- Investor sentiment in CRE cooled significantly in Q1 2025, driven by extreme policy uncertainty and economic volatility, prompting a shift toward hold strategies.

- Apartment assets emerged as the top investment choice, with investor preference surging to 71%—the highest since tracking began in 2011.

- CRE transaction volume fell 3.9% in March, with declines in all sectors except industrial and hotel; however, early signs of price stabilization are emerging.

As reported by SitusAMC, commercial real estate investors are facing one of the most uncertain periods in recent memory. Policy instability and economic unpredictability pushed many into a holding pattern in the first quarter. Activity slowed sharply as the market reacted to new tariffs, rising inflation concerns, and growing CRE uncertainty.

The Capital Market Context

Financial markets remained turbulent. A strong April jobs report and a flat interest rate decision by the Fed added to the confusion. Tariffs announced in early April triggered volatility. Investors responded by shifting toward perceived safe assets like CRE.

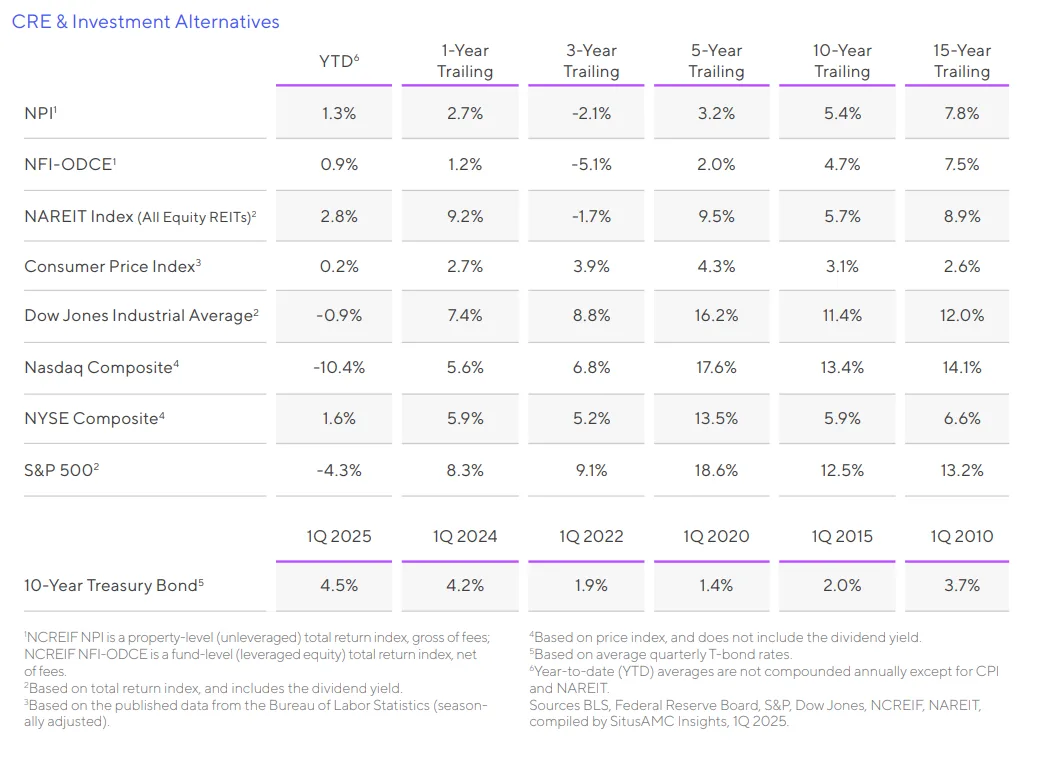

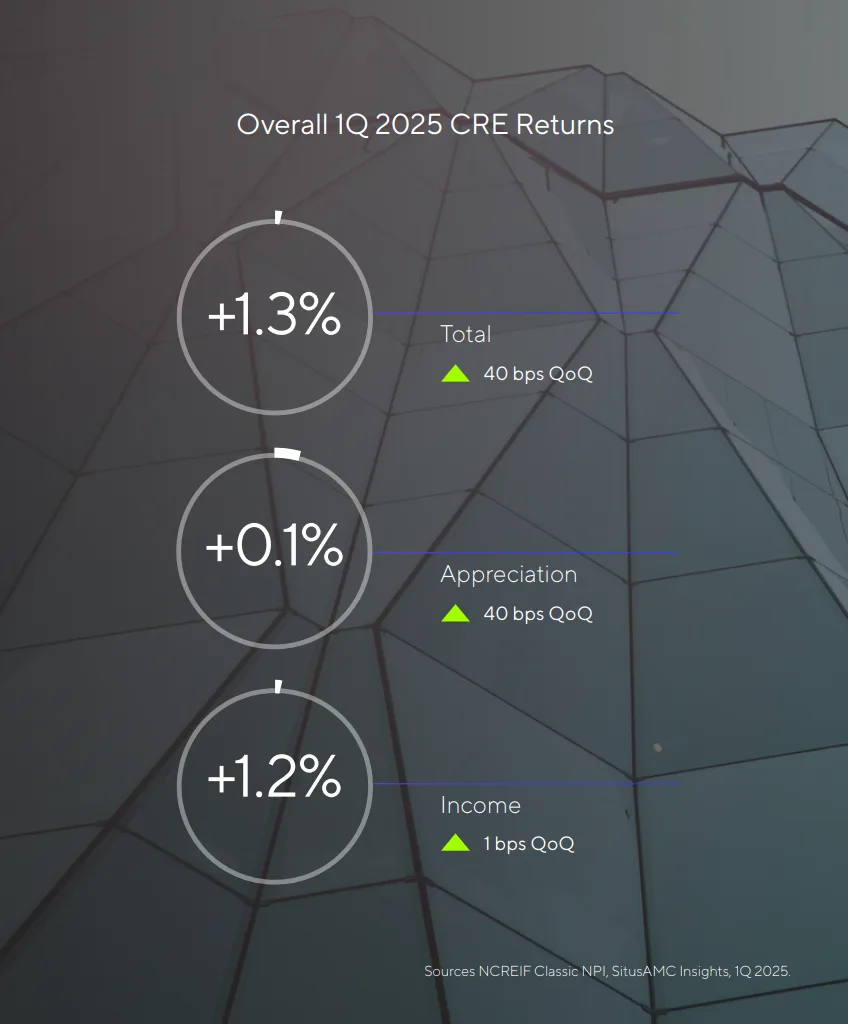

Despite broader CRE uncertainty, returns grew by 40 basis points—the highest in almost three years. Yet, buying slowed. Just 23% of investors recommended buying CRE in Q1, down from the previous quarter. Meanwhile, 70% preferred to hold, reflecting a cautious stance.

CRE as a Safe Haven

Amid broader market volatility, investors saw CRE as a relative safe haven. Apartments stood out. Investor preference jumped 38 points to 71%—a record high. Stable income, strong demand, and limited new supply made the sector attractive.

Sector Performance Overview

- Apartments: Occupancy stayed flat. Rents rose slightly. Net absorption hit a one-year low. Still, low completions support future rent growth. Gen Z renters are driving demand for amenity-rich living.

- Industrial: Investor interest dropped, but fundamentals stayed strong. Occupancy improved. Rent growth was steady. Warehouse demand remains high due to inventory reshuffling amid trade tensions.

- Retail: Investor sentiment held steady. Grocery-anchored centers and quick-service restaurants attracted attention. Retail led all sectors in one-year trailing returns at 6.5%.

- Office: Returns turned positive for the first time in nearly three years. Yet, occupancy dropped again. The sector remains the least favored due to weak demand and high vacancy.

- Hotel: Investor preference rose modestly. However, occupancy fell by over 100 basis points. International travel slowed. Canadian visitor bookings dropped, posing risks to tourist-heavy markets.

Why It Matters

CRE’s stability is being tested by ongoing policy shifts. Investors are now favoring sectors that offer reliable income and limited exposure to economic shocks. Apartments, in particular, are benefiting from this trend.

What’s Next

Until US policy becomes clearer and CRE uncertainty subsides, most investors will remain cautious. However, sectors with solid fundamentals—like apartments and industrial—are well positioned for recovery. As macro conditions stabilize, CRE capital flows are expected to resume.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes