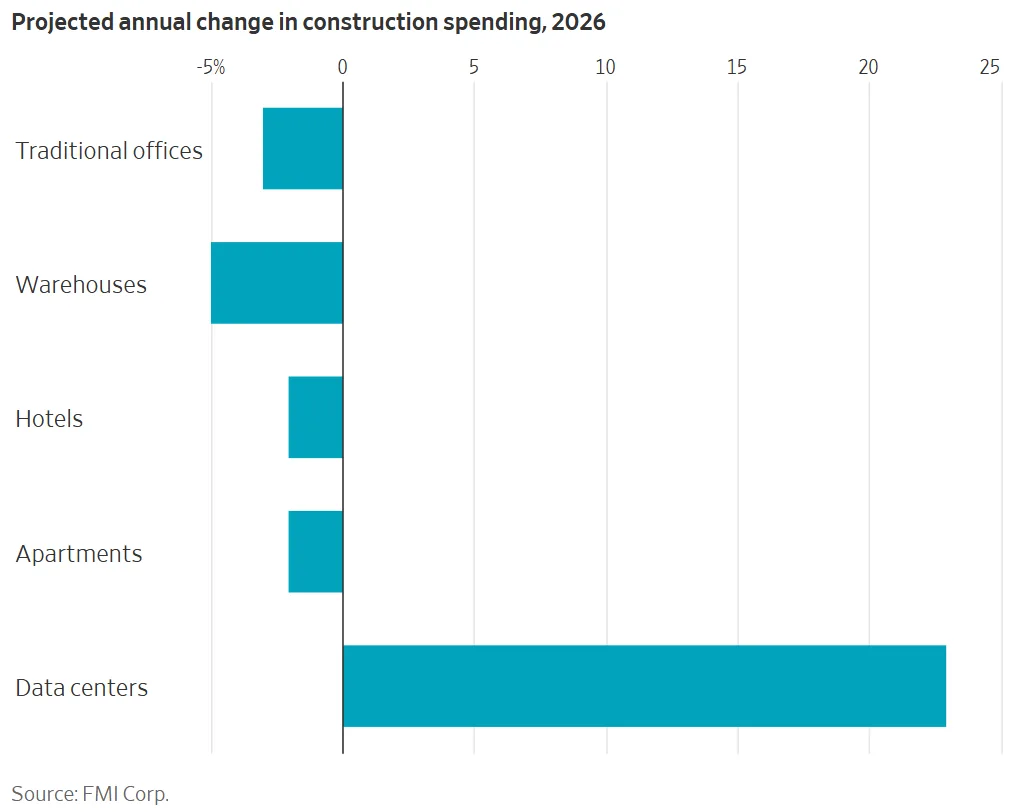

- Data center construction spending is expected to rise 23% in 2026, bucking sector slowdowns.

- Other commercial real estate segments—office, hotel, apartment, warehouse—are projected to contract.

- Labor shortages and material cost increases continue to hamper most CRE construction.

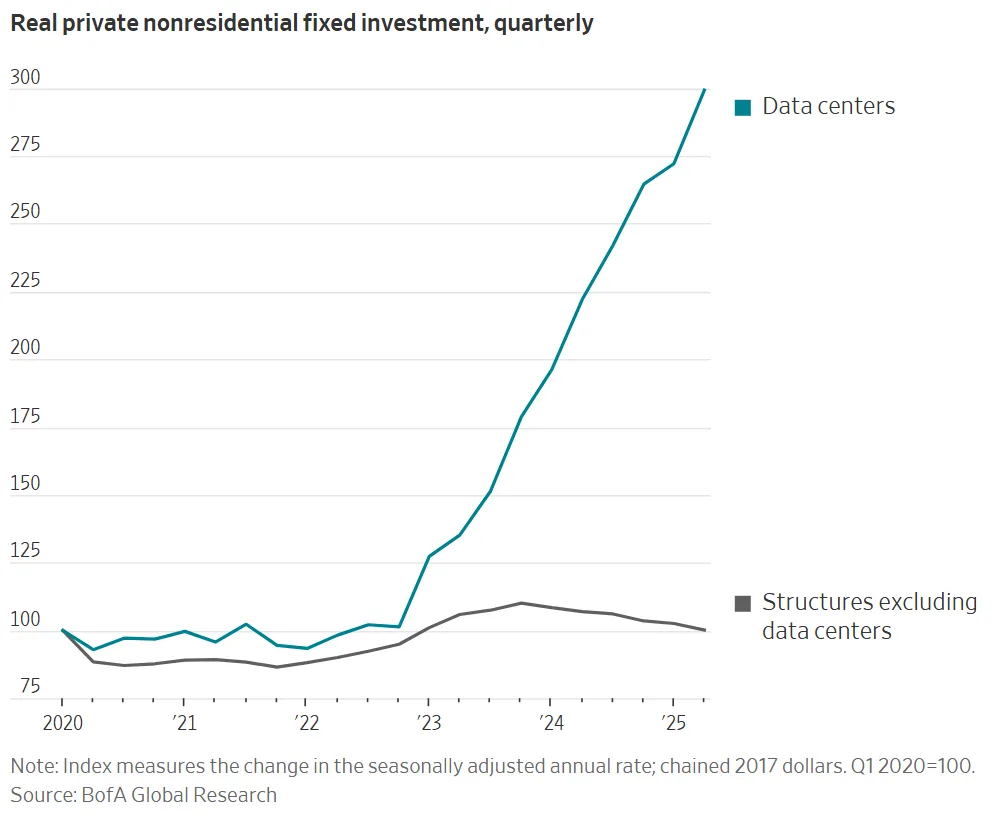

- Data centers now make up a growing share of nonresidential construction spending.

Data Center Growth Defies Industry Trends

According to The WSJ, commercial builders are shifting focus sharply toward data centers as traditional CRE construction faces declining demand. Firms like Amazon, Google, and Oracle are driving a new wave of data center building, fueled by massive investments in artificial intelligence infrastructure. Even as costs climb, these tech giants continue to pour billions into new development, creating a rare bright spot in an otherwise challenging construction landscape.

CRE Sectors Face Slowdown

Rising interest rates, expensive materials, and persistent labor shortages have slowed construction for most commercial asset classes. FMI Corp. projects that spending on offices, hotels, apartments, and warehouses will decline in 2026. Overall nonresidential building construction is set to reach $844.4B—a mere 0.14% uptick from 2025, which declines in real terms when accounting for inflation.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Large-Scale Investment and Labor Pressures

Data center projects outpace other types in both scale and complexity, often costing $1B or more and supporting thousands of construction jobs. However, this surge in data center development puts further strain on already tight labor pools. Industry groups are also voicing concern that new federal immigration policies could further limit access to skilled construction workers, especially in high-demand states like Texas and Arizona. Trade associations are now lobbying for expanded guest worker programs to ease the pressure.

Material Costs and Tariff Impacts

Tariff-driven price hikes for steel, aluminum, copper, and lumber compound construction challenges. Forty percent of surveyed firms have raised bid prices as a direct response to tariffs, and only a minority can fully absorb these increased costs. Despite these headwinds, demand for data centers remains robust as US tech companies race to scale up digital infrastructure, suggesting the trend will continue into the near future.