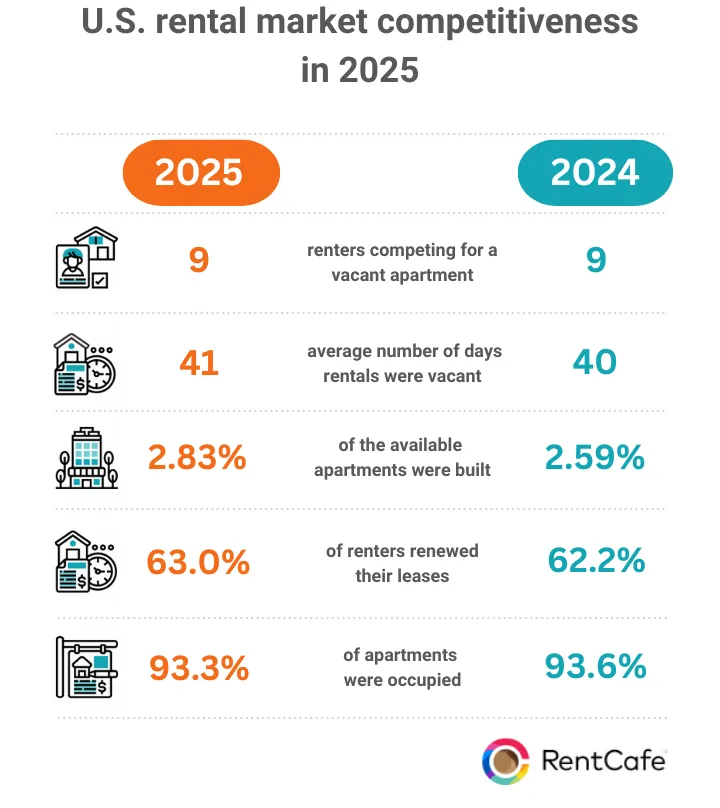

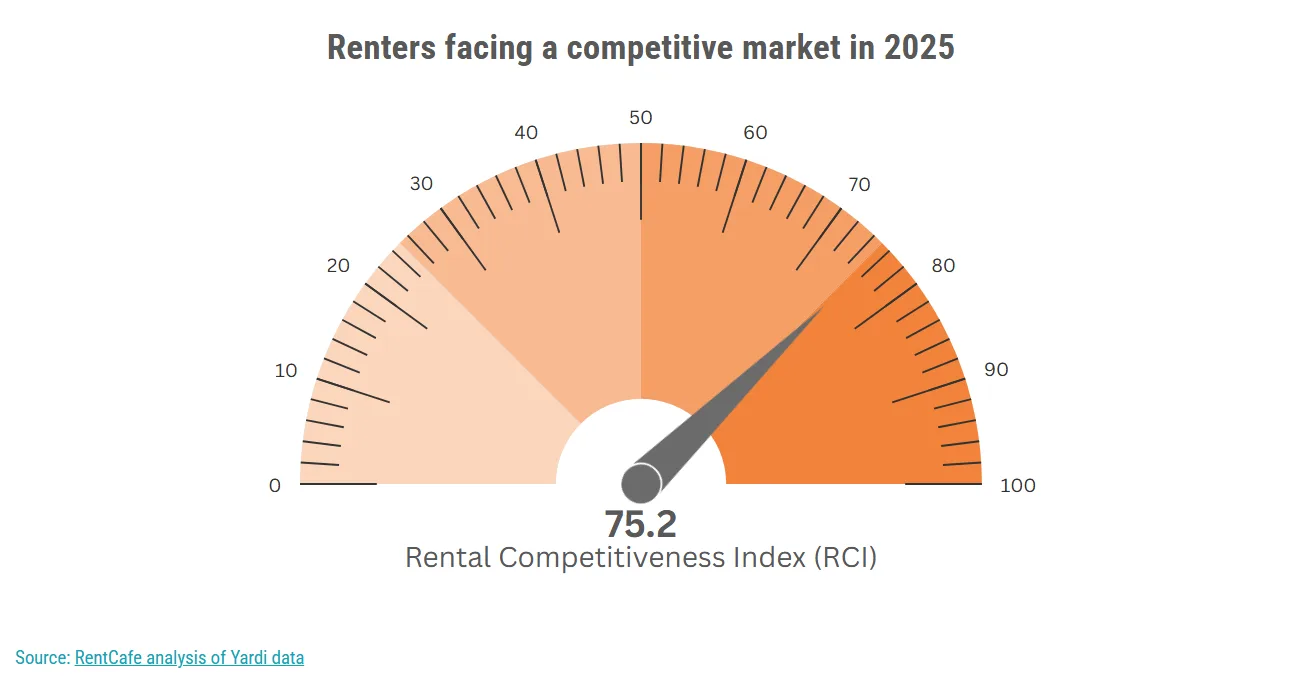

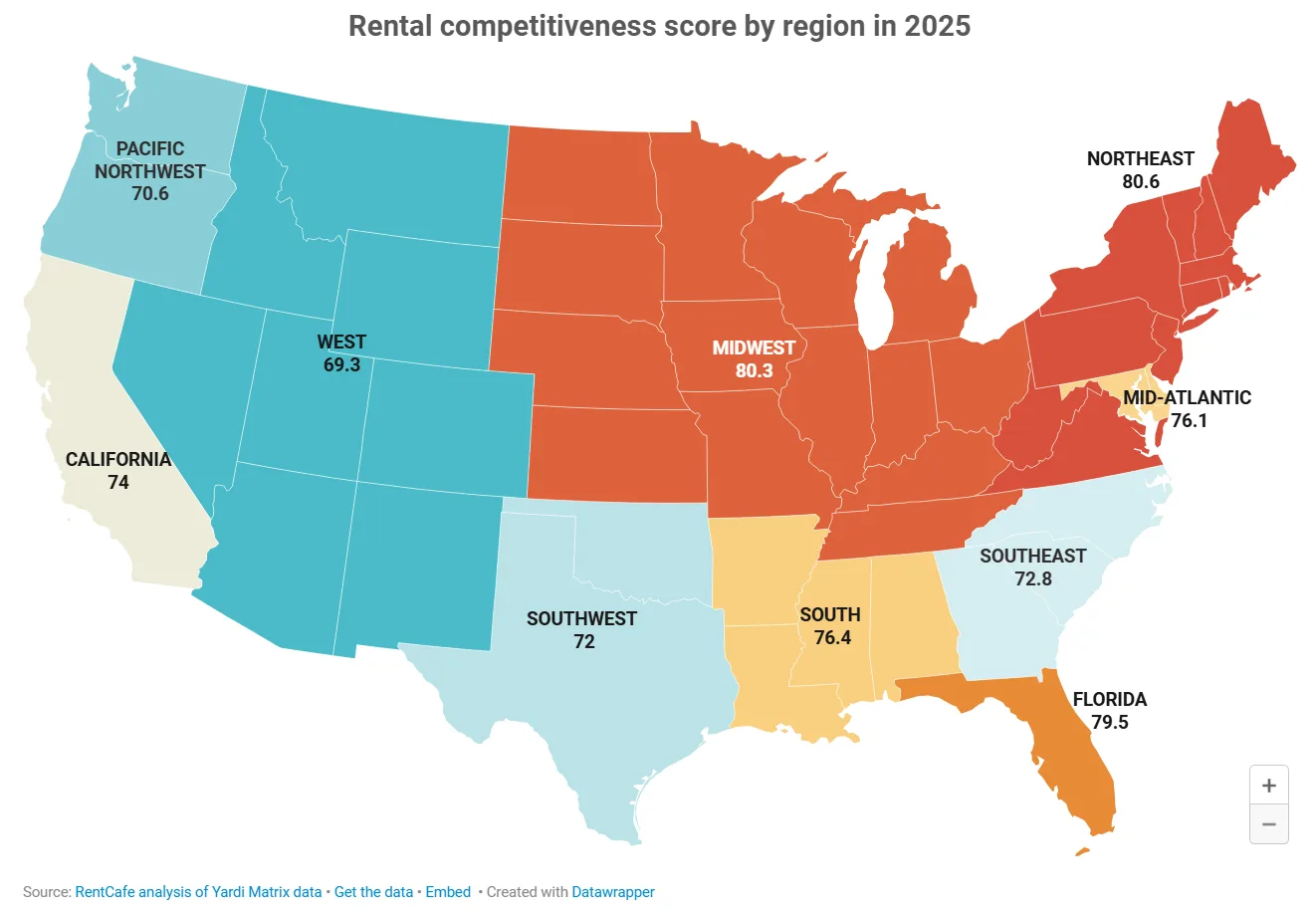

- US rental competitiveness increased in 2025, with a national RCI score of 75.2, up from 74.4 last year.

- Miami (RCI 92.9) remained the hardest place to find an apartment, with Chicago (88.2) and Suburban Chicago (88.1) close behind.

- Manhattan surged into the top 5 most competitive markets, driven by limited new supply, high renewal rates, and return-to-office trends.

- Smaller markets like Fayetteville, AR and Port St. Lucie, FL also saw sharp increases in demand, reflecting a national squeeze.

Manhattan Enters the Top Five

RentCafe reports that Manhattan became the fourth-most competitive rental market in the country this year, marking its debut in the top five. The borough’s competitiveness stemmed from a convergence of returning office workers, limited new inventory, and high lease renewals.

- 66.3% of renters renewed their leases (up from 64.7%).

- Occupancy rose to 95.9%, while vacant units saw 11 applicants on average (up from 8).

- Apartments leased faster, averaging 36 days on the market — four days quicker than in 2024.

Miami Still #1, Chicago Not Far Behind

For the second year in a row, Miami topped the list of most competitive rental markets. The metro’s evolution into a hub for tech, finance, and remote work continues to attract a steady stream of renters.

- RCI score: 92.9

- 73% of renters renewed in 2025.

- Each vacant unit drew 19 applicants, up from 18 last year.

- Average lease time: 33 days.

Chicago followed closely, securing second place:

- RCI score: 88.2

- Renewal rate rose to 61.1%, while supply fell to 0.75% growth.

- Units leased in 32 days, the fastest among major metros.

The Suburban Chicago area (Naperville, Evanston, Arlington Heights) ranked third with an RCI of 88.1, driven by similarly limited supply and high renewal rates (70.3%). Chicago’s hold on renters is no surprise, as the Midwest has been steadily growing in appeal over the past few years — even as some Sunbelt markets have lost a bit of their edge.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Twin Cities and San Francisco Lead in Competitive Growth

The Suburban Twin Cities saw the largest jump in competitiveness (+9.2 points), propelled by shrinking supply and more renters staying put.

- RCI: 82.1

- 67.8% of renters renewed leases.

- Units filled in 38 days, with 11 applicants per vacancy.

San Francisco followed as the second-fastest riser, thanks to a resurgence in high-paying jobs and a sharp decline in new construction.

- RCI: 72.8 (up 7.4 points)

- Occupancy reached 94.6%.

- Applicants per unit increased from 7 to 11.

Small Markets: Fayetteville & Port St. Lucie Are Tougher Than Ever

While large metros dominated headlines, smaller markets also became pressure points.

Fayetteville, AR is now the most competitive small rental market:

- RCI: 92.4

- Units leased in just 22 days — the fastest nationwide.

- 73% renewal rate.

- Each vacancy drew 12 applicants.

Meanwhile, Port St. Lucie, FL, became the fastest-rising small metro, with its RCI soaring 12.5 points to 86.9. A sharp drop in new supply and rising demand fueled competition.

Outlook for 2026: Relief May Be Short-Lived

The early months of 2026 may offer brief relief, with apartments taking 51 days to lease. But by summer, competition is expected to spike, with 11 renters per unit, matching 2025’s peak levels.

Though 1.29% growth in new supply is forecasted, construction is projected to slow to just 0.47% by year-end, likely pushing occupancy and renewal rates higher.

Why It Matters

Despite the influx of new apartments, more renters are staying put — a trend that’s outpacing supply. Developers, investors, and property managers should expect continued demand pressure into 2026, especially in high-growth metros and affordable small markets.