- Austin leads in office employment growth, with a 27.8% increase since 2020—outpacing all major US metros.

- National office vacancy sits at 18.6%, but markets like Austin (26.9%) and Seattle (27.4%) face higher-than-average rates amid strong development pipelines.

- Denver office assets are selling at steep discounts, with recent deals closing at up to 86% off peak prices, illustrating significant investor repricing.

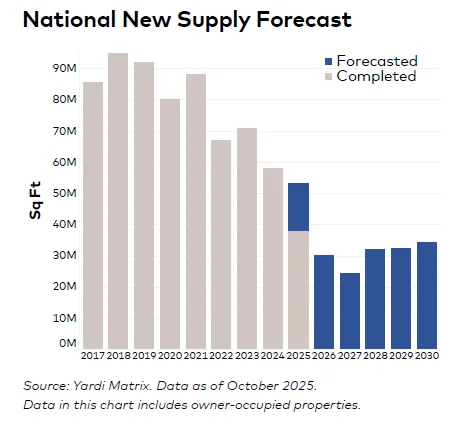

- New construction remains subdued, with just 33.4M SF underway nationally—reflecting a long-term realignment in demand.

Hybrid Work Redefines Utilization

The post-pandemic office landscape continues to evolve, as reported by Yardi Matrix. While remote work has declined from its 2021 peak, it remains well above pre-pandemic levels, cementing hybrid work as the new norm. This shift has created uneven office utilization across the top 25 US metros.

Austin, for instance, has the highest percentage of residents working from home at 23.2%. It also leads in office occupancy, with a 74.6% rate based on Kastle’s access data. This apparent paradox is explained by the metro’s rapid growth in office-using employment and an influx of business relocations.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Vacancy & Pricing Pressures Mount In Key Markets

Despite strong fundamentals in some metros, vacancy remains a major concern:

- Austin’s vacancy rate jumped to 26.9% after adding 15.6M SF of space this decade, equal to 16% of its office stock.

- Manhattan, with slower office job growth and only 3.6% new supply added, managed to reduce its vacancy rate, fueling a spike in investor interest and 59 transactions year-to-date.

- Charlotte, although showing a slight decline in listing rates and higher vacancies (18.9%), remains strong thanks to robust job growth and limited future supply.

Supply Slows To A Crawl

Only 33.4M SF of office space are currently under construction nationwide, equating to just 0.5% of total inventory. Los Angeles exemplifies this pullback, with no new office starts in 2025 despite historically strong demand. Projects that are moving forward focus on high-end amenities and pre-leased anchor tenants.

Bargain Hunting In Denver

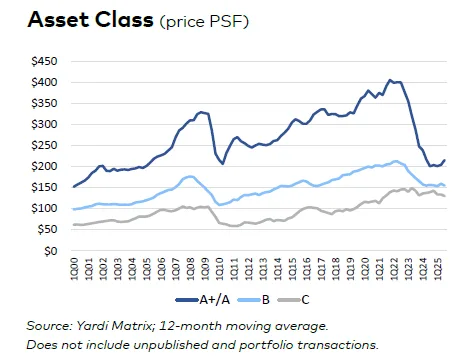

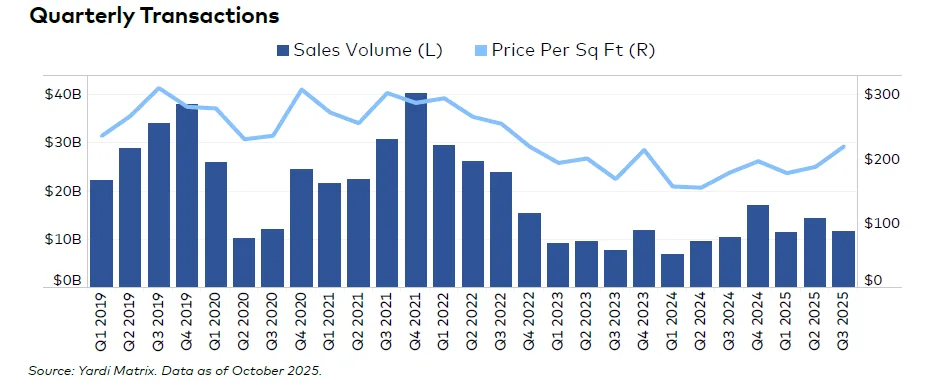

Office investment volume hit $42.6B through October 2025, with properties averaging $191 PSF. However, steep discounts are emerging:

- Denver’s average sale price fell to $125 PSF—less than half of its 2022 peak.

- Notably, Brookfield Properties sold two downtown towers at an 86% discount to Wayzata Investment Partners.

Markets like Manhattan ($523/SF) and the Bay Area ($386/SF) still command premium pricing, though buyers are increasingly selective.

What’s Next?

As the office sector adjusts to a hybrid-centric future, flexibility, conversions, and repositioning will become central strategies for landlords. While development remains constrained, metros with strong job growth and favorable demographics—like Austin, Charlotte, and Miami—are likely to recover faster.

Expect coworking spaces, creative reuse, and targeted high-end developments to fill the void left by shrinking traditional demand.