- Office investment forecast notes a market reset, with demand stabilizing but uneven recovery across regions and asset types.

- Record-low new supply and supply constraints support existing asset values amid slow leasing progress.

- Distressed loans are high, but forced property sales remain limited, with distress concentrated among older buildings.

- Medical office remains a defensive sector as broader office investment activity slowly returns.

Office Demand Shifts and Divergence

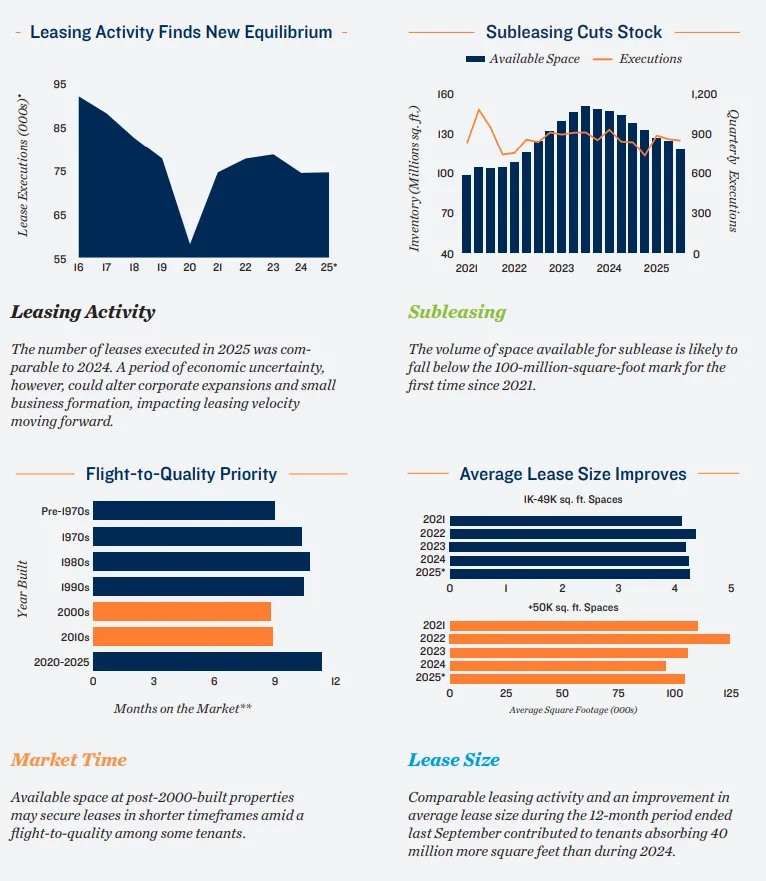

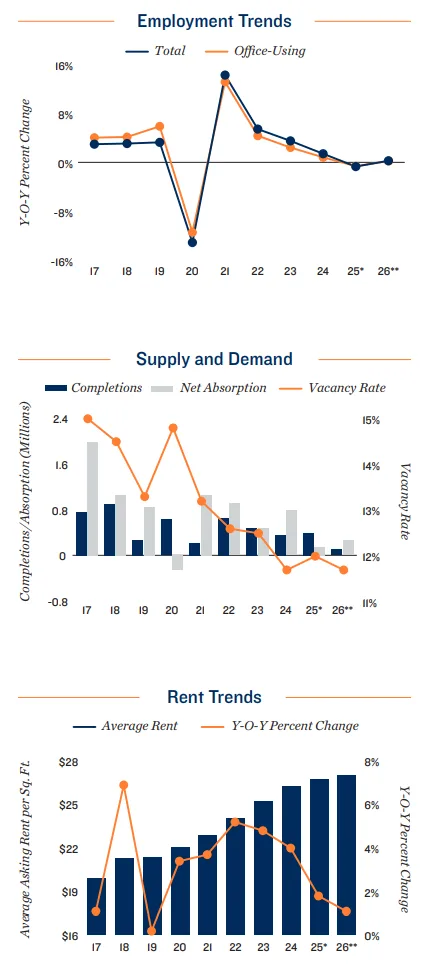

The Marcus & Millichap office investment forecast for 2026 signals that the US office sector has moved past its lowest point but is recovering unevenly. In 2025, office absorption hit its strongest mark since 2019, with nearly 85M SF absorbed nationwide and occupancy growth in 43 of the top 50 office markets.

However, elevated vacancies persist, especially in large coastal metros dominated by outdated properties. Secondary and select suburban markets in the Southeast are returning to pre-pandemic levels more quickly, while the flight to higher-quality, modernized buildings continues to define new leasing activity.

Supply Pipeline at Record Lows

The supply side of the office sector is emerging as a structural benefit. Just 51M SF was under construction nationwide entering 2026, equating to only 0.6% of inventory. With most new projects delivered as build-to-suit, and tight development financing cooling further additions, the office investment forecast anticipates continued supply discipline. This dynamic is seen as key to reducing vacancy and limiting downside risks in stabilizing markets.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Labor Trends and Changing Space Needs

Shifting labor market trends are shaping demand for modern office space. The 2026 office investment forecast highlights employment growth clustered in high-skill, office-using sectors, even as support roles and space utilization are affected by hybrid work and AI adoption. Modern, collaborative office environments are favored, though longer-term space reductions are possible as technology matures.

Capital Markets and Distress Dynamics

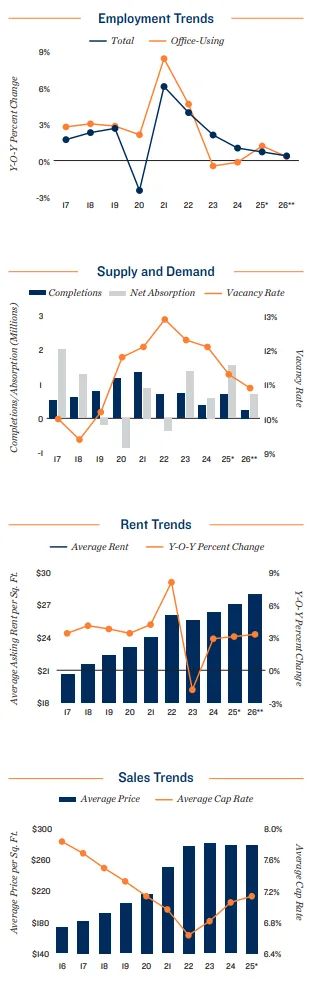

Capital availability for US office remains selective. The Federal Reserve’s more accommodative policy and rising loan originations offer some relief to the market. However, debt terms remain conservative, and lenders apply strict, asset-specific underwriting standards. Office CMBS delinquencies now exceed financial crisis levels, reflecting ongoing distress.

Yet, forced sales remain rare as lenders choose to extend or restructure troubled loans instead. Distress is focused on older, large-format offices, with modern assets still attracting opportunistic capital.

Office Investment Activity and Opportunities

Investment activity in offices increased over 30% year-over-year in 2025. Strategies range from private buyers targeting smaller Class B and C buildings to institutions pursuing portfolio repositionings. Value-add and opportunistic investors are acquiring distressed assets at steep discounts, while a significant pool of uncommitted capital is positioned for contrarian opportunities during this pre-recovery phase outlined in the office investment forecast.

Medical Office Remains Resilient

The medical office subsector stands out with stable vacancies and rising transaction volumes, underpinned by demographic factors and steady demand. While some near-term policy uncertainty exists, medical office buildings remain a preferred option for investors seeking lower volatility and reliable cash flow within the office spectrum. This trend aligns with broader shifts in tenant composition, including the growing presence of medical users in traditional office settings, as noted here.

What’s Next

The 2026 office outlook points to success through local market insight, capital flexibility, and operational discipline. Investors who focus on cities with strong white-collar job growth, limited new supply, and solid asset fundamentals will likely outperform.

Older buildings in oversupplied markets will continue to underperform. However, patient investors with long-term strategies may find rare opportunities in the current market. The next year could offer a unique entry point ahead of a broader sector recovery.