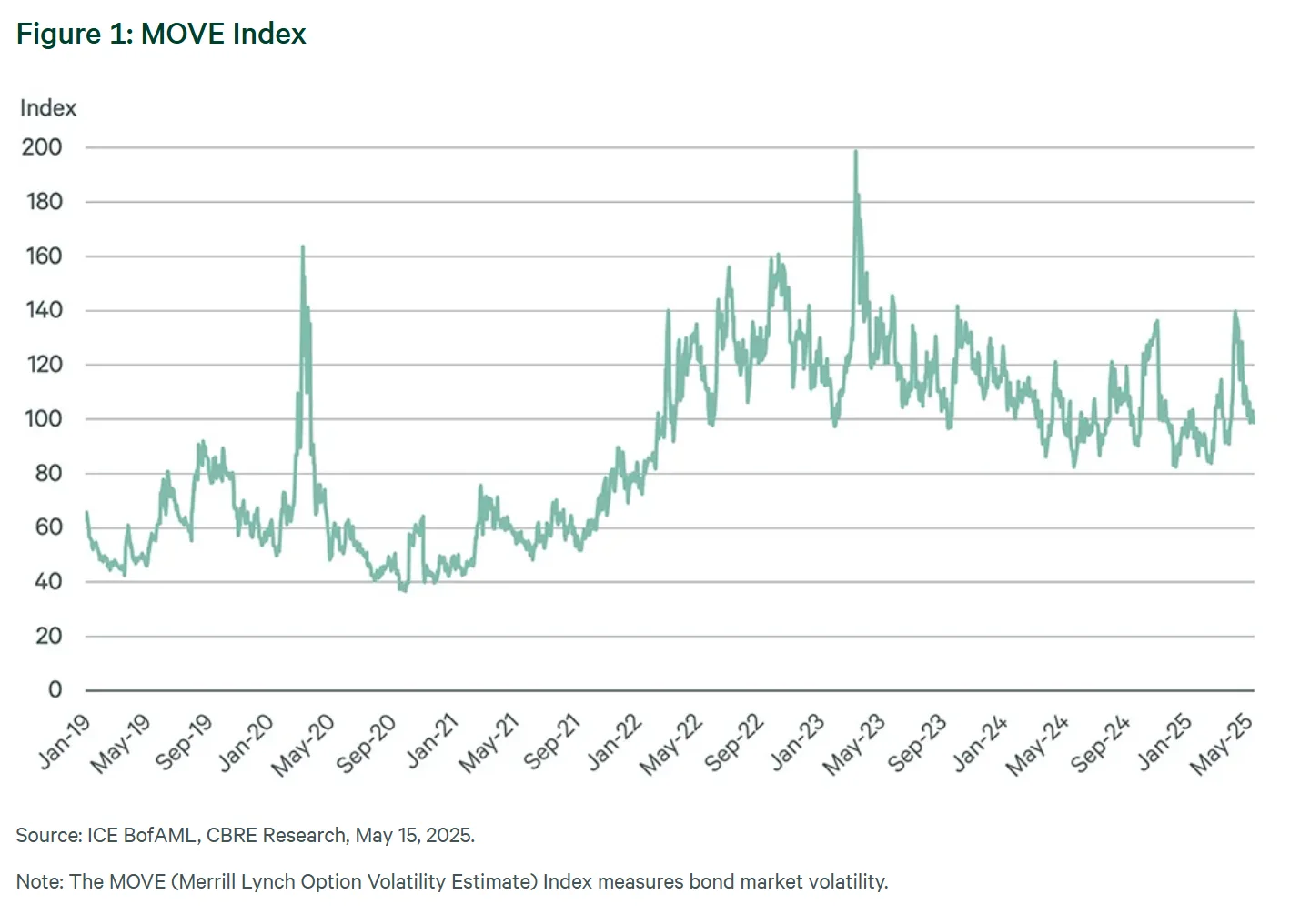

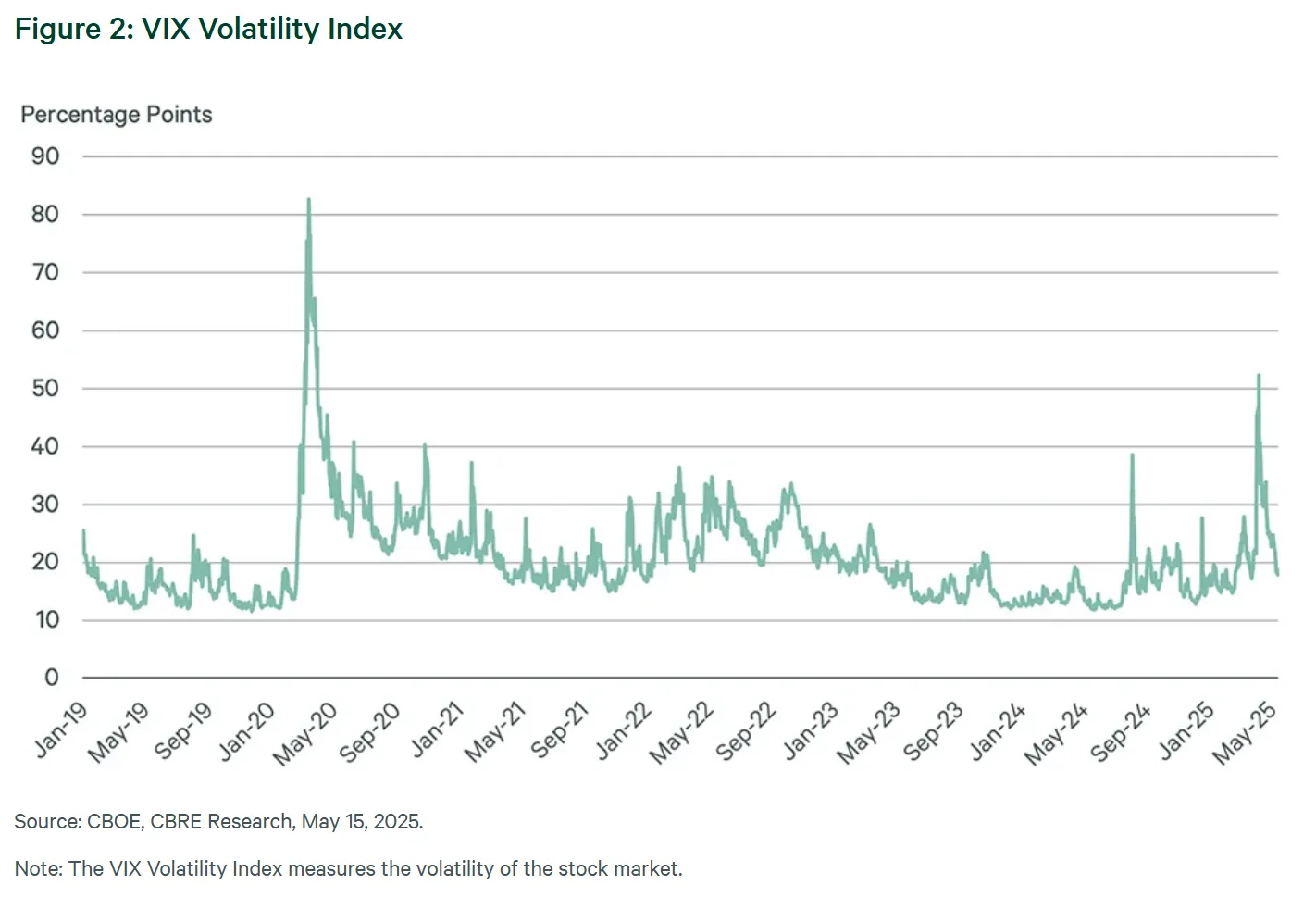

Capital Markets

Investment volume rose 14% year-over-year in Q1 to $88B. CBRE forecasts up to 8% growth in 2025, contingent on trade policy and bond market performance. Investors continue to favor multifamily and industrial, though interest in retail and office is rising.

Looking Ahead

Economic conditions and broader uncertainty remain key themes across commercial real estate, but opportunities persist. Strategic plays in non-prime Class A offices, trade-aligned industrial corridors, well-anchored retail, and Midwest multifamily assets remain attractive. Strong investor appetite and resilient sector fundamentals suggest that despite challenges, the CRE market is poised for selective growth in 2025.