- Trump orders Fannie Mae and Freddie Mac to buy $200B in mortgage bonds.

- This move asserts executive power in housing finance, traditionally the Fed’s domain.

- Analysts expect the MBS purchases to lower mortgage rates by up to 0.25%.

- Uncertainty grows around the future of GSE privatization and their role as policy levers.

Executive Action Redefines Mortgage Market

President Donald Trump has instructed Fannie Mae and Freddie Mac to purchase $200B of mortgage-backed securities (MBS), aiming to improve housing affordability. According to Bloomberg, the action puts federal housing-finance giants in an unprecedented asset-buying role, expanding executive influence in markets usually regulated by the Federal Reserve.

Blurring Boundaries with the Fed

The mortgage bonds directive marks a significant shift, as asset purchases of this scale have historically been a function of the Federal Reserve, not the White House. Analysts suggest that while $200B is smaller than recent Fed quantitative easing, the move could put downward pressure on mortgage rates, lowering them by as much as a quarter percentage point and making home loans more accessible.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Market Reaction and Debate

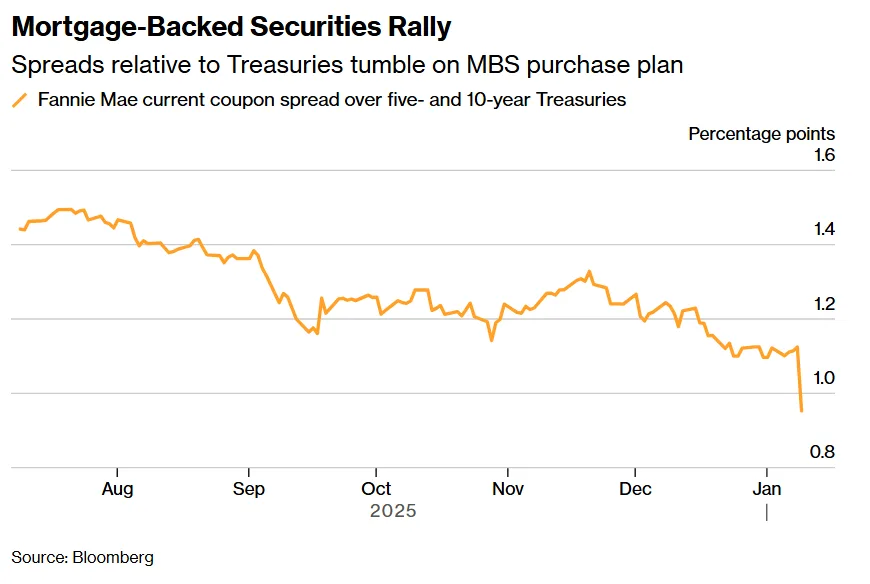

News of the MBS purchases has already narrowed risk premiums on newly printed mortgage bonds by 0.18 percentage points, which may be directly reflected in lower mortgage rates for borrowers. Still, the directive is sparking debate among market participants and policy experts about the boundaries of presidential authority—and potential political risk—within the mortgage market.

Long-Term Implications for GSEs

The Fannie Mae and Freddie Mac asset acquisition plan complicates their potential return to private ownership. While such moves might enhance their balance sheets ahead of an IPO, observers question whether continued federal control signals a permanent shift toward using these entities as policy tools. This concern isn’t new—recent commentary from former leadership has cast doubt on whether the GSEs will exit conservatorship at all, given their growing utility in policy execution. Industry participants remain divided on the longer-term impact of the mortgage bonds directive, particularly concerning GSE independence and market stability.