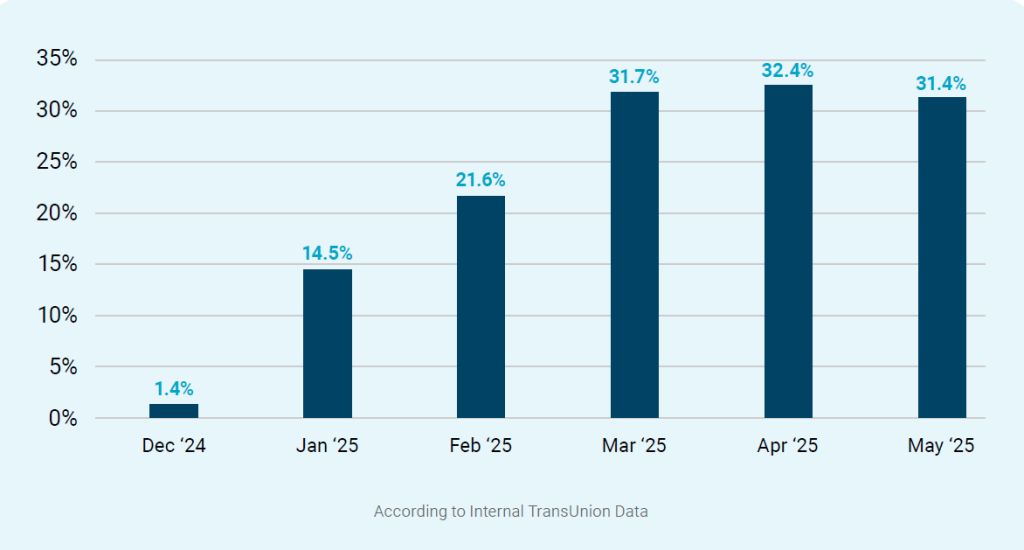

- Student loan delinquencies among renters more than doubled between January and May 2025, jumping from 14.5% to 31.4%, according to TransUnion.

- Millions of borrowers have seen their credit scores drop, with many moving from super prime to near prime or even subprime categories.

- Lower credit scores are disqualifying more renters during screening, shrinking the tenant pool and potentially increasing vacancy rates.

- Property managers are being urged to rethink approval criteria and adopt more nuanced screening models that look beyond credit scores.

A Financial Ripple Effect

Student loan payments resumed in early 2025, and the ripple effect is already hitting the rental market, reports MHN. According to TransUnion’s Q3 2025 Student Loan Repayment Study, loan delinquencies among renters have spiked—from 14.5% in January to over 31% by May. That’s a 2K% increase compared to December 2024.

The result? Credit scores are plummeting. And with many landlords relying on credit ratings to vet potential tenants, a growing share of renters may no longer meet leasing criteria.

Credit Score Shake-Up

TransUnion data shows one in three borrowers is now more than 90 days behind on payments, and one in five has stopped paying altogether. As a result, millions of renters are shifting into higher-risk credit tiers.

- 51% of former super prime renters (781–850) fell into the prime category (661–720).

- 45% dropped even further to near prime (601–660).

- Over 2.2M borrowers experienced a 100+ point drop in credit score.

Those in the prime category also took a hit:

- 59% moved to near prime.

- 23% slipped into subprime (600 and below).

According to TransUnion’s Maitri Johnson, the speed and severity of this credit deterioration was unexpected—and troubling.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Tightening The Pool Of Qualified Renters

As more applicants fall below standard leasing thresholds, landlords face a smaller—and potentially riskier—pool of prospective tenants. With fewer qualified renters, occupancy rates could decline. TransUnion also warns of a possible uptick in application fraud and evictions, further complicating leasing operations.

A Call For Screening Reform

To adapt to this shifting credit landscape, landlords are being encouraged to look beyond traditional credit scores. Johnson recommends re-evaluating how student loan debt is factored into leasing decisions. Factors like the loan’s age, outstanding balance, and historical payment behavior could provide more context.

AI-powered screening tools and rental-specific risk models are also gaining traction. These technologies can help property managers:

- Detect fraud more effectively

- Identify rental payment behavior

- Make quicker and more confident leasing decisions

Why It Matters

With student loan debt reshaping renters’ financial profiles, multifamily operators must adjust. The alternative—stricter standards with no flexibility—could mean higher vacancies, lower retention, and more financial risk over time.

Landlords that evolve their underwriting processes now may be better positioned to maintain occupancy in a market where financial stress is only expected to grow.