- Multifamily delinquency reached 1.37% in Q3 2025, highest since post-GFC.

- Serious delinquencies (90+ days) make up $7.1B of stressed loans.

- Loss rates accelerated to 0.14% ($911M) in Q3 2025, up from $504M the year prior.

- Distress is focused in specific vintages and geographies, requiring proactive management.

Delinquency Trends Reflect Changing Market

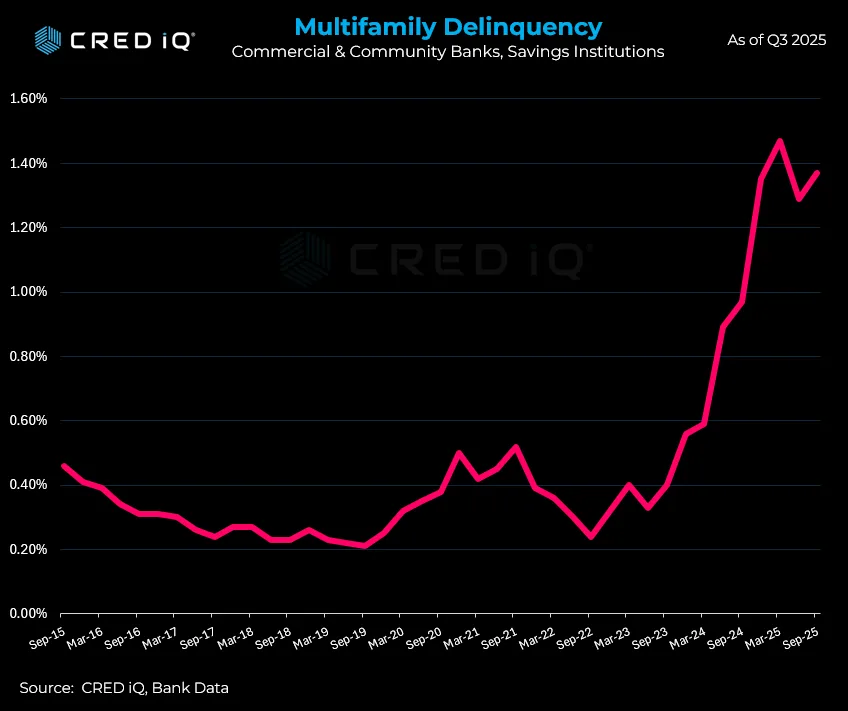

Multifamily loan delinquencies have sharply increased in the past two years, signaling a fundamental shift for the sector. According to CRED iQ data, overall multifamily delinquency rates jumped from 0.40% in Q3 2023 to 1.37% by Q3 2025. The dollar amount of delinquent loans surged from $2.4B to $8.9B over the same period, reflecting mounting distress as interest rates and cap rates climbed.

Serious Delinquencies and Accelerating Losses

Most multifamily delinquencies now sit in the serious category. Loans 90 days or more past due account for 1.09% of total exposure.

Meanwhile, early-stage delinquencies between 30 and 89 days remain limited at 0.28%. This gap shows that long-term problem loans, not new slippage, drive the current stress cycle. A similar pattern has emerged in the broader CMBS market, where stress is increasingly concentrated in specific property types and loan cohorts rather than evenly distributed. Loss rates have also risen, reaching 0.14% ($911M) in Q3 2025—nearly double the $504M reported a year earlier.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

What It Means for Stakeholders

For lenders, the rise in multifamily delinquencies and losses underscores the urgency of proactive asset management and resolution strategies. Investors may find new opportunities in the distressed segment but must underwrite carefully, especially for properties with overleveraged 2021–2022 vintage debt. Brokers are positioned to identify and source deals as distress becomes more concentrated by location, loan age, and lender type.

Outlook: Multifamily Stress Arrives

While fundamental demand for multifamily remains, the latest multifamily data from CRED iQ makes clear that the sector is in an active stress cycle. Market participants should monitor multifamily delinquencies closely and prepare for ongoing resolution, restructuring, and possible transaction activity as the credit cycle evolves.