Rent Is Quietly Driving Inflation Lower

CPI slowed to 2.7% in November, with core inflation easing to 2.6%.

Good morning. November’s inflation report came in cooler than expected, with core CPI rising just 2.6%—its slowest pace since early 2021. But behind the headline numbers, rent is playing a bigger role than most realize.

Today's issue is sponsored by QC Capital—giving accredited investors access to stable, passive flex space returns and long-term upside.

CRE Trivia 🧠

Which family topped Bloomberg’s 2025 list of the world’s richest families, with a fortune exceeding $500B for the first time?

(Answer at the bottom of the newsletter)

Market Snapshot

|

|

||||

|

|

*Data as of 12/18/2025 market close.

Inflation Eases

Despite headlines cheering November’s cooler inflation, the real driver may be flying under the radar: rent.

CPI eases: Core inflation rose 2.6% in November, the slowest pace since early 2021, while overall CPI hit 2.7%. Despite shutdown-related data quirks, the surprise slowdown was driven by falling costs in hotels, recreation, and apparel—with shelter playing a major behind-the-scenes role.

Shelter inflation cools sharply: Shelter costs rose just 3%—the weakest pace in over four years, according to Jay Parsons. With CPI rent data lagging real-time trends (now near 0% growth), housing inflation is likely to continue cooling well into 2026 or beyond.

Why rents are falling: A record apartment-building boom in 2023–2024 has flooded the market, pushing rents down, especially in the Sun Belt and urban cores. Even as new starts slow, ongoing lease-ups mean rent pressure will stay low for some time.

Mortgage and Fed outlook: Cooling inflation, especially in shelter, could nudge mortgage rates lower and boost odds of Fed cuts in early 2026—though officials remain cautious, awaiting more data.

➥ THE TAKEAWAY

Big picture: Rent is the anchor holding inflation down—and likely will be through 2027. For markets and the Fed, it’s the sleeper story shaping the 2026 outlook.

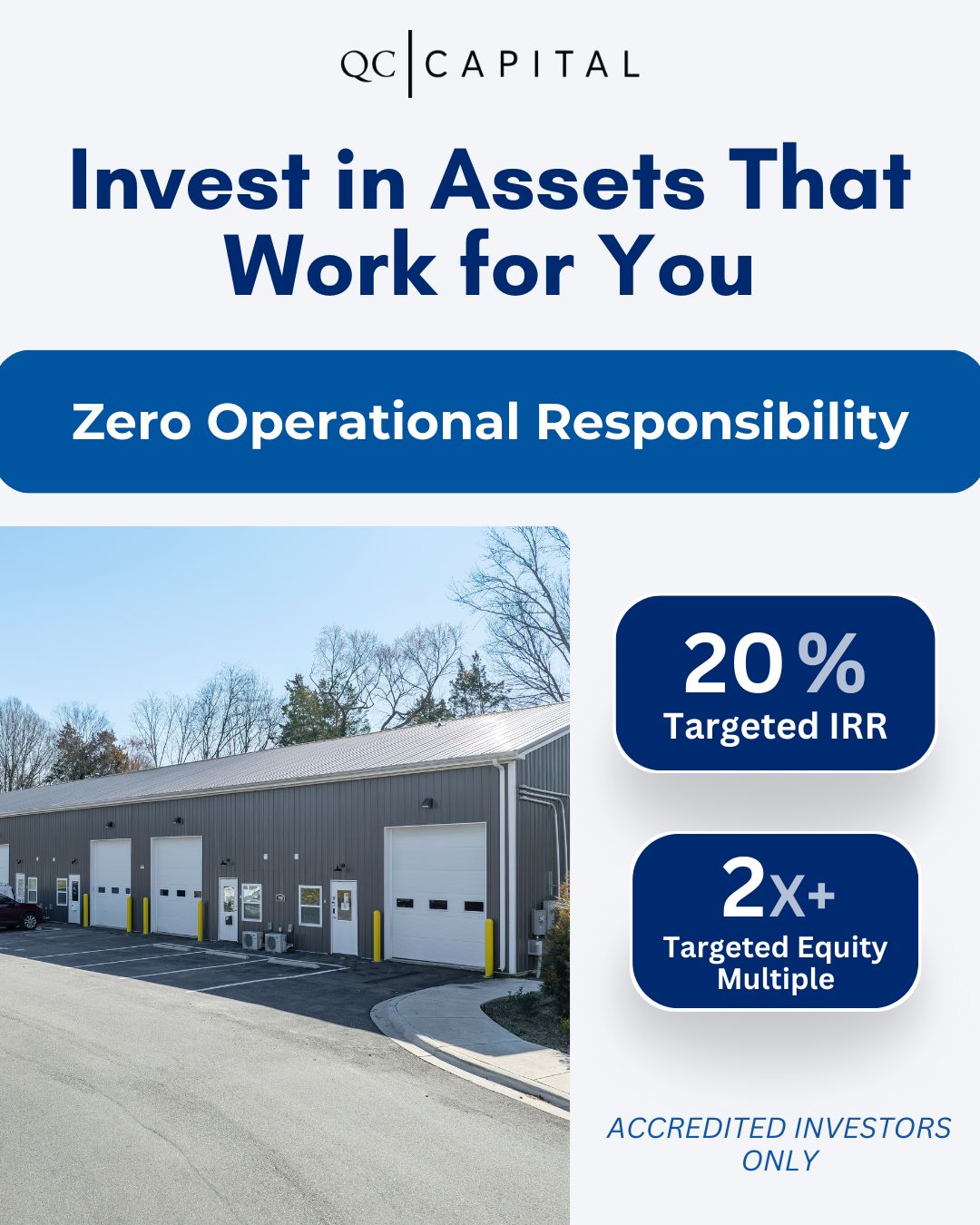

TOGETHER WITH QC CAPITAL

Discover the Power of Passive Flex Space Investing

Looking for an investment that delivers stability and long-term growth?

QC Capital’s Flex Space Fund is designed for accredited investors seeking passive income and strategic upside.

✅ 8% Preferred Return – Consistent income backed by fully leased assets.

✅ 70% Back-End Equity Kicker – Offers immediate cash flow and long-term value.

✅ Hands-Off Investing – Zero operational responsibility through NNN leases.

✅ Exposure to a Fast-Growing Asset Class – Flex space is in high demand nationwide.

This isn’t just about passive income, it’s about investing in one of the most resilient and scalable asset classes in commercial real estate.

Round 2 Commit Date Deadline: January 5th. Spots are first come, first serve.

*This is a paid advertisement. Please see the full disclosure at the bottom of the newsletter.

✍️ Editor’s Picks

-

CRE under Trump: What investors should watch as policy shifts influence taxes, lending, and commercial real estate fundamentals. (sponsored)

-

Grid pressure: Senate Democrats are probing whether AI-fueled data center growth is driving up electricity bills for consumers, putting Big Tech on the defensive.

-

Liquidity lift: CRE liquidity conditions improved for the sixth straight quarter in Q3 2025, signaling cautious optimism as markets rebound from post-pandemic lows.

-

Build faster: The House passed the SPEED Act to cut red tape and speed up multifamily housing development.

-

Homefield blitz: The Chicago Bears are using a potential move to Indiana as leverage to secure public funding for a new stadium in Illinois.

-

Inflation eases: U.S. inflation slowed to 2.7% in November, surprising economists and fueling speculation of Fed rate cuts.

-

Defining deals: CRE weathered a volatile 2025, with rate cuts and renewed deal flow signaling a slow but resilient recovery.

🏘️ MULTIFAMILY

-

Balance test: As 2026 begins, multifamily faces mixed signals, with rent growth hinging on how quickly supply slows.

-

Renting recap: In 2025, renters faced fierce competition in major metros like NYC and Miami, while the South led in new supply, affordability, and “luxury for less” opportunities.

-

Renter renovations: Wealthy renters are investing heavily to customize high-end leases, and many landlords are embracing the value boost.

-

Incentive era: With vacancy still high and rent growth sluggish, multifamily landlords will lean on concessions again in 2026 to attract and retain tenants.

-

Supply squeeze: A surge in mortgage-free homeownership across NYC is tightening housing supply, freezing move-up activity, and squeezing first-time buyers out of the market.

-

Artful living: Neology, Lion Development, and the Rubell family are launching a 330-unit, art-centric residential project in Miami’s Allapattah.

🏭 Industrial

-

Industrial standouts: Richmond and Oklahoma City top CoStar’s industrial rankings, driven by tight vacancy, low supply growth, and strong tenant demand.

-

Lakeland expansion: Parkway and Silverpeak secured $40.67M to kick off Phase 2 of Lakeland Central Park, adding 261K SF of industrial space to their $750M development.

-

Eco investment: Galvanize bought seven Chicago industrial assets to retrofit and resell as part of its $1.85B decarbonization strategy.

-

Tenant displacement: Data center expansion in Northern Virginia is displacing industrial tenants, reshaping leasing patterns, and fueling rent spikes.

-

Card factory: Pokémon card maker Millennium Print Group has reportedly signed 2025’s largest U.S. manufacturing lease—1.3M SF at Morrisville’s Spark LS campus.

-

Executive overhaul: EastGroup Properties reshuffled its executive team as industrial leasing improves and the REIT positions for early-mover development gains.

🏬 RETAIL

-

Investor optimism: Mall sales rebound in 2025 as investors look past weak sentiment and bet on solid fundamentals and spending.

-

Retail debut: Oxford Properties entered the U.S. retail market with a $250M Texas shopping center deal, marking the start of a broader push into open-air retail.

-

Miami buy: JBL bought the 96K SF Pinecrest Town Center for $42.5M, driven by strong occupancy and Miami-area demand.

-

Mall refi: Onyx Equities and PCCP landed a $35M loan from U.S. Bancorp to refinance the 253K SF Westgate Mall in Bethlehem, PA.

-

Stabilized sale: Brookfield is listing its 86%-leased FIGat7th retail center in DTLA, aiming to offload stabilized assets.

-

Hot spots: Salt Lake City, Reno, Indianapolis, Raleigh, and Tampa are seeing strong retail momentum driven by population growth and rising spending.

🏢 OFFICE

-

Metro divide: Office market performance is splitting, with some metros rebounding while others stall, as coworking keeps expanding.

-

Adaptive reuse: Thanks to new tax incentives, zoning reforms, and falling office values, NYC office-to-residential conversions are set to more than double in 2026.

-

Texan takeover: Texas-based investors, including Douglas MacMahon and Hines, are aggressively buying and building in San Francisco.

-

Asset rebalance: SL Green plans to sell $2.5B in Manhattan assets, including stakes in major office and resi buildings, as it battles high interest rates.

-

Boston bargain: A South Station office building just sold at a 63% discount, reflecting ongoing distress in Boston’s Class B/C office market.

-

Spec bet: Developers are betting on demand for top-tier office space, launching spec projects in a few high-performing markets.

🏨 HOSPITALITY

-

Historic revival: Itex Group plans to convert Galveston’s long-vacant 1929 Medical Arts Building into a 120-room Hilton Tapestry hotel, set to open in 2028.

-

Liability leak: A contract error has left two developers on the hook for $43M, with CIM Group accused of exploiting the mistake to enforce extended personal guarantees.

-

Global ambitions: Hilton is doubling down on Signia growth with global conversions, key U.S. new builds, and expanding appeal to luxury group travel.

📈 CHART OF THE DAY

According to the 4Q25 Fear and Greed Index, liquidity conditions improved across all CRE sectors in 4Q25, but elevated interest rates kept access to capital tight enough that most investors stayed on the sidelines, with 64% holding their exposure flat.

CRE Trivia (Answer)🧠

The Walton family, heirs to Walmart, with an estimated net worth of $513.4B.

You currently have 0 referrals, only 1 away from receiving Multifamily Stress Test Model.

What did you think of today's newsletter? |

1