- US apartment demand fell by nearly 40,400 units in Q4 2025—the first seasonal dip since 2022—bringing annual absorption to just over 365,900 units.

- Apartment rents declined by 1.7% in Q4, double the typical seasonal drop, marking the sector’s second straight quarter and year of rent cuts.

- High-supply markets like Austin, Denver, and Phoenix saw the steepest rent declines, while rent growth persisted in tech hubs and select Midwest cities.

Return to Normalcy: Demand Resets After Pandemic Spike

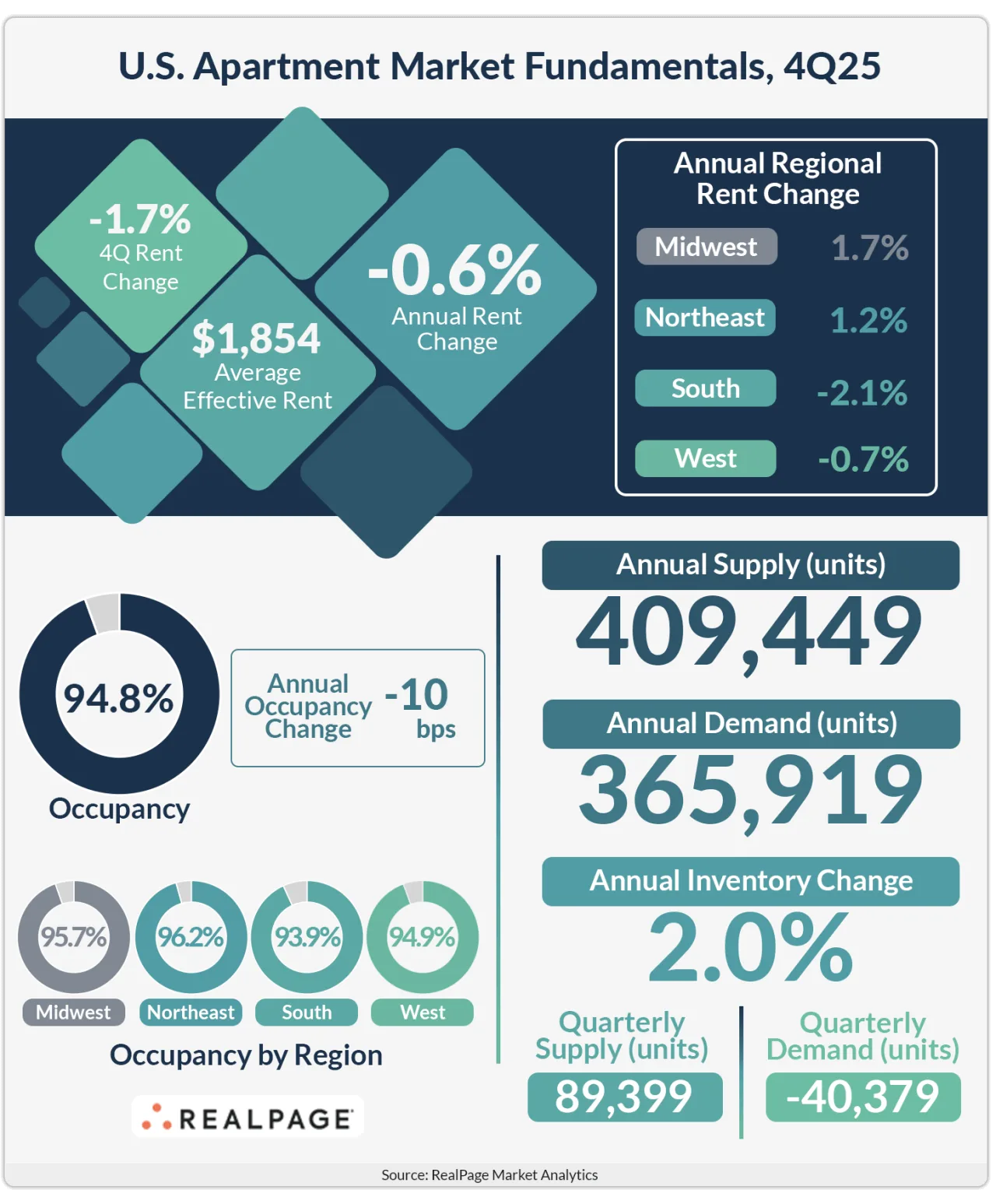

As reported by RealPage, the US apartment market saw its first seasonal Q4 move-outs in three years, with net demand falling by 40,400 units in the final quarter of 2025. This shift follows a cooling in Q3 and reflects a broader trend toward historical averages, after a prolonged post-COVID expansion. Annual apartment absorption now sits at around 365,900 units—just below the five-year average and slightly above the 10-year norm.

Supply Still Elevated, But Cooling

While new supply volumes are easing, they continue to outpace demand. Roughly 409,500 units were delivered in 2025, including 89,400 in Q4 alone. Though this marks the fourth straight quarter of decline since the 2024 peak, supply remains elevated by historical standards—adding pressure on landlords amid softening demand.

Occupancy and Rent Decline Into Year-End

US apartment occupancy fell to 94.8% in Q4, down 60 basis points quarter-over-quarter. It’s the second straight quarterly drop following a five-quarter stretch of gains.

Effective asking rents also declined 1.7% in Q4—twice the seasonal average for this period. Annual rent change for 2025 came in at -0.6%, the steepest annual drop since early 2021.

Landlords are turning to concessions to attract renters, with over 23% of properties offering incentives averaging around 7%. This trend may further delay any meaningful rent growth as discounts work through the system.

Where Rent Cuts Hit Hardest

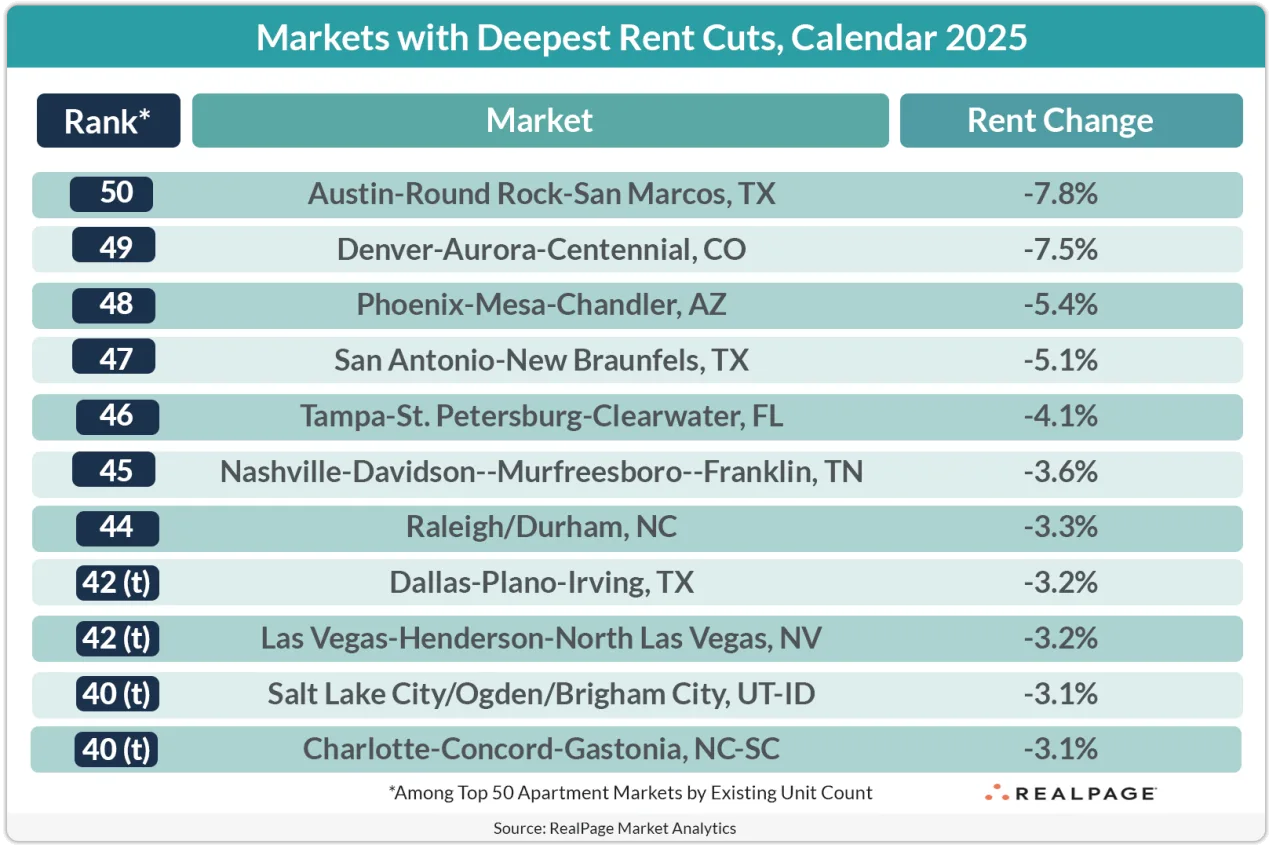

Supply-heavy metros bore the brunt of rent declines in Q4. Austin and Denver led the way, both posting nearly 8% annual rent drops. San Antonio and Phoenix followed closely, with declines of around 5%.

Tourism-dependent markets—Tampa, Las Vegas, and Nashville—also saw continued weakness. These metros are often early indicators of broader economic softening, as consumers pull back on discretionary spending.

Pockets of Strength in Coastal Tech and Midwest Markets

Despite broader declines, several coastal tech hubs posted Q4 rent gains. San Francisco, San Jose, and New York benefited from factors like return-to-office policies, AI-sector optimism, and easing supply pressure, a pattern that’s also been reflected in how large apartment owners have been expanding their footprints along the coasts.

Midwest markets with more moderate supply—Chicago, Cincinnati, Milwaukee, Minneapolis, and St. Louis—also logged healthy rent increases, ranging from 2% to 4% for the year.

Outlook: Stabilization Over Growth

The multifamily sector is gradually returning to a more balanced state. While supply and softening demand continue to challenge fundamentals, rent declines remain manageable in most markets. Operators are expected to lean more heavily on concessions in early 2026 as they focus on occupancy, with true rent growth likely to remain subdued until excess inventory is absorbed.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes