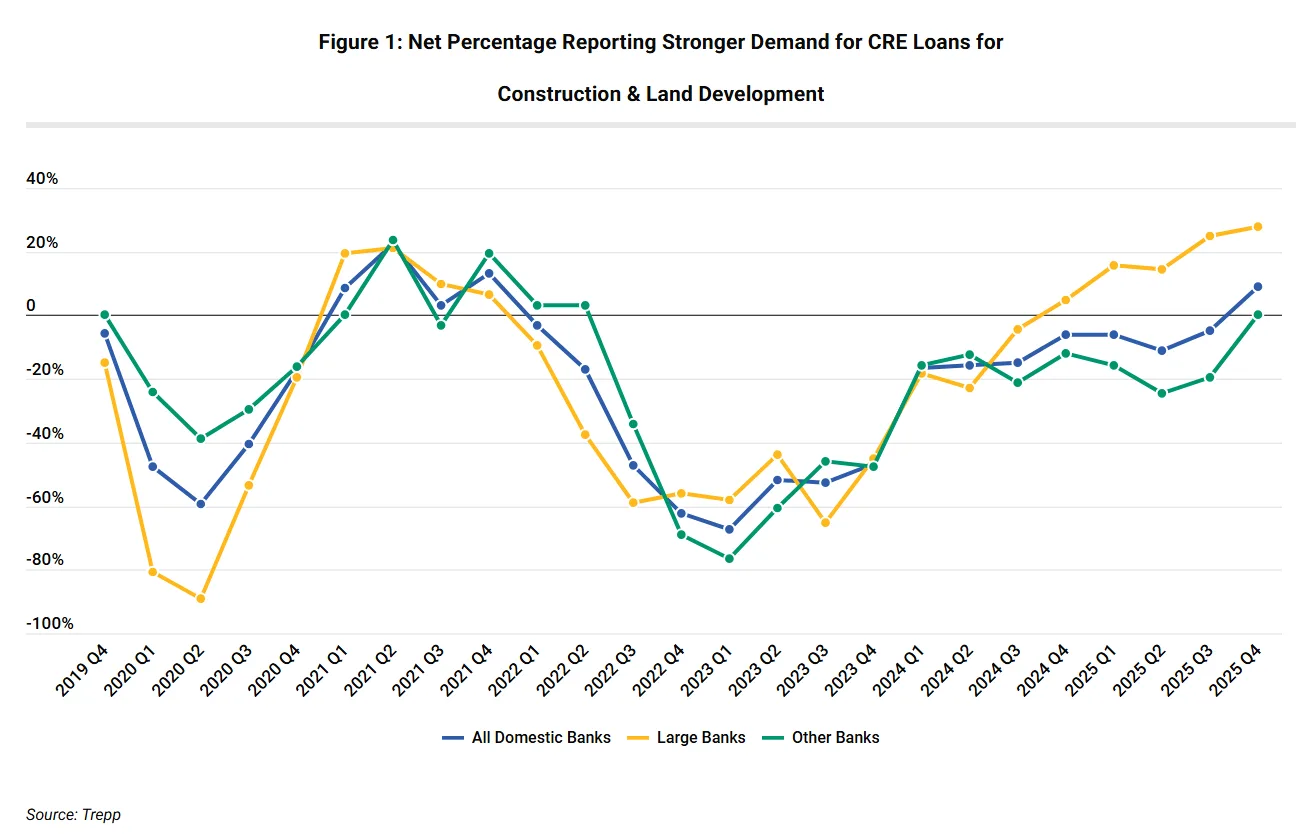

- Construction lending demand turned positive in Q4 2025, led by large banks.

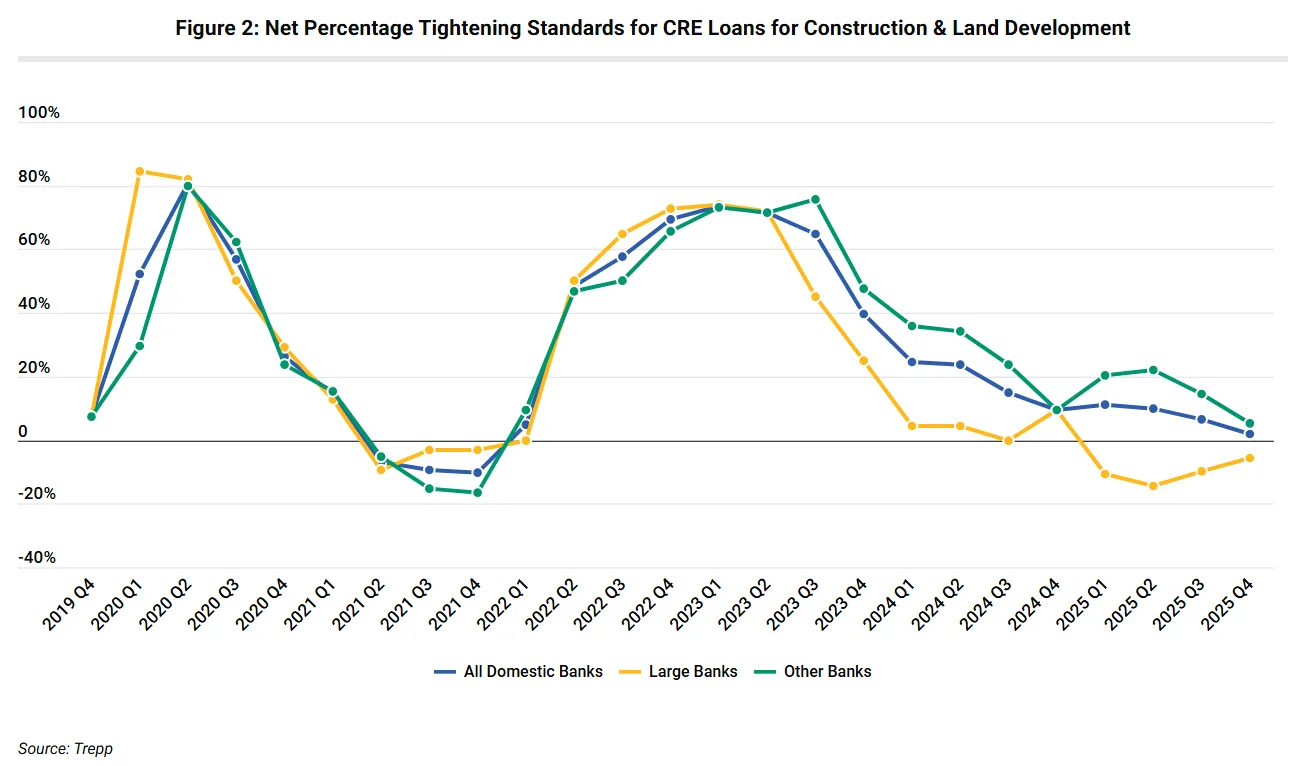

- Lending standards are now near-neutral, though smaller banks remain cautious.

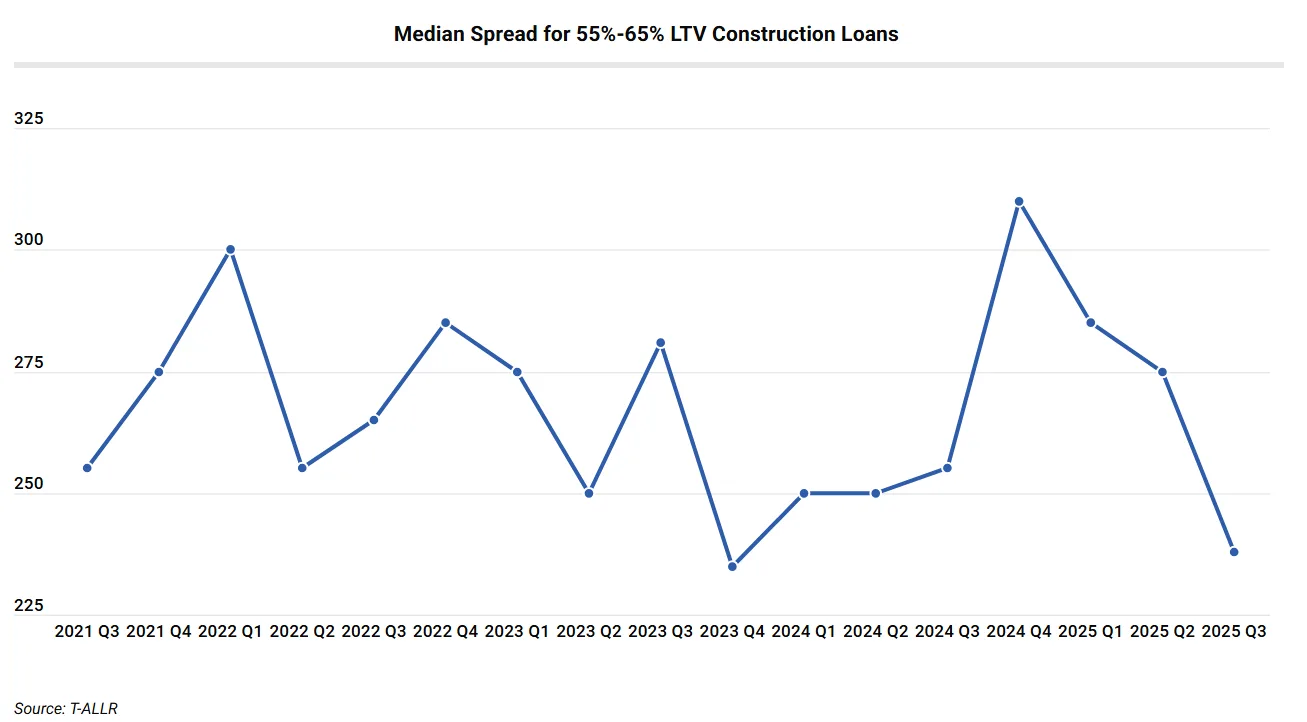

- Median construction loan spreads tightened to 237.5 bps by Q3 2025.

- Market conditions show selective improvement but not a return to peak lending.

Demand for Construction Loans Rebounds

The Federal Reserve’s January 2026 Senior Loan Officer Opinion Survey (SLOOS) reports renewed demand for construction lending after several soft quarters. Net demand for construction and land development loans flipped positive at +8.9% for all domestic banks, with large banks posting a standout +27.8%. According to Trepp, other banks hovered near neutral, signaling a broad stabilization but with stronger momentum among bigger players.

Lending Standards Move Toward Neutral

SLOOS showed that construction lending standards are approaching neutral across the board. Large banks reported net easing (-5.6%) while smaller institutions still reported some tightening (+5.3%), albeit at a slowing pace. Overall, this represents a shift away from the restrictive environment seen in prior quarters, though smaller banks remain more cautious in their underwriting.

Construction Loan Spreads Narrow

Trepp’s Anonymized Loan-Level Repository (T-ALLR) data revealed tangible improvement in loan pricing. Construction loan spreads peaked near 310 basis points by late 2024, but tightened to 237.5 basis points by Q3 2025. These spreads are near the lowest level seen since 2021, suggesting lenders are getting more comfortable originating construction loans as credit conditions stabilize. This tightening mirrors broader spread compression across structured CRE finance markets, where improved risk sentiment has begun translating into renewed lending momentum.

Why It Matters

Paired SLOOS sentiment and real-world pricing show that construction lending is not fully back to pre-tightening activity, but the landscape is shifting. Demand and pricing both reflect a cautiously improving market, with large banks leading on both fronts. While some risk aversion persists among smaller lenders, the direction is clear: construction lending is rebounding, though not yet surging.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes