- Multifamily construction completions are down 15% year-over-year, easing recent supply pressures.

- National vacancy rates have stabilized at 6.5% through 2025, with notable regional variation.

- Rent growth slowed to 1.1% annually, and more than half of tracked markets posted lower rents in Q3 2025.

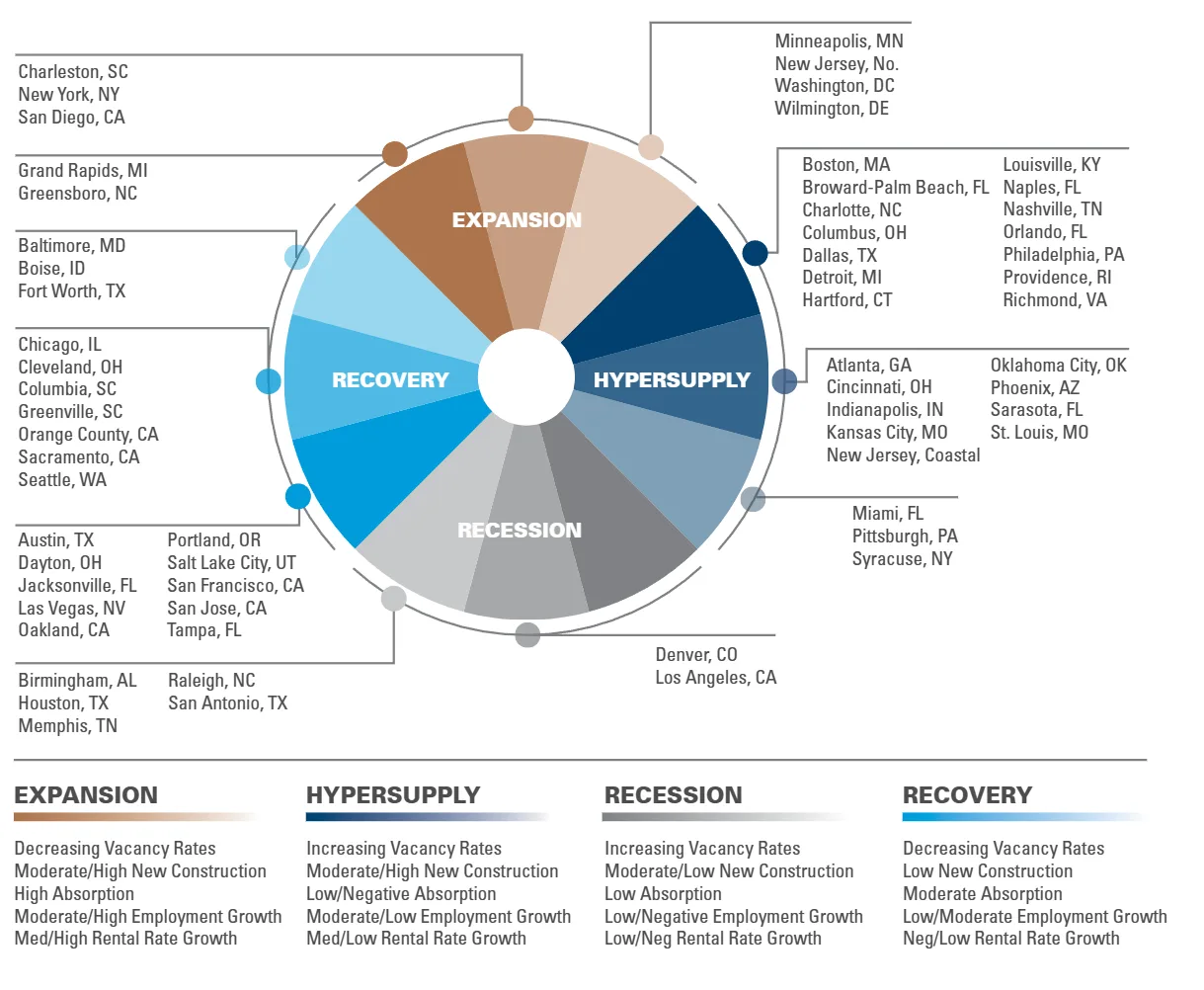

- Over half of US multifamily markets are now in hypersupply or recession phases as the sector rebalances.

Building Boom Winding Down

The US multifamily sector is entering a period of stabilization after several years of rapid construction and elevated volatility. According to a new multifamily report by Integra Realty Resources, new development completions fell by roughly 15% year-over-year as of Q3 2025, although levels remain significantly above pre-pandemic norms. This slowdown in supply growth has allowed demand to catch up, bringing national multifamily vacancy rates to a steady average of 6.5% for the year.

Regional differences remain pronounced: Sun Belt metros still lead in inventory growth driven by prior renter demand and business-friendly policies, while Midwest and Western markets saw more limited increases as migration faded and job growth softened.

Rents and Absorption Face Pressure

Annual rent growth decelerated to 1.1% in September—below overall inflation trends—with Q3 2025 marking the first quarterly decline in both asking and effective rents since 2023. Over half of the 82 major markets tracked reported lower asking rents than the prior quarter. Sun Belt hubs that expanded rapidly during the pandemic have adjusted as in-migration and job creation moderated, while several Snow Belt cities continue to see steady demand due to affordability advantages.

Market cycle analysis shows over 50% of primary markets in either hypersupply or recession, indicating many areas are absorbing significant new deliveries from the recent construction boom. Western US markets contained most of the nation’s recovery-phase metros, benefiting from lower levels of new supply.

Expense Growth Outpaces Income

Operating costs for multifamily assets continued to rise faster than both rental income and inflation. Electricity costs, for example, hit $29B in the first half of 2025, with some markets posting increases above 15%. With rents growing sluggishly, many owners are scaling back on non-essential improvements to prioritize repairs, potentially impacting long-term building quality and satisfaction.

Outlook for Multifamily Sector

Market fundamentals have mostly stabilized, but key challenges remain. One in five markets saw negative net absorption in Q3—the highest in a year. Effective rent growth still trails historical norms, signaling continued softness in demand. Some Sun Belt cities, including Austin, Phoenix, and Nashville, show early signs of recovery. Lower vacancies and modest rent gains suggest these metros are working through oversupply pressures.

Investor sentiment has started to shift more positively as fundamentals stabilize, suggesting improved expectations for multifamily performance heading into 2025. Nationwide, rent growth is expected to stay under 1% through 2025. Completions may drop another 20–25% as new starts decline into 2027. This shift marks a sharp contrast from the sector’s recent building surge.

The report highlights a broader recalibration underway. Developers and investors are closely watching local trends in job growth, migration, and affordability. These metrics will shape risks and returns as the multifamily market adjusts to slower expansion and evolving demand.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes