- Camden’s annualized net turnover rate fell to 31% in Q1 2025 — among the lowest in its history — with move-outs for home purchases at just 10.4%.

- Apartment starts plummeted up to 80% in several Sun Belt metros including Austin, Houston, and Charlotte, reducing new supply pressures.

- Despite a strong operational quarter, Camden maintained a cautious full-year outlook due to broader economic unpredictability.

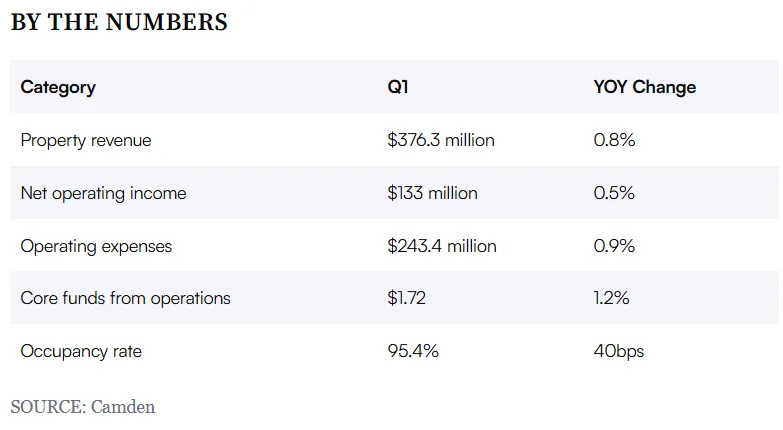

- Core FFO came in at $1.72 per share, $0.04 above the midpoint of guidance, supported by favorable rent-to-income trends and steady occupancy.

Q1 Overview

Camden Property Trust joined its multifamily REIT peers in reporting a stable first quarter, posting $189.8M in core funds from operations, or $1.72 per share, reports Multifamily Dive. The result came in slightly above expectations, but uncertainty around the broader economy kept full-year guidance unchanged.

A Cautious Confidence

CEO Ric Campo pointed to global market volatility and job concerns as reasons for restraint, even as Camden’s operations showed strength. “We have seen really no cracks in the ice,” he said, noting strong fundamentals and demand across the company’s Sun Belt portfolio.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Supply Squeeze

New apartment starts are drying up in many of Camden’s core markets, reaching a 13-year low. Austin saw an 80% drop in starts, while Houston, Denver, DC, Atlanta, and several North Carolina cities reported declines of 65–80%. Campo cited these drops as a key tailwind for maintaining occupancy and rent strength.

Affordability Advantage

With wages outpacing rent growth by over 300 basis points for more than two years, Camden sees a persistent affordability gap favoring rentals. This dynamic, combined with high costs of homeownership, is keeping residents in place.

Retention High, Leasing Soft

Camden’s renewal rates were up 3.3%, helping offset a 3.1% decline in new lease rents. The REIT posted a blended rent change of -0.1%, improving slightly from Q4 2024.

Top-Performing Markets

Washington, DC, Houston, and Tampa led revenue growth, generating 1.3%–4.5% gains, compared to Camden’s portfolio-wide growth of 0.8%.

Looking Ahead

Camden’s historically low resident turnover and steady fundamentals highlight the resilience of Sun Belt multifamily markets, even amid economic uncertainty. Slowing construction and high ownership costs position Camden to sustain strong occupancy and steady cash flow through 2025.

Camden sees pressure in Austin and Nashville easing late 2025 as new apartment deliveries begin to decline. Developer pullback and renter retention may boost REIT performance as supply tightens and rent trends improve in late 2025.