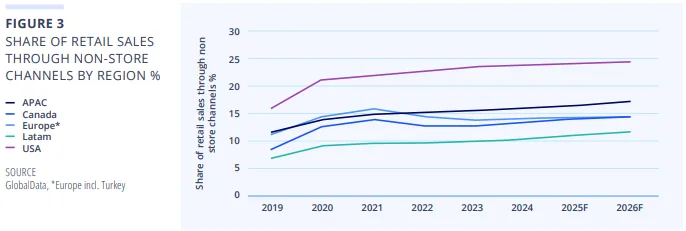

- Digital-physical integration is now non-negotiable across all markets, with APAC leading in omnichannel and social commerce innovation, while North America and Europe refine mature digital ecosystems.

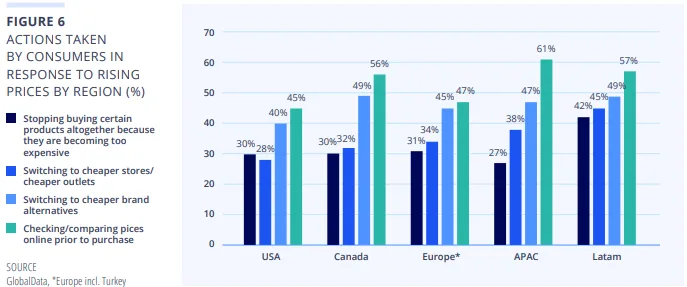

- Consumer behavior is shifting, with price sensitivity and value-driven purchases accelerating globally due to inflation, debt, and geopolitical uncertainty.

- Gen Z and the middle class in APAC and LATAM are reshaping retail priorities, pushing for personalized, tech-enabled, and experience-driven shopping.

Global trends: A Tale Of Divergence And Transformation

Retail in 2025 is defined by resilience, transformation, and divergence, reports Colliers. The industry is navigating a new normal where digital and physical retail must coexist. Global consumer confidence remains fragile as economic pressures—from inflation to trade wars—reshape spending habits. Yet, technology, urbanization, and tourism offer long-term growth levers.

APAC Leads The Way

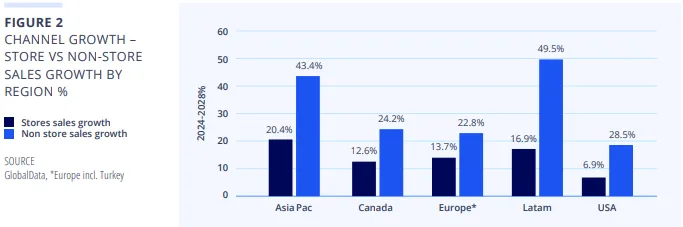

The Asia-Pacific region continues to dominate in retail innovation. Social commerce and omnichannel strategies are flourishing, fueled by a rapidly growing middle class and tech-savvy Gen Z consumers. Both online (+43.4%) and in-store (+20.4%) retail are expected to see strong growth through 2028.

Retailers in the region benefit from high mobile penetration and cultural habits like dining out, which supports robust growth in F&B (7%) and furnishings (5%) categories.

Europe Retools For Resilience

European retail is facing a value-driven reset. Inflation fatigue and waning luxury spend—especially among tourists—are hitting legacy brands. Luxury giants like LVMH, Moncler, and Prada have cited declining tourist spend as a key headwind.

Still, omnichannel strategies are keeping retailers afloat, with physical stores doubling as last-mile logistics hubs. High streets remain resilient, and new trade agreements with the US could stabilize the outlook heading into 2026.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

North America: Barbell Effect Deepens

In the US, stable top-line retail performance hides a stark divide: premium and value segments thrive, while the mid-market lags. With limited new construction, backfilling in Class A locations is strong, and the “retail space squeeze” is real.

Canada, meanwhile, grapples with fallout from a trade war with the US. Yet, F&B remains a standout category, and domestic brands are riding a wave of nationalist consumer sentiment. The bankruptcy of Hudson’s Bay marks the end of an era for large-format retail in Canada.

LATAM’s Digital Leap

Latin America is undergoing a transformation, balancing physical retail reinvention with booming e-commerce adoption. Mobile payments, click-and-collect, and social commerce are reshaping markets from Brazil to Colombia.

As a result, the region’s Gen Z consumers are increasingly demanding sustainable, flexible, and authentic retail experiences, which in turn is accelerating the shift toward hybrid formats and experiential spaces.

Why It Matters

Given current market dynamics, retailers can no longer afford to treat digital and physical channels separately. Meanwhile, consumers are becoming increasingly price-sensitive, with 80% globally expressing concern about their financial outlook. Consequently, brands that lead in flexibility, transparency, and experience will be better positioned to navigate ongoing geopolitical volatility and rapidly shifting consumer priorities.

What’s Next

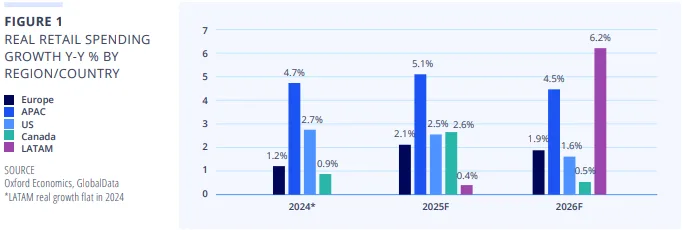

Retailers’ responses to trade disruptions, inflation management, and demographic shifts will shape the retail landscape in 2026. With real retail spending forecast to grow steadily—APAC (4.5%), LATAM (6.2%), and the US/Europe (2–3%)—there’s opportunity, but only for those ready to adapt.