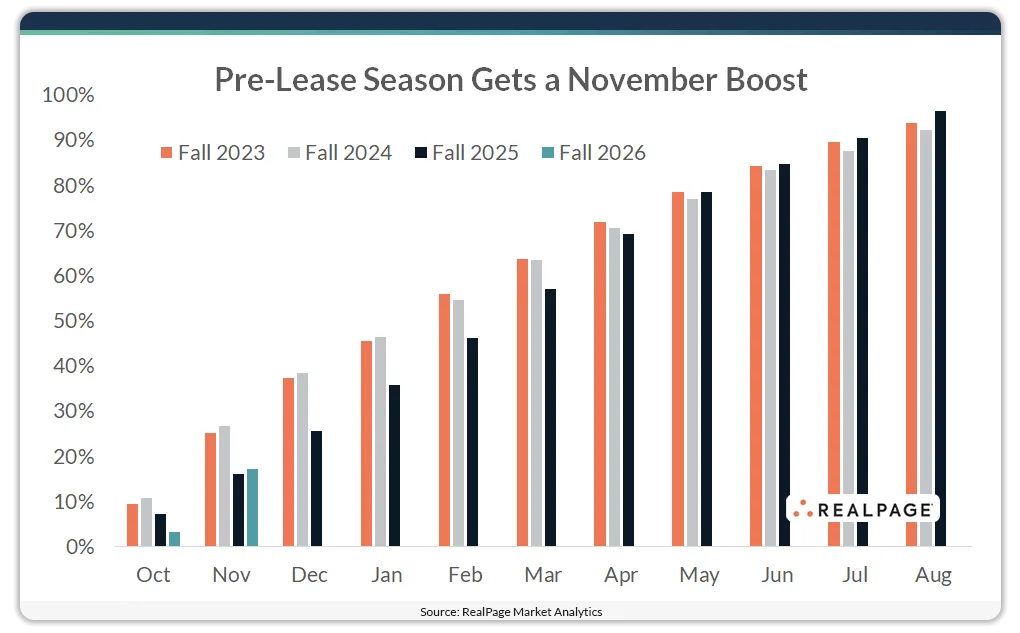

- Pre-leasing for Fall 2026 jumped to 17.3% in November, rebounding sharply from a decade-low October start.

- Leasing pace outperformed Fall 2025 for November, despite still trailing Fall 2023 and Fall 2024 levels.

- Core 175 universities saw similar gains, with 18.4% of beds pre-leased by November.

- Pre-leasing rates were consistent across locations, with minimal variation based on distance from campus.

A Strong November Turnaround

After the slowest October since 2015, Fall 2026 student housing pre-leasing rebounded significantly in November, reports RealPage. Pre-leasing jumped to 17.3% of beds leased nationwide, a strong month-over-month improvement that put it slightly ahead of Fall 2025 at the same point.

Fall 2026 still trails the higher early leasing rates of Fall 2023 and Fall 2024. However, the rebound signals demand recovery heading into winter and spring leasing peaks.

Market Performance Across Core Universities

Pre-leasing at 175 universities rose to 18.4% in November, up from just 3.3% in October. This mirrors the national trend and reinforces confidence in the broader student housing market’s leasing cycle.

Location Still A Factor, But Not A Deciding One

Leasing rates across property distances remained tightly grouped. Interestingly, properties slightly farther from campus (0.5–1 mile) saw the highest pre-leasing rate at 18.4%, narrowly edging out more central locations (within 0.5 miles at 17.2%) and those farther out (16.4%).

Outlook

While it’s still early in the pre-lease season, the November surge offers a strong early signal. Fall 2026 could mirror Fall 2025—starting slow but potentially finishing strong. With historical data showing a weak start doesn’t preclude a record-breaking finish, investors and operators may find reason for optimism heading into 2026.