DealGround Overview

DealGround is an AI-driven commercial real estate data and workflow platform built to streamline property research, owner identification, prospecting, and deal execution. Designed primarily for investment sales and leasing brokers, the platform extracts structured data from offering memoranda (OMs), combines it with national title and point-of-interest datasets, and delivers a highly searchable research engine that goes deeper than traditional CRE data providers.

Brokers can upload private OMs, access publicly available deal brochures, analyze tenant and lease-level details, and filter properties by rent, NOI, square footage, lease term, and more—all from a single interface. With AI-updated lease escalations, ownership contact details discovery, and integrated prospecting tools, DealGround serves as a modern alternative to the manual, time-intensive research workflows still common in CRE.

Our Take On DealGround

Best for brokers and deal teams who want a fast, AI-powered way to research properties, uncover ownership, and generate targeted prospecting lists.

DealGround consolidates OM data, title data, tenant data, and ownership information into a single workflow, enabling brokers to move from research to outbound calling significantly faster than with legacy methods.

Pros

Pros- AI extracts detailed tenant, lease, and financial data directly from OMs

- Brokers can upload private OMs without sharing data outside their team

- Combines OM, title, owner, and POI tenant datasets into a single interface

- Powerful filtering for NOI, rent, square footage, lease term, options & more

- Automated lease escalations and lease term expirations keep financial data current year-over-year

- Prospecting lists with owner names, emails, and phone numbers

- Built-in ownership contacts, confidence scoring, and AI rationale (it shows its work)

- Map-based list management with export to Excel/CRM

Cons

Cons- Primarily optimized for retail assets; industrial and multifamily support coming soon

- Public OM data coverage is strongest west of Colorado; other regions depend, to a large extent, on user-uploaded OMs

Pros Explained

AI extraction of tenant and lease data from OMs: DealGround transforms static PDF OMs into structured datasets, including NOI, rent schedules, renewal options, lease types, tenant categories, and square footage. This eliminates days of manual data review and enables highly specific, real-time filtering.

Private OM uploads remain private: Teams can upload thousands of their historical OMs without sharing them with other users. Each team builds its own proprietary dataset while also benefiting from DealGround’s broader library of publicly available OMs.

Unified data from OMs, title records, and tenant POI databases: Unlike tools that provide only title data or only listings, DealGround merges multiple data sources into a single research engine. Users can see transaction history, loan details, tenant type, rent trends, and owner identity on a single page – helping brokers create targeted owner outreach lists, such as “McDonald’s in the Midwest which haven’t sold in the last five years.”

Advanced filters for precise prospecting: Searches can be narrowed by NOI range, rent range, remaining lease term, tenant brand, square footage, and more—helping brokers create highly targeted outreach lists, such as “Starbucks in Ohio with <5 years of lease term remaining.”

Automatic lease escalations: Even though OMs are static PDFs, DealGround updates escalations as they happen in real time. Brokers see the current rent and remaining lease term, not just the marketed rent or lease term remaining at the time of OM issuance.

Ownership discovery with contact information: DealGround links LLCs and trusts to real individuals, providing names, emails, phone numbers, related entities, and confidence scoring with AI-generated rationale and source citations.

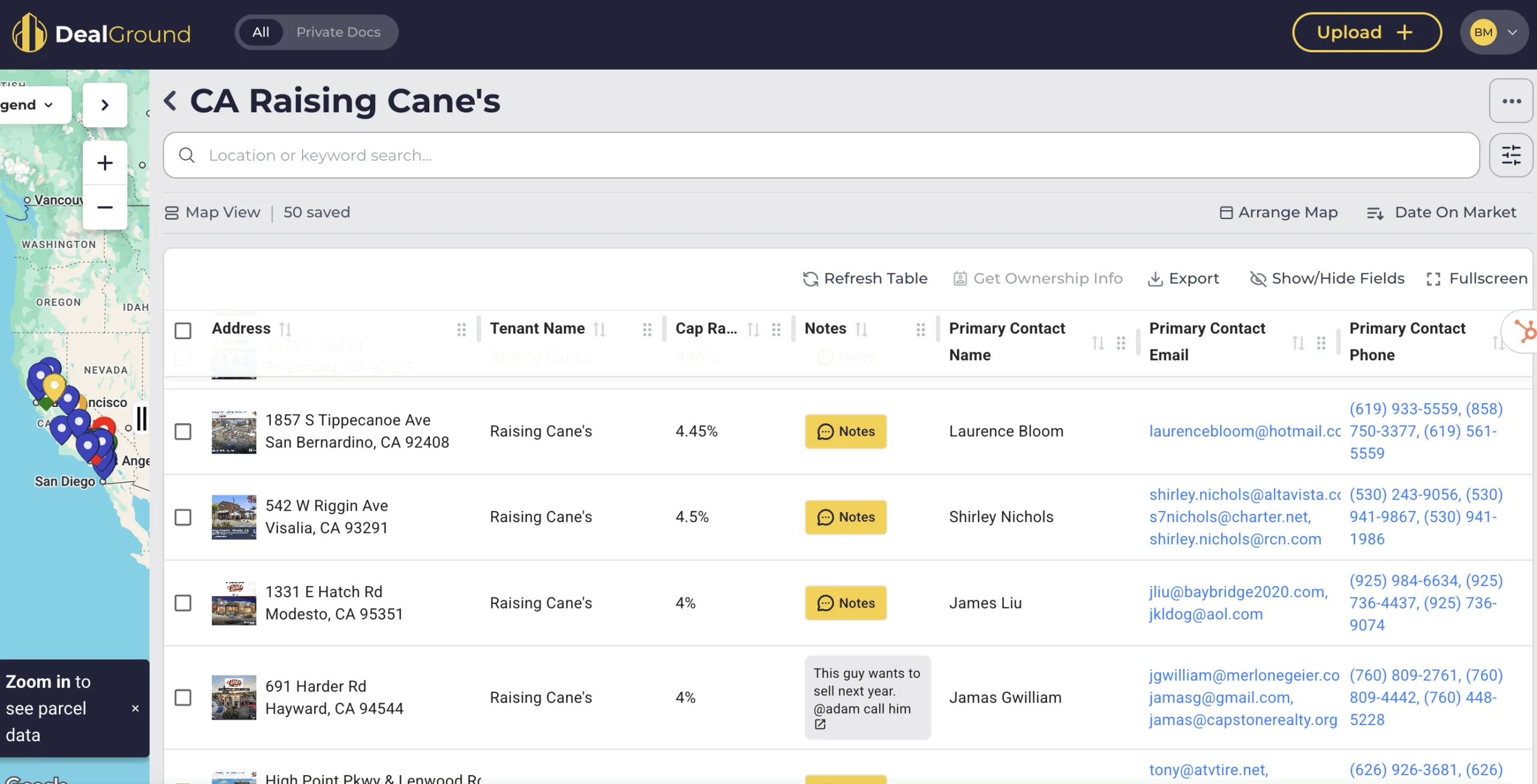

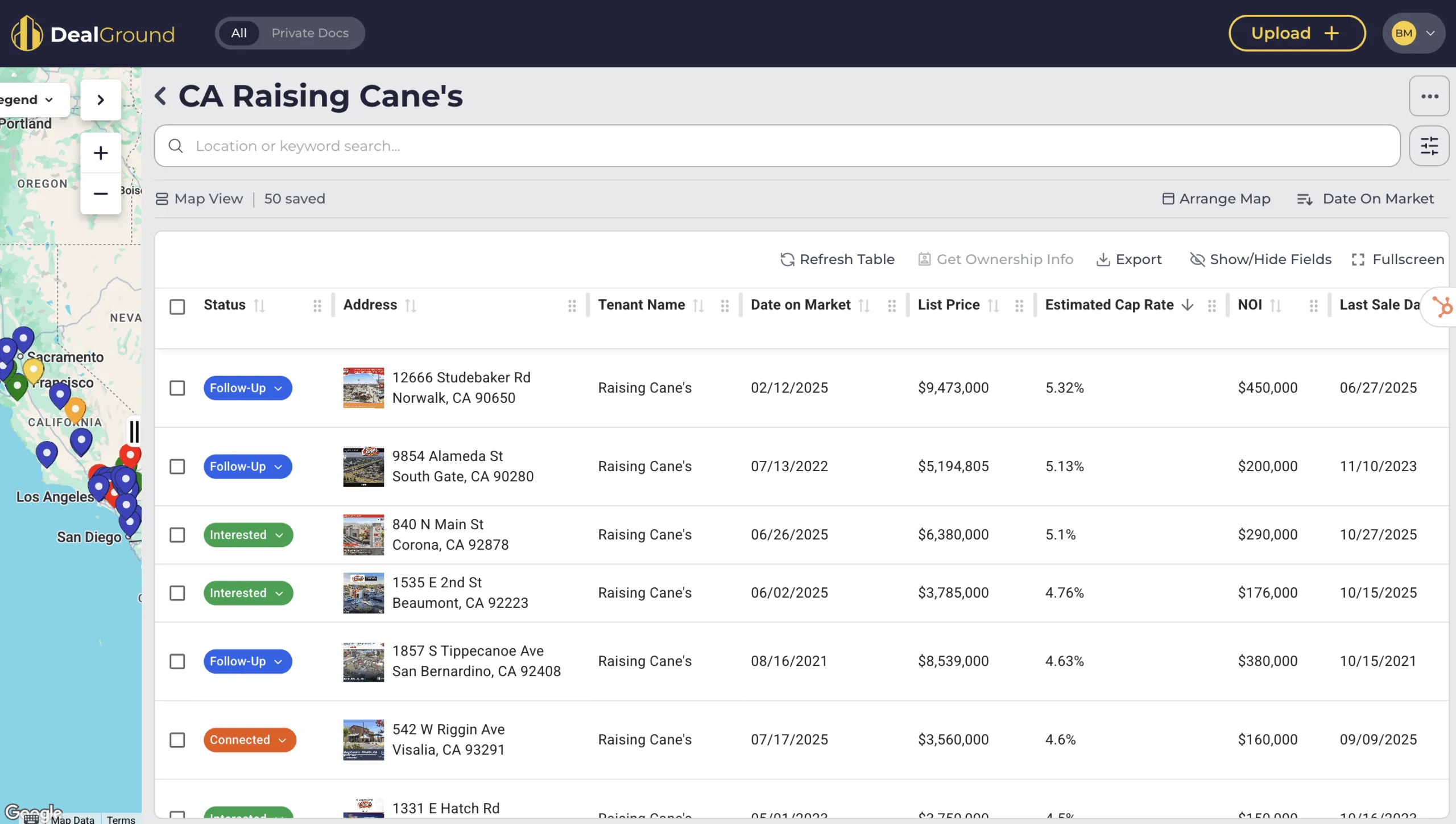

Integrated prospecting workflow: Users can annotate properties, set statuses, create call lists, export to Excel, and manage follow-up activities directly from the platform.

Con Explained

Limited support for non-retail asset classes: While industrial and multifamily OMs can be uploaded, DealGround does not yet extract key industrial or multifamily attributes (e.g., dock-high doors, power, clear height). The company notes these enhancements are slated for a release in Q1 of 2026.

Uneven geographic data density: DealGround’s strongest public OM coverage is currently in the western U.S. Eastern markets rely more heavily on brokerage user uploads to achieve OM dataset coverage. The company’s title data and tenant datasets are national in scope.

DealGround Key Features

OM Upload & Automated Data Extraction

DealGround’s flagship capability is converting static offering memoranda into structured, searchable datasets. Users can upload any PDF—legacy brochures, current listings, or archived deal files—and the system automatically extracts core property information, including tenant name, lease type, NOI, rent schedules, increases, options, square footage, and land area.

Unlike traditional platforms that rely on manually entered or inconsistent metadata, DealGround pulls insights directly from the source document, ensuring accuracy and consistency across thousands of deals. This OM-to-database automation is especially powerful for brokers who have accumulated decades of files and want to activate their historical knowledge base.

AI-Powered Lease Analysis and Automatic Escalation Updates

A unique differentiator for DealGround is its dynamic rent-escalation and lease term tracking engine. Although offering memoranda contain static financial snapshots, DealGround recalculates rents and lease terms monthly based on documented lease schedules. This means that if a tenant has scheduled increases each year, the platform automatically updates the current NOI and rent figure to reflect real-time values—something no other OM-based platform provides.

This feature transforms archived or stale OMs into living data assets and ensures brokers are always working from the most accurate, up-to-date financial metrics when preparing valuations, comps, or buyer pitches.

Deal Library With Public OMs and Daily Automated Ingestion

DealGround maintains a shared library of thousands of OMs sourced from brokers who publicly distribute them, plus those collected through automated ingestion of daily deal email blasts from every brokerage firm nationwide.

Subscribers receive new brochures daily without manually sorting through inbox clutter. This library grows continuously, strengthening each user’s ability to identify comps, analyze tenant performance, and find off-market opportunities.

Title Data Integration

DealGround integrates directly with First American Title to provide granular legal and transactional insights. Each property page includes:

- Deed history with transfer dates

- Sale prices and grantor/grantee details

- Recorded mortgage amounts

- Lender information

- Transaction timelines going back decades

This combination of OM data + title data gives brokers a complete perspective on the property and enables deeper prospecting conversations with owners who may be nearing refinance or disposition timelines.

Instant Sales Comp Generation

DealGround combines extracted OM data with verified title transfer records to give brokers immediate access to reliable sales comparables. By pairing historical transaction data with tenant, lease, and NOI details from offering memoranda, users can quickly validate pricing, analyze prior trades, and generate comps without switching platforms or manually reconciling multiple data sources. This integration allows brokers to underwrite faster and speak confidently about value when pricing assets or advising clients.

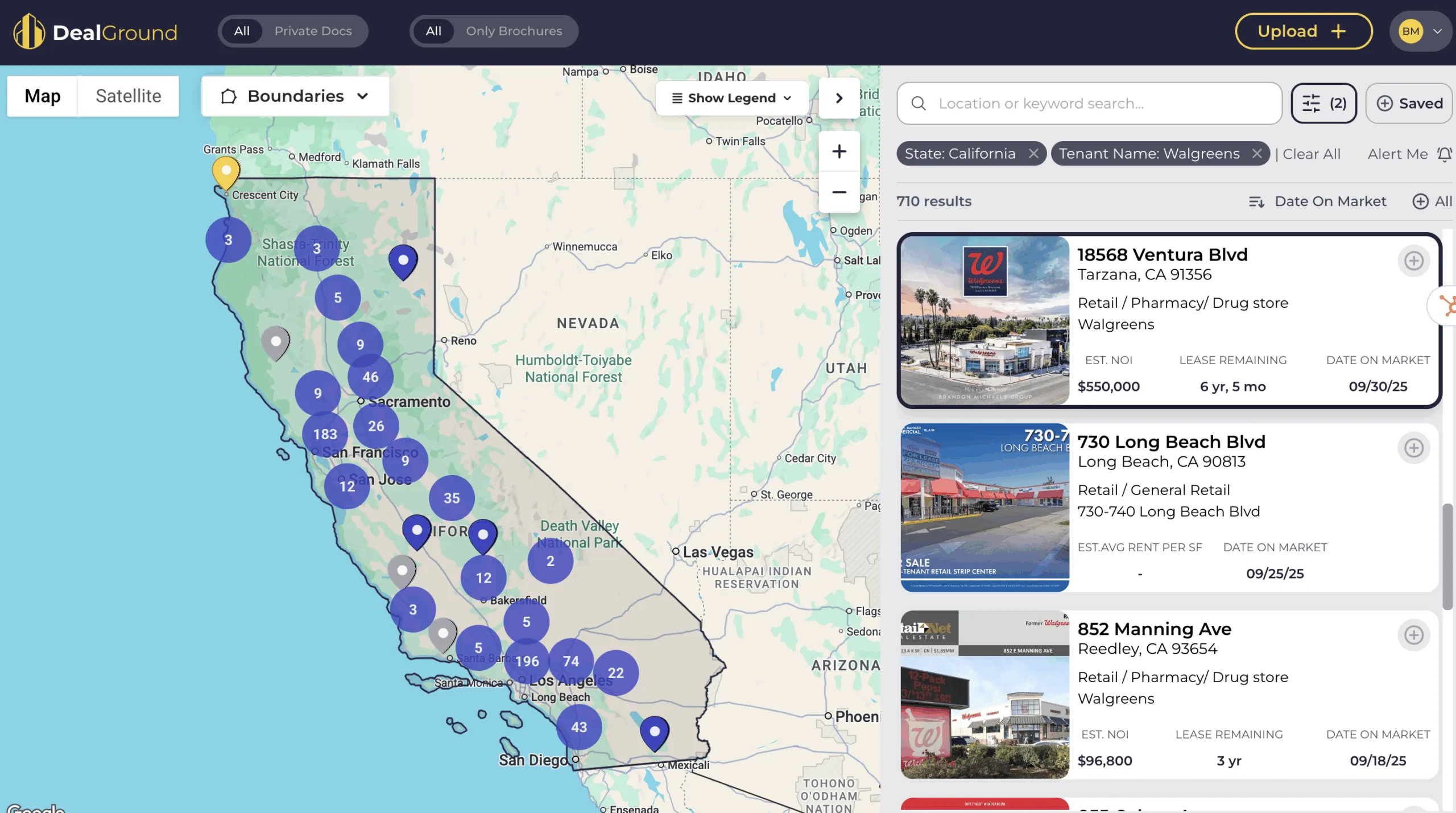

Tenant & Point-of-Interest (POI) Data Overlay

For properties without an uploaded OM, DealGround surfaces tenant information using point-of-interest datasets. This allows users to run tenant-driven searches (e.g., Starbucks, Dutch Bros, Chick-fil-A) against title data even when no marketing brochure exists.

The platform identifies tenant type (QSR, medical, retail, automotive) and provides spatial context across markets. Leasing and tenant-rep brokers can view trade areas, analyze rental trends, and identify expiring leases or under-marketed locations for potential relocations or expansions.

Ownership Discovery & Contact Intelligence

DealGround’s ownership feature traces LLCs and trusts back to actual individuals using a blend of public records, AI matching, and third-party data. Each ownership profile typically includes:

- Full name

- Email addresses

- Phone numbers

- Related entities

- LinkedIn connections

- Spouse and family office associations (when publicly linked)

The platform also displays an AI-generated rationale and a confidence score that explain why an individual is tied to an LLC. For brokers, this eliminates hours of Secretary of State research, manual skip tracing, and outdated contact lists.

Advanced Search & Filtering Tools

DealGround’s filtering engine is built around the metrics brokers rely on most. Users can sort and filter by:

- NOI or rent ranges

- Lease term remaining

- Options and increase schedules

- Tenant brand and category

- Square footage (building and land)

- Asset class

- On-market vs. off-market status

- Transaction recency

- Year built or last traded

This level of granularity enables high-probability prospecting strategies. For example, creating a list of “all QSR properties in Georgia with 10+ years on the lease and a $4M–$4.5M price indication for a 1031 buyer.”

List Creation & Prospecting Pipeline

DealGround is built for brokers to move seamlessly from research to outbound prospecting. Users can:

- Create custom prospecting lists

- Assign deal statuses

- Add notes and call logs

- Sort properties by days-on-market, NOI, or tenant type

- Export data to Excel

- Sync lists with external CRMs

The map view updates dynamically based on list status, allowing brokers to visually track progress, prioritize outreach, and manage territory-based strategies.

AI Ownership Export & Call List Generation

Users can select any number of properties and instantly generate a fully enriched call list with verified ownership contacts. This drastically reduces preparation time for outbound campaigns and enables brokers to scale their origination efforts without hiring analysts or researchers.

Bulk OM Upload & Team Data Sharing

Firms with large OM archives can upload 5,000–20,000 documents at once, instantly converting decades of deal history into a searchable, proprietary database.

Team-based permissions ensure that:

- Each team retains complete control of its private data

- No private data is visible to other DealGround users

- Analysts, associates, and senior brokers can collaborate in one shared environment

Market Alerts

DealGround has an alerts engine that notifies users when new deals match their search criteria. Alerts can be configured around:

- Tenant brand

- Geography

- NOI thresholds

- Lease term

- On-market changes

This continues DealGround’s journey toward becoming a proactive lead-generation tool, in addition to a research platform.

User Experience

DealGround offers a clean, intuitive interface that mirrors brokers’ natural workflows. The map-based search, integrated data panels, and Excel export tools reduce the friction typically found in legacy databases. Users report that search setup, list building, and owner identification take minutes rather than hours.

Because the platform is data-dense, new users may require a brief orientation, but the learning curve is minimal compared to traditional CRE databases.

Customer Support

Subscribers receive hands-on onboarding, troubleshooting support for OM uploads, and direct assistance with data correction requests. DealGround’s team proactively monitors upload issues and regularly holds check-ins with brokers to gather product feedback. A dedicated customer success team oversees:

- Data accuracy adjustments

- Ownership match corrections

- Workflow coaching

Support cadence is more personal and more frequent than that of typical enterprise CRE platforms.

Pricing

DealGround offers a straightforward, per-seat pricing model with a 30-day risk-free trial and no credit card required.

Paid subscriptions are priced at $99 per member per month, or $83 per member per month when billed annually. This includes 20 free ownership research credits per month. This pricing structure is designed to scale easily from individual brokers to larger teams.

DealGround’s pricing is transparent and notably lower than many legacy CRE data platforms, making it accessible for teams looking to modernize their research and prospecting stack.

Competitors

CoStar

CoStar provides broad CRE inventory, comps, and listings but lacks OM-level tenant and lease detail, automated rent extractions, and integrated prospecting tools.

Crexi

A listings marketplace with marketing tools, but not an OM-driven data extraction engine or ownership discovery comparable to DealGround.

Reonomy

Strong for owner lookup and entity mapping, but lacks deep tenant/lease-level analysis and OM data extraction.

Buildout / Apto / CRE CRM Tools

These platforms enable marketing and CRM workflows but do not provide DealGround’s research data or AI extraction capabilities.

FAQs

DealGround is an AI-powered research and prospecting platform that extracts data from OMs, merges it with title and tenant datasets, and enables brokers to create targeted outreach lists.

Investment sales brokers, leasing brokers, developers, and owners who rely heavily on tenant/lease data, market research, and owner outreach.

No. All uploaded OMs are private to your team unless they are already publicly available.

OM uploads (public + private), automated ingestion of listing emails, First American Title data, and point-of-interest tenant datasets.

Yes, but retail is the most mature segment. Industrial, multifamily, and office support features are expanding.

Yes. Users can sign up for a free 30-day trial with no credit card required.

How We Evaluated DealGround

When evaluating DealGround, we examined several factors, including:

- Product and service offerings: We studied DealGround’s full suite of features and how they support investment sales brokers and CRE professionals throughout their workflow.

- Pros and Cons: We checked the boxes on what potential clients are looking for and compared features that make DealGround stand out from its competitors.

- Ease of use: We examined how user-friendly DealGround’s platform is, how intuitive the onboarding process can be, and how quickly a new user is likely to understand and take advantage of the platform’s full functionality.

- Customer support: We evaluated DealGround’s existing customer support network and scored it on response times, training materials, and access to customer success reps.

- Pricing and transparency: We examined the pricing of DealGround’s products and services and whether readily available pricing information is available on its website.

Summary of DealGround

DealGround offers a modern, AI-driven approach to CRE data and prospecting built around automation and broker-first workflows. By extracting data from offering memoranda and enriching it with title, tenant, and ownership information, the platform replaces the manual, fragmented research processes still common in the industry.

DealGround’s speed, data depth, and prospecting efficiency make it a compelling tool for brokers aiming to close more deals with less research time. For teams looking to modernize their research stack and operate with analyst-level capabilities without expanding headcount, DealGround stands out in 2026.

Disclaimer

This page may contain affiliate links. If you make a purchase or investment through these links, CRE Daily LLC may receive a commission at no extra cost to you. These recommendations are based on our direct experience with these companies and are suggested for their usefulness and effectiveness. We advise only purchasing products that you believe will assist in reaching your business objectives and investment goals. Nothing in this message should be regarded as investment advice, either on behalf of a particular security or regarding an overall investment strategy, a recommendation, an offer to sell, or a solicitation of or an offer to buy any security. Advice from a securities professional is strongly advised, and we recommend that you consult with a financial advisor, attorney, accountant, and any other professional who can help you understand and assess the risks associated with any real estate investment. For any questions or assistance, feel free to contact [email protected]. We’re here to help!