- President Trump’s push to reduce the federal real estate footprint led to widespread confusion and reversals.

- The General Services Administration (GSA) struggled to implement changes due to leadership turnover and staffing losses.

- While the government made modest progress selling assets and reducing leases, experts expect real movement in 2026.

A Year of Disruption and Reversals

Bisnow reports that in 2025, the commercial real estate industry braced for federal downsizing. President Trump’s early executive orders created shockwaves by targeting rapid cuts to government office space.

He formed the Department of Government Efficiency (DOGE) days into his term and appointed Elon Musk to lead it. Within weeks, DOGE published lists of lease cancellations and asset sales. The sudden moves rattled landlords and brokers.

But most announcements were later reversed. DOGE rescinded terminations and removed asset lists within days, undermining confidence and creating widespread confusion.

Transwestern Managing Director Lucy Kitchin summed it up plainly: “It was a chaotic year.”

Leadership Instability at the GSA

The GSA, which manages federal real estate, struggled through a year of turnover and transition. Several top officials, including Acting Administrator Stephen Ehikian and Public Buildings Commissioner Michael Peters, left midyear.

Michael Rigas and Andrew Heller filled in temporarily. In December, the Senate finally confirmed Edward Forst as GSA Administrator, bringing long-awaited stability.

Meanwhile, the Public Buildings Service (PBS) lost nearly half its employees in 2025. Staff numbers dropped from 5,655 to 3,126, draining the agency of institutional knowledge.

To respond, GSA centralized operations by replacing 11 regional offices with a single national structure.

Lease Cancellations and DOGE’s Collapse

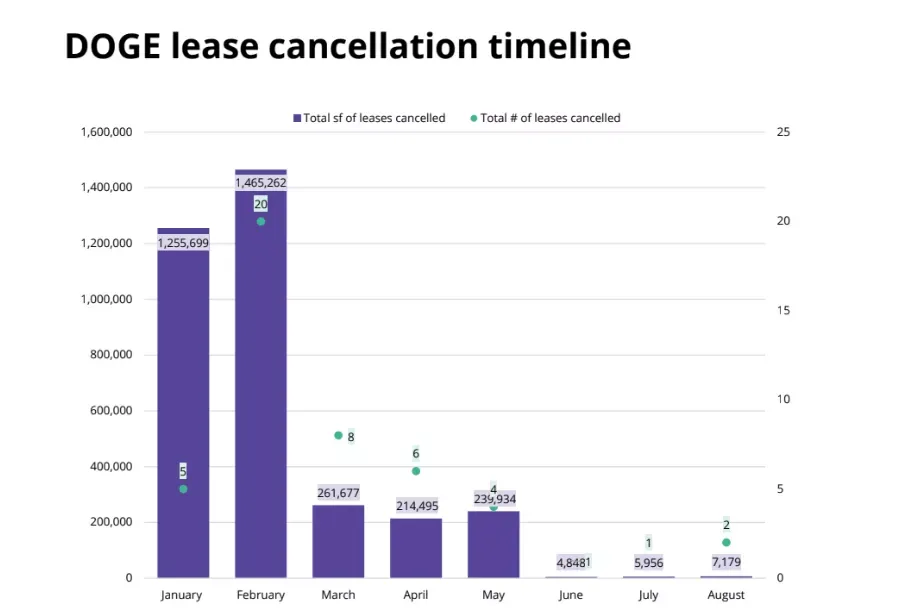

DOGE announced 748 lease terminations by March, totaling 9.6M SF and claiming $660M in savings. But further analysis revealed that most leases were already nearing expiration.

CoStar found that 89% of the leases DOGE claimed to cancel were already ending. Transwestern’s Kitchin noted that most landlords who received termination notices saw them later rescinded.

Only one major surprise cancellation stood out in the D.C. region — the 290K SF lease for the US Agency for Global Media.

By April, Elon Musk had left DOGE. In November, the agency shut down entirely.

JLL’s last update showed DOGE had permanently canceled 384 leases (4.8M SF) while walking back another 484. GSA’s total leased footprint dropped slightly, from 173.6M SF in December 2024 to 170.6M SF by October.

In the D.C. area, space contracted from 42.9M SF to 40.7M SF.

Modest Leasing and One Major Move

Despite early activity, new federal leasing remained slow through most of 2025. Brokers noted that most new space went to immigration and homeland security agencies.

Only one major headquarters relocation materialized: HUD moved to Alexandria, Virginia, taking over the National Science Foundation’s lease. The NSF later backfilled another nearby federal lease.

This move allows the government to dispose of HUD’s 1.1M SF building in D.C. — the only example so far of a shift from owned to leased space.

Progress on Sales, But Slower Than Promised

In March, GSA released a list of 443 properties — nearly 80M SF — it planned to evaluate for sale. The assets included agency headquarters for the FBI, USDA, SSA, and others. The government estimated they carried $8.3B in recapitalization needs. Officials floated the possibility of shedding a major portion of the federal portfolio, which immediately raised concerns about feasibility and market impact.

But within a day, GSA took down the list. A spokesperson cited “overwhelming interest” and said the agency would republish it. It never did in full. Only a few dozen properties were quietly added back to the site by May.

Congressional leaders criticized the lack of transparency, calling it “mass confusion.”

The GSA did make some progress. It sold 90 buildings (3M SF) in 2025. Key sales included a former US Geological Survey site in Menlo Park and an Army Reserve center in New Mexico.

The Public Buildings Reform Board (PBRB) recommended a third round of sales totaling 7M SF. Most of the buildings were already flagged by GSA, but PBRB’s list allows them to move faster.

The recommendations included the 1.7M SF Department of Energy Forrestal Building — a long-rumored disposal target.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

A Clearer Path in 2026

PBRB members believe the Trump administration’s mandate for federal employees to return to offices full time will clarify long-term space needs.

Agencies must submit space occupancy data in January. If they occupy less than 60% of their space, they will need to develop consolidation plans.

That requirement could finally create the conditions for GSA to act.

Federal properties currently face $50B in deferred maintenance, but GSA receives only $600M annually to address it. PBRB members hope that better data, clearer leadership, and a willing administration can unlock faster action.

Dan Mathews, a PBRB board member, said the difference between this year and prior years was stark.

“We had a very substantial set of recommendations approved,” he said. “For the last four years, we had zero.”

Why It Matters

Federal agencies hold vast real estate portfolios in cities like Washington, D.C., creating major ripple effects in local office markets.

Delayed leasing decisions, canceled asset sales, and unclear agency plans disrupt planning for both public and private landlords. Developers, brokers, and investors need consistent signals to make long-term bets.

What’s Next

With new GSA leadership in place and agency space reports due in early 2026, the government may finally begin executing a clearer real estate strategy.

PBRB will release one final round of property recommendations before it sunsets in 2026. Members say this last slate will be substantial.

Whether the government follows through will depend on whether the leadership can turn clarity into action.