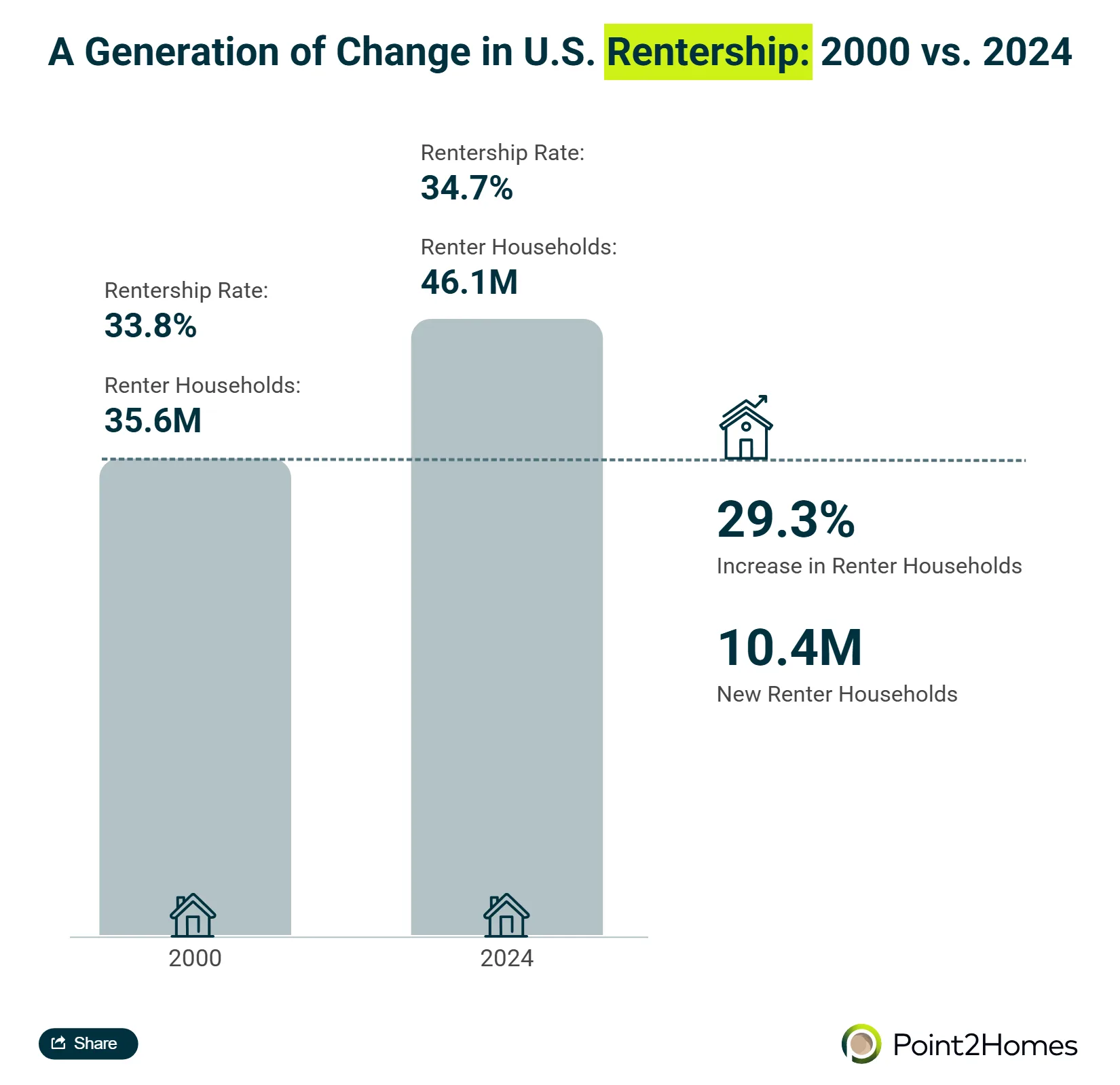

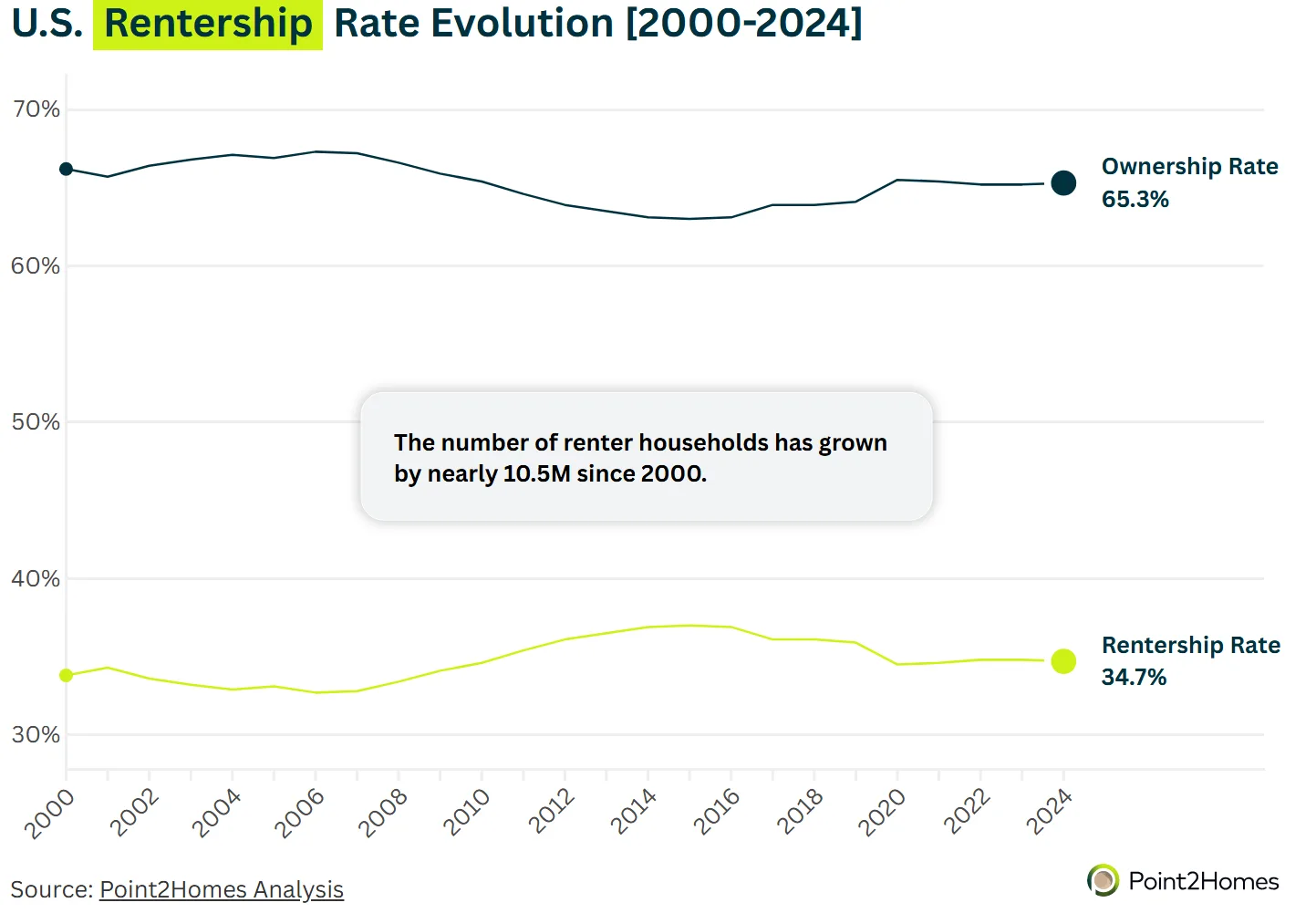

- Nearly 10.5M renter households have been added since 2000, with the US rentership rate climbing slightly from 33.8% to 34.73%.

- The Great Recession, tighter credit standards, and pandemic-driven disruptions made renting a more permanent housing option.

- Texas, California, and Florida alone account for over a third of renter household growth in the past 25 years.

- The number of renter-majority cities grew from 144 in 2000 to 169 in 2024, with many smaller cities seeing the biggest shifts.

The Big Picture: Renting Is No Longer Just a Phase

For much of the 20th century, owning a home symbolized stability, success, and the American Dream. But today, that dream looks different. After decades of rising homeownership, the last 25 years have seen a quiet but profound shift: renting is no longer just a temporary step—it’s become the destination for millions, per Point2Homes.

The national rentership rate is nearly the same as it was in 2000, but underneath that surface lies a different story: over 10M new renter households have emerged. Homeownership still dominates, but renters are growing faster, fueled by affordability pressures, economic volatility, and shifting preferences.

From Boom to Bust: How the Economy Rewrote Housing Norms

At the turn of the century, homeownership was riding high. By 2006, over two-thirds of American households owned homes. But when the housing bubble burst in 2008, millions lost their homes, and the rental market swelled almost overnight. That shift persisted well into the 2010s as tighter lending standards and high student debt sidelined would-be buyers.

Even after the market rebounded, homeownership never returned to its previous peak. The pandemic briefly reignited the buying frenzy, but rising mortgage rates and low inventory reversed that trend by 2022. Renting, once a fallback, had become a foundation and a lifestyle now embraced across generations, including older adults who are increasingly opting for flexibility over homeownership.

Where Renting Is Rising Fastest

Though rentership remains highest in large cities like Los Angeles, New York, and San Francisco, smaller cities are where the biggest changes are taking place. Union City (82%) and Newark (77%), both in New Jersey, now lead the nation in renter share—largely due to their proximity to NYC and limited housing supply.

Nationwide, 169 cities are now renter-majority—up from 144 in 2000. Cities like Hartford, CT, and Santa Monica, CA, now have rentership rates above 70%, while Houston, NYC, and L.A. each added over 160,000 renter households in the past two decades.

![Top 10 States by Share of Renters [2024]](https://cdn.credaily.com/uploads/2025/11/image-69.webp)

The Demographic Shift: Millennials and Modern Lifestyles

Millennials have been at the heart of the rentership surge. Many delayed marriage, children, and major financial commitments like homeownership, either by choice or due to economic constraints. That delay has extended the rental phase of life, even as home prices and interest rates made buying increasingly difficult.

And while remote work opened new housing possibilities, affordability still defines access. In places where home prices are out of reach, renting remains the only viable option.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Why It Matters: A New Kind of Housing Market

Rentership is growing faster than ownership, not only in numbers but in cultural relevance. Developers, investors, and city planners are increasingly catering to long-term renters with upgraded amenities, flexible leasing, and better design. Some markets are even seeing purpose-built rental communities that mirror the feel of homeownership—without the commitment.

More broadly, the rise of renting suggests a cultural reset. The American Dream isn’t disappearing—it’s evolving. For millions, stability now means flexibility, not a mortgage.

What’s Next

If current trends hold, renting will continue gaining ground in the decade ahead—especially in high-growth, high-cost metros. The housing market’s future may be less about ownership and more about access, mobility, and resilience.

As Point2Homes’ data shows, the story of renting isn’t just about housing—it’s about how Americans live, move, and define success in a changing world.