- Hotel F&B revenue per occupied room rose 3.8% in H1 2025, outperforming overall hotel revenue growth.

- Luxury and resort hotels lead gains, fueled by leisure demand and investments in elevated dining concepts.

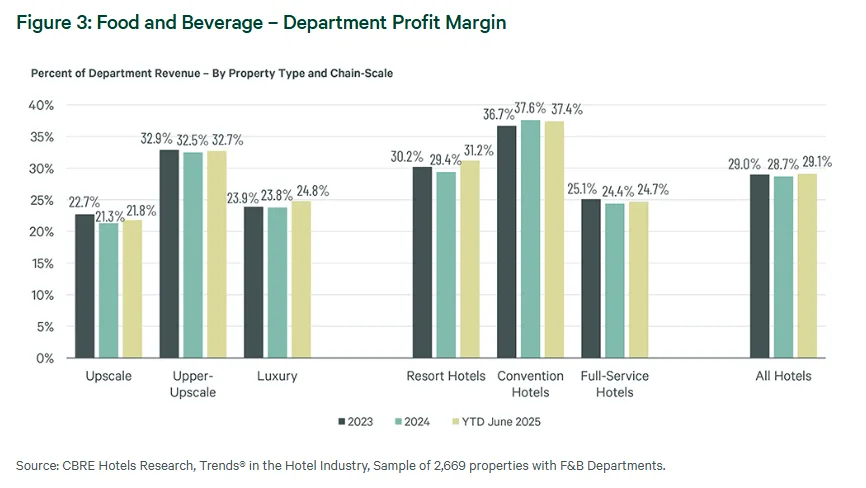

- F&B profit margins improved to 29.1%, as operators managed labor and food costs more efficiently.

- Convention hotels struggle, with banquet revenue down 7.3%, while resorts saw strong group dining growth.

Revenue Pressure Shifts Focus To F&B

With room revenue growth plateauing, US hotels in 2025 are looking beyond traditional income streams. A weak 0.8% rooms revenue rise and flat RevPAR forecast pushed hoteliers to focus more on food and beverage, reports CBRE. Historically the second-largest revenue source, F&B is emerging as a bright spot.

F&B Rebound Fueled By Design, Demand, And Pricing

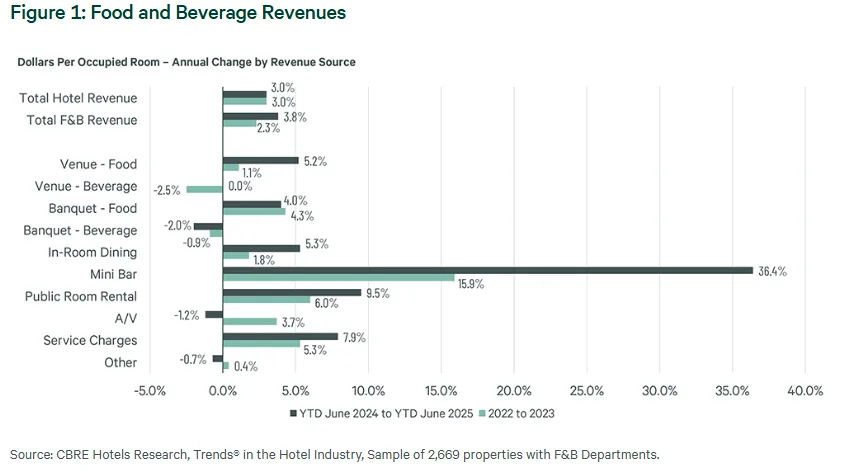

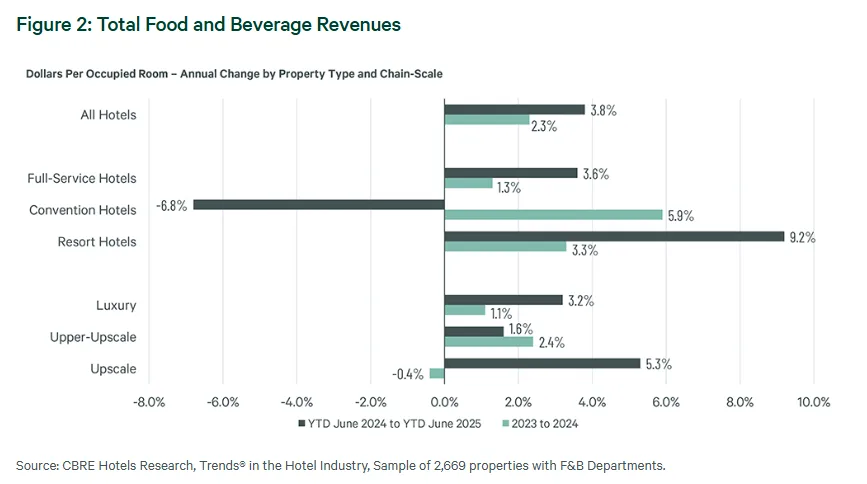

Analyzing data from over 2,600 full-service, resort, and convention hotels, CBRE reports a 3.8% year-over-year increase in F&B revenue per occupied room (POR) in the first half of 2025. This outpaced the total hotel revenue growth of 3.0%. The rebound is largely driven by luxury and resort properties, which continue to benefit from resilient leisure travel and higher-spending guests.

Hotels that revamped their F&B spaces post-pandemic have reaped the rewards. They introduced modern concepts, integrated lobby lounges with dining, and embraced data-driven operations. These updates have allowed properties to raise menu prices with confidence. They’ve moved away from discounting and focused on service, ambiance, and culinary quality.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Profit Margins And Strategic Spend

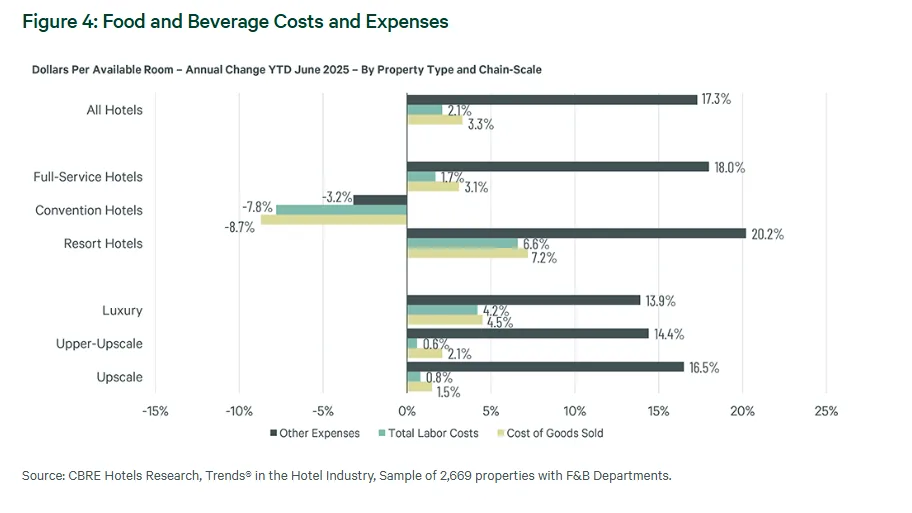

Food and beverage operations are not just generating more revenue — they’re becoming more profitable. Profit margins in F&B departments rose to 29.1% in the first half of 2025, up from 28.7% a year earlier. While labor remains the largest expense (59.4%), increases in labor costs (2.1%) and cost of goods sold (3.3%) have been contained. Interestingly, beverage costs declined, aligning with weaker beverage revenue trends.

Investments in buffet-style and grab-and-go services have helped manage labor shortages and reduce reliance on full-service staffing, further contributing to cost control.

Convention Hotels Face Headwinds

While resorts are thriving, convention hotels have seen setbacks in 2025. Banquet revenue at these properties dropped 7.3%. Federal budget cuts and reduced participation in large-scale events have driven the decline. In contrast, resort hotels saw banquet revenues rise 8.7%, as meeting planners shifted events to leisure-friendly destinations with competitive offseason rates.

New Trends In Beverage And Venue Revenue

Mindful drinking is influencing hotel menus, with mocktails and low-alcohol beverages gaining popularity — not just among adults, but as family-friendly options too. Although mini bar revenue remains small in total share (0.2% of F&B revenue), it posted the largest year-over-year growth percentage.

Service charges and public room rental fees grew by 7.9% and 9.5%, respectively. This shows hotel sales teams are now enforcing previously negotiable fees.

What’s Driving F&B Success

Across the board, successful hotel F&B operations in 2025 share common traits: clear financial goals, well-trained teams, menu engineering, and strategic marketing. Some hotels are now assigning revenue goals to key F&B positions and investing in upselling programs to drive performance.

For properties with underutilized space or stagnant revenue, ownership is increasingly applying asset management principles to F&B. They are assessing outlets not just for ambiance, but for real ROI. The focus is also on each outlet’s contribution to the broader property value.

Outlook

With slow occupancy and room rate growth, F&B has become a key driver of hotel revenue expansion in 2025. Hotels are proving that food and beverage is more than just a service. From reimagined dining spaces to elevated culinary programs and sharper pricing strategies, it’s become a strategic asset.

As leisure guests seek experiences and planners look beyond boardrooms, hotel F&B continues to drive growth for the future.