- Brookfield and GIC will acquire National Storage REIT for A$4B (~$2.7B USD) in an all-cash deal at A$2.86 per share, representing a 26% premium over the pre-deal share price.

- The transaction, pending regulatory approvals, is expected to close in Q2 2026, with the National Storage board unanimously recommending shareholder approval.

- National Storage operates 270+ storage centers across Australia and New Zealand, making it the largest self-storage provider in the region.

A Big Bet On Storage

Brookfield Asset Management and Singapore’s sovereign wealth fund GIC have officially entered into a binding agreement, reports Bloomberg. They plan to acquire National Storage REIT, a publicly listed self-storage company based in Australia. The deal, valued at approximately A$4B (US$2.7B), reflects a strong vote of confidence in the growing storage sector across Australasia.

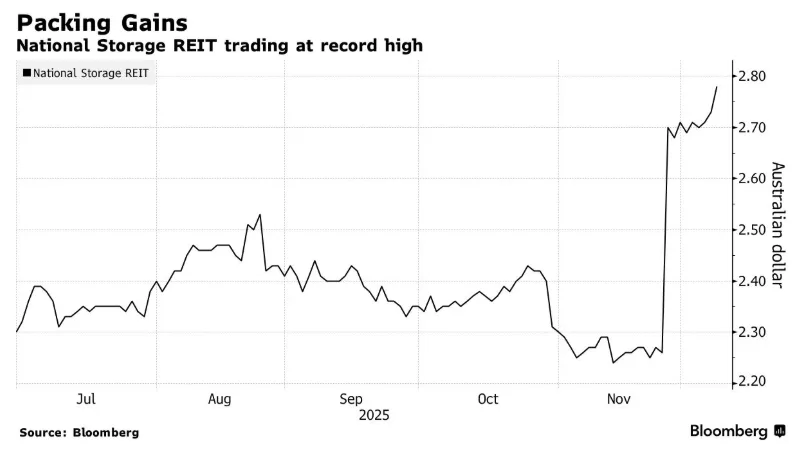

The buyers will pay A$2.86 per share, a 26% premium to the stock’s price before news of the deal emerged. National Storage shares climbed nearly 3% on the news, hitting a record high of A$2.81.

National Storage’s Rapid Growth

Founded in 1995 in Oxley, Queensland, National Storage has expanded significantly over the past three decades. Today, it operates more than 270 facilities across Australia and New Zealand. Its scale and dominant position in the market made it an attractive acquisition target amid increased investor interest in alternative real estate asset classes like self-storage.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Strategic Alignment

Brookfield and GIC cited global storage experience and plan to work with National Storage’s board to complete the deal. The acquisition aligns with both firms’ strategies to invest in resilient, income-generating real estate sectors.

Broader M&A Landscape

The deal provides a boost to Australia’s otherwise muted M&A activity in 2025. Several high-profile transactions, including bids by EQT and CVC for AUB Group and BHP’s attempt to acquire Anglo American, have recently fallen through.

If completed, this transaction will stand out as one of the largest take-private deals in the region for the year.

What’s Next

Pending regulatory approvals and shareholder consent, the deal is expected to close by the second quarter of 2026. Analysts suggest this could prompt further interest in Australia’s REIT sector, particularly in alternative real estate categories like logistics, storage, and data centers.