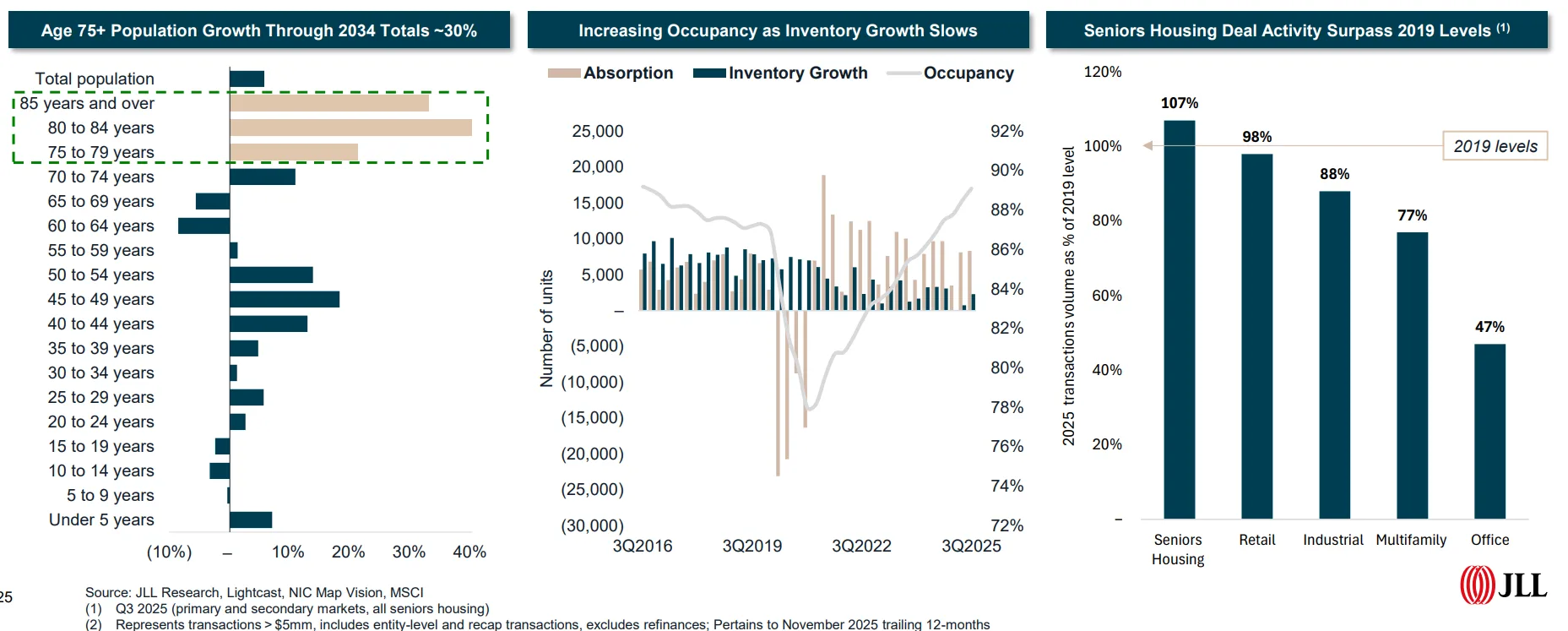

- Senior housing occupancy climbed to a 10-plus year high in Q3 2025, reaching 90.4% across the sector.

- Transaction volume in senior housing rose to 110% of 2019 levels, outpacing other property types.

- Population of individuals aged 75 and older is projected to increase nearly 30% over the next decade.

- New inventory growth for senior housing slowed by 60% year-over-year through Q3 2025.

Demographics Drive Senior Housing Sector

JLL reports that the senior housing sector is experiencing a sharp rise in occupancy and transaction activity. Thanks to demographic trends, the population aged 75-plus is set to expand nearly 30% by 2034—five times faster than the national average. The result: stronger fundamentals and increased interest from investors seeking stable, long-term opportunities in senior housing.

Inventory Growth Slows, Fundamentals Improve

Senior housing occupancy hit a new cycle high in Q3 2025 after 18 straight quarters of absorption gains. Inventory growth slowed to 0.7%, allowing demand to exceed supply. Developers delivered fewer units this year, creating tighter market conditions. As a result, occupancy improved across assisted living, independent living, and nursing care segments.

Transaction Volume Surges Past Pre-Pandemic Levels

Senior housing transaction volume reached $5.2B in Q3 2025, marking a 68% year-over-year increase and surpassing 2019 figures. This contrasts with other major property types, which remain below pre-pandemic volume. Investor appetite was fueled further by robust rent growth, as annual rent increases in senior housing exceeded those in both single-family and multifamily sectors.

Why Senior Housing Outperforms in 2025

Senior housing outperforms in 2025 due to tightening supply, strong demographics, and steady rent growth. Investors are returning to the sector, attracted by stable, long-term demand and improving performance.

Occupancy rates reached their highest level in over a decade, signaling renewed market strength. With fewer units delivered and more seniors entering the market, demand now outpaces supply. Fundamentals continue to improve, positioning the sector for lasting momentum into 2026. Earlier gains in occupancy and performance during 2024 helped set the stage for this growth.