- Sublet space in Class A office buildings is gaining traction as direct availability of premium space declines.

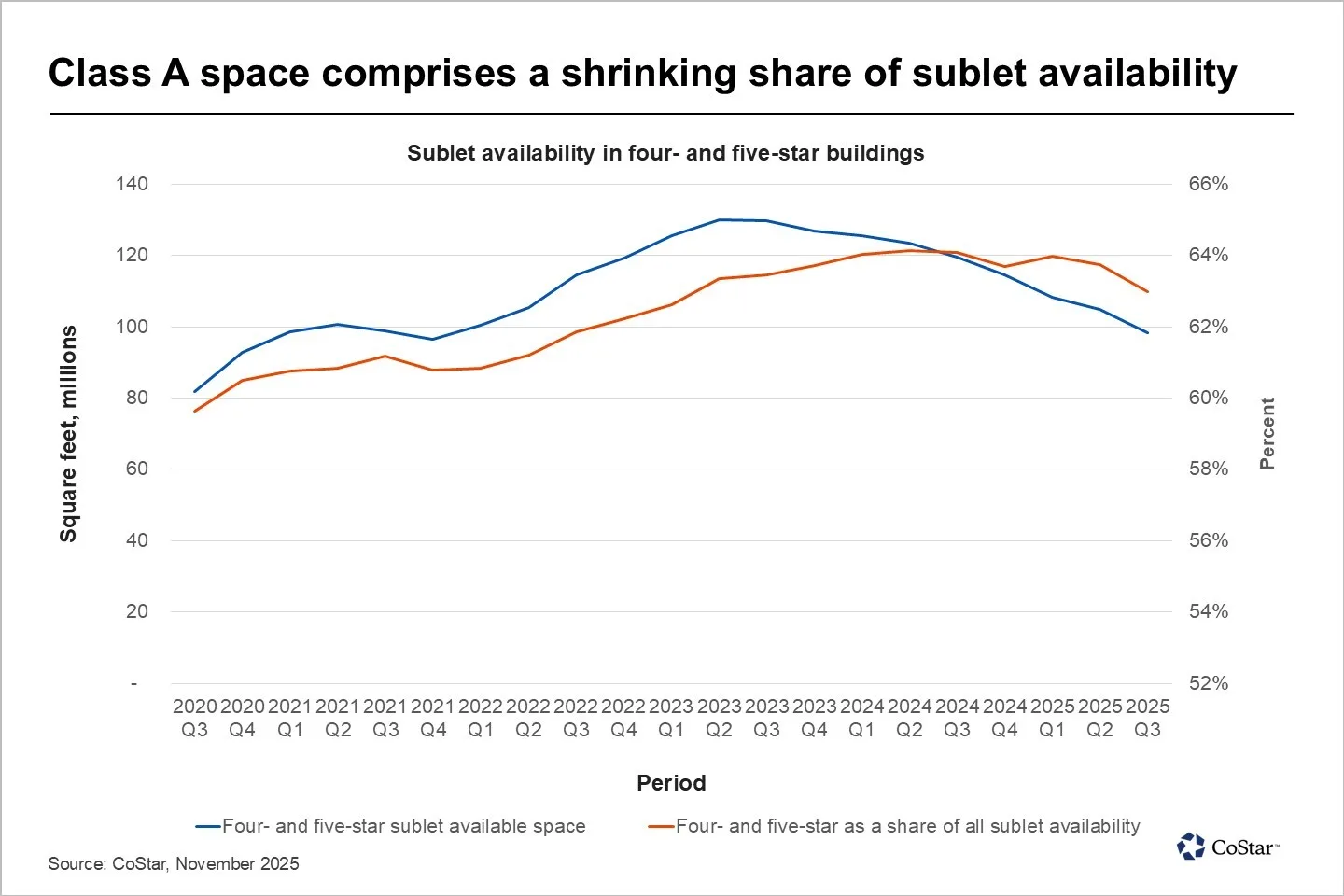

- Over 60% of available US sublet space is in four- and five-star properties, but the share has peaked.

- Landlords may face increased competition from sublet offerings, potentially putting pressure on direct rents.

- Tenants could secure quality space and prime locations by considering sublet office deals in 2026.

Shift in Leasing Preferences

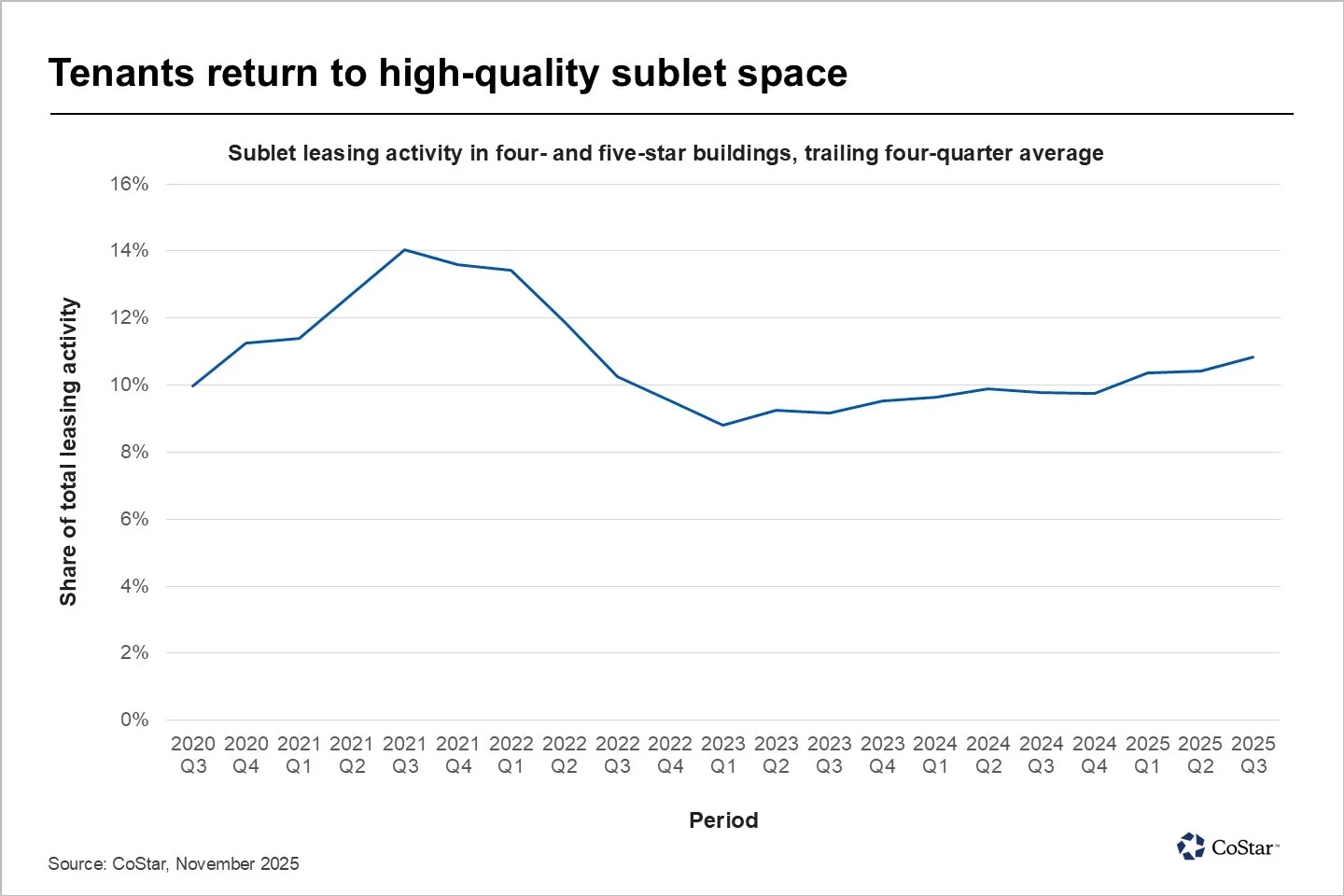

In 2026, sublet space is emerging as a compelling option for office occupiers, especially among tenants targeting premium buildings. According to CoStar, recent deals, such as Amazon’s nearly 200,000 KSF sublease at 237 Park Avenue, reflect a trend where occupiers increasingly turn to the secondary market amid declining direct supply.

Office Pipeline Tightens

The office development pipeline has contracted, with few new premium projects underway. This has resulted in fewer opportunities for tenants seeking large blocks of Class A office space. In some gateway markets, surging demand from sectors like AI is helping offset limited new supply by absorbing existing premium inventory. As direct space becomes scarce, the sublet market is seeing more attention—especially in highly rated, well-located properties.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Sublet Availability Peaks

Sublet space currently accounts for nearly 100M SF nationwide, with 60% in Class A buildings. Recent data suggests both the overall volume and share of top-quality sublet space have peaked, indicating many tenants are already absorbing this inventory. For landlords, increased competition from sublets could dampen rent growth, while tenants may benefit from more options without compromising on quality or location.

Market Implications for 2026

Sublets could remain attractive as long as job growth supports office demand. If broader leasing slows, direct and sublet availability may both rise. Some landlords may also recapture and remarket sublet listings, further blurring the line between direct and indirect space. For now, sublet space is poised to play a significant role in the office market throughout 2026.